The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning 19 Dec: Electoral College vote, Bank of Japan meeting, US personal income & spending

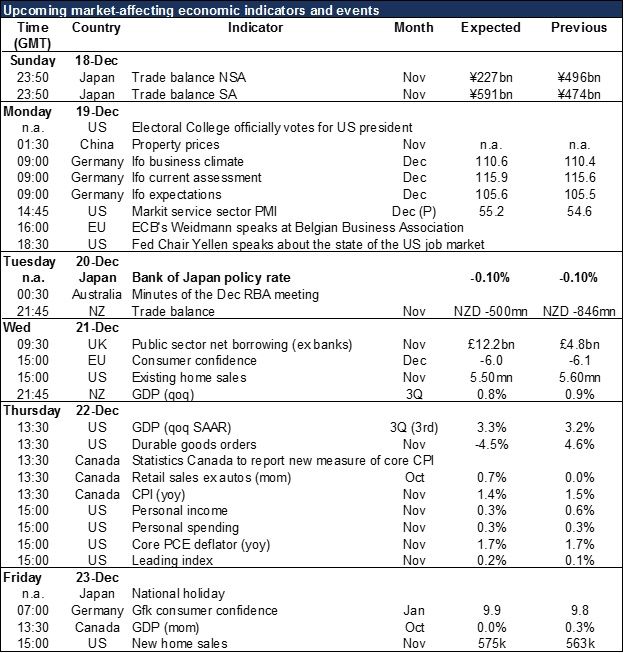

As the year draws to a close, things start to shut down. There’s little data out this week and most central bankers seem to be on holiday: we have speeches today from two senior central bankers and tomorrow’s Bank of Japan meeting, and that’s it. Several US indicators are due out when that market opens on Thursday. Otherwise, there’s not much on the schedule.

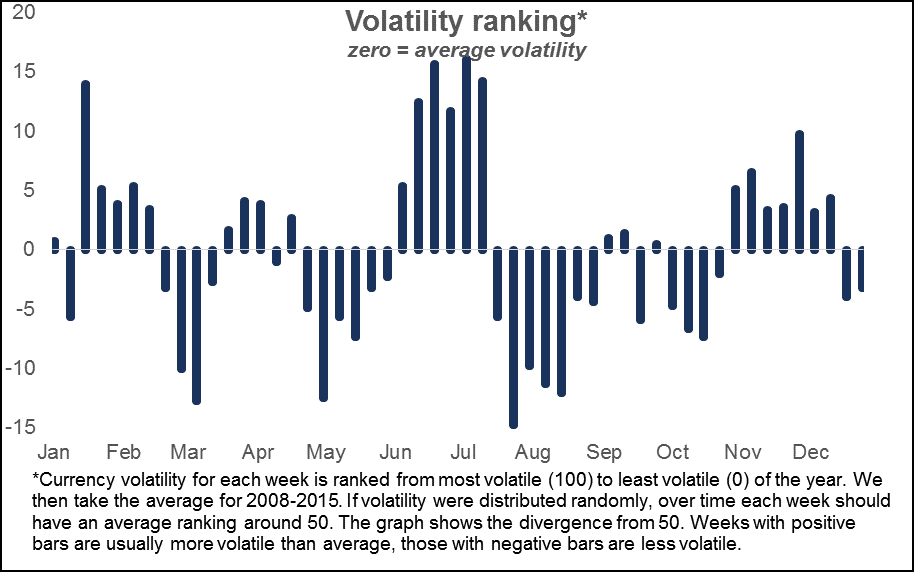

That doesn’t guarantee peace and quiet, though. The last two weeks of the year have been pretty quiet in five of the last nine years, but in two years — 2008 and 2014 – they were the most volatile weeks of the year. It depends on what happens.

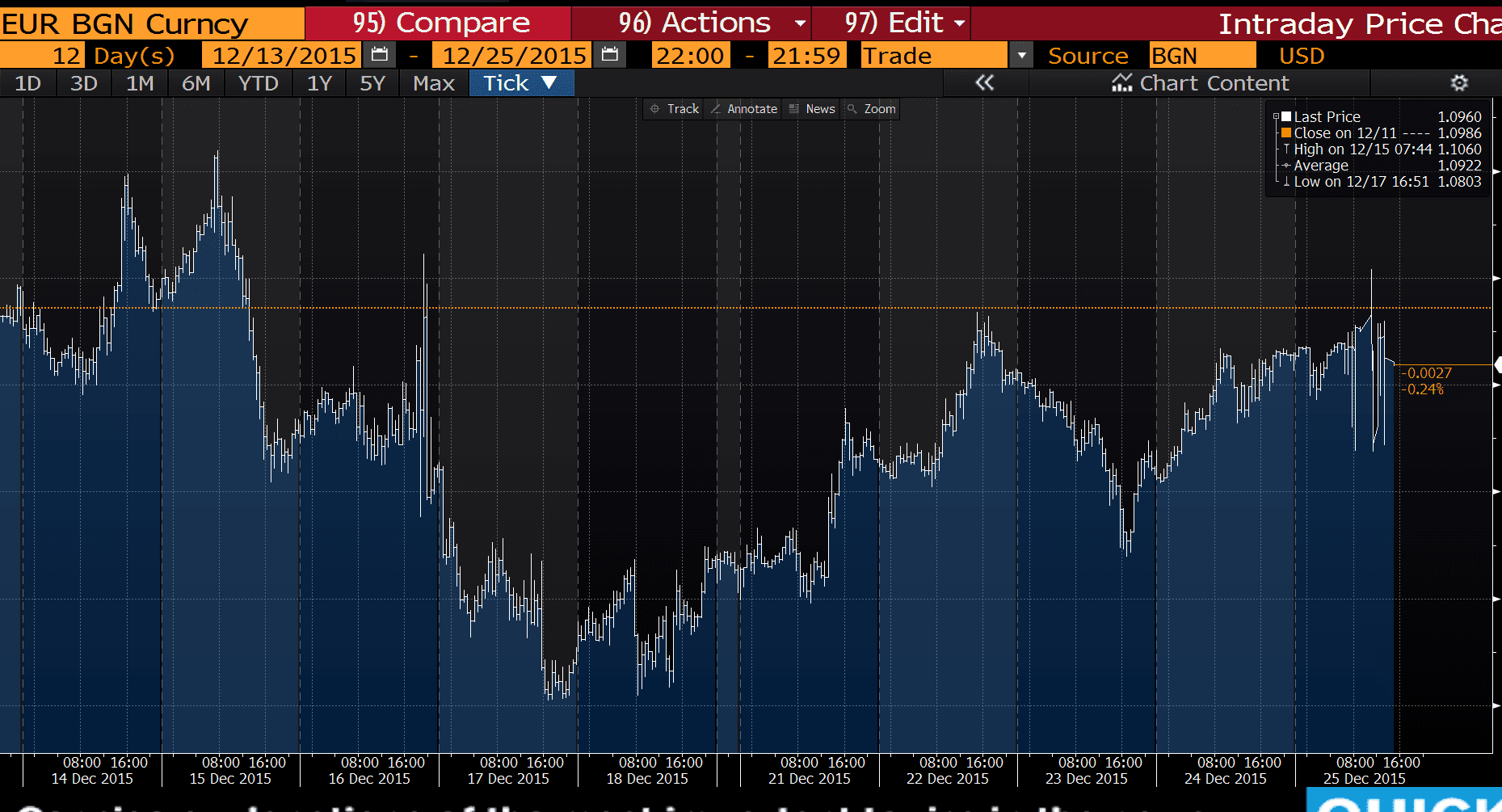

Generally speaking, I expect the dollar to consolidate somewhat this week after its sharp gains following last week’s US rate hike. Last December, when the Fed raised rates on a Wednesday, EUR/USD bottomed out on Friday and then recovered the following week to end a bit higher than before the rate hike.

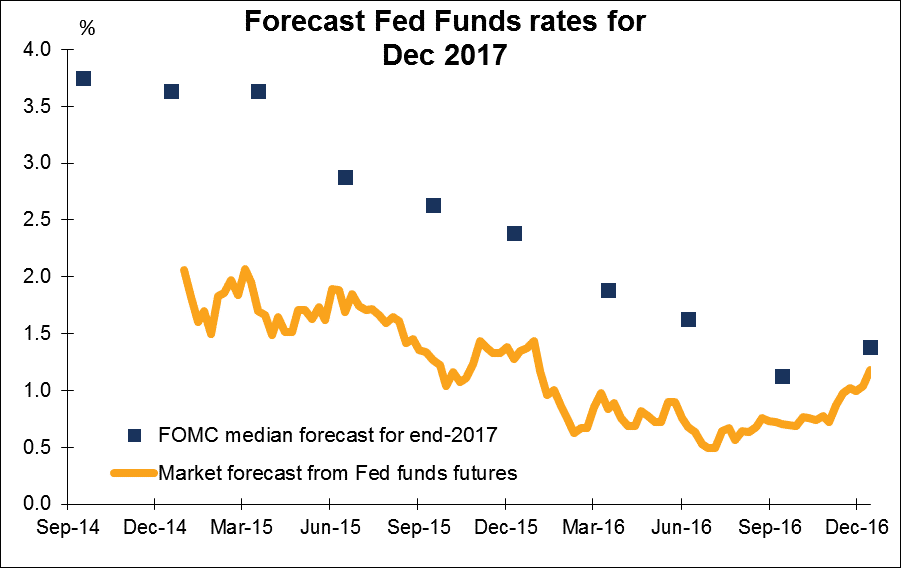

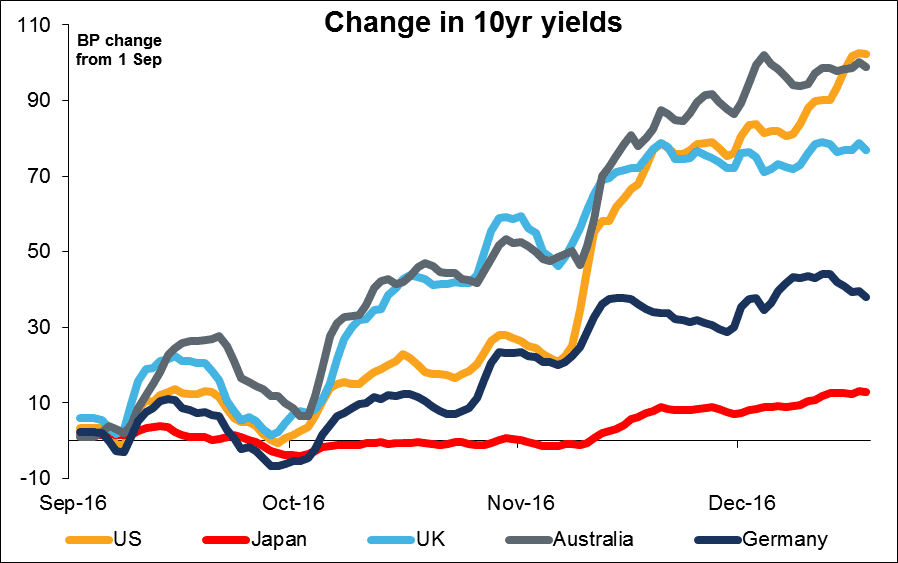

However, last year the Committee also revised down their forecasts for the future pace of rate hikes, whereas this time around they raised their median forecasts, which would tend to amplify the rate hike’s effect. That should mean less room for mean reversion this week.

There’s an unusual event today (Monday) that could cause considerable volatility: the US Electoral College meets to formally elect the US President. Electors have failed to vote for the presidential candidate whom they are pledged to vote for (“faithless electors”), but this is the first time ever that there’s been an organized campaign to encourage a protest vote. It’s unlikely though that the required 37 Republican electors will change their votes and prevent President-Elect Trump from taking office. But if they did, it would mean absolute chaos for the market.

Other US events this week include a speech today by Fed Chair Yellen about the US job market. The FOMC slight upgraded its outlook on the labor market – we may get further clarification today. That could be bullish for the dollar.

The US indicators are mostly clustered around the opening on Thursday. These include third estimate of US Q3 GDP, durable goods orders, personal income & spending, and the leading indicator. They’re expected to be mixed. The headline durable goods orders is forecast to be down sharply, but the nondefense capital goods orders (excluding aircraft) is forecast to be higher. Similarly, incomes are forecast to be lower, but spending should hold up. The core PCE deflator, the Fed’s targeted inflation rate, is expected to hold the same yoy growth rate slightly below the Fed’s 2% target.

In short, the US news may not bolster expectations of higher rates nor diminish those expectations either. That’s why the dollar may just consolidate this week, perhaps weakening slightly vs EUR but probably not back to where it was before the FOMC meeting, in my view.

The key event for JPY will be Tuesday’s Bank of Japan meeting and press conference by BoJ Gov. Kuroda. All 39 economists polled by Bloomberg expect no change in policy. Economic indicators remain solid and core inflation may have bottomed out. Stocks are up, the yen is down. With no big changes in Japanese monetary policy in sight, the divergence between the BoJ and Fed remains intact and the weaker JPY trend is likely to continue as well, in my view.

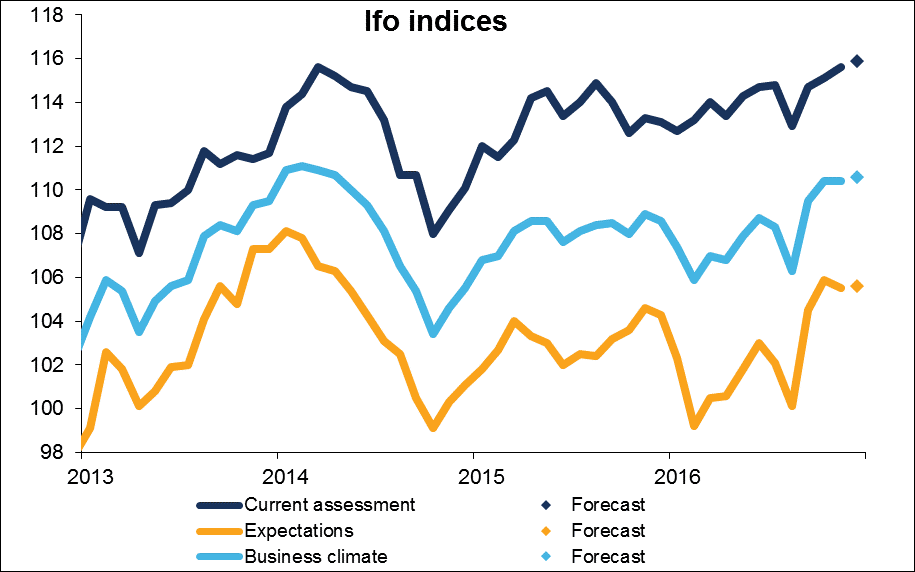

For Europe, today’s Ifo indices are expected to be up a bit, which could support EUR somewhat, but not dramatically. Talking today, Bundesbank President Jens Weidmann is unlikely to say anything different than what he said Friday, when he noted that politicians can’t rely on central bankers to rescue them from difficult decisions. EU consumer confidence on Wednesday is expected to be fairly stable.

There’s nothing major on the schedule for GBP. With no news to push it one way or the other, the pound could recover some but not all of its losses vs USD, while EUR/GBP is likely to remain within its 0.8350-0.8400 channel.

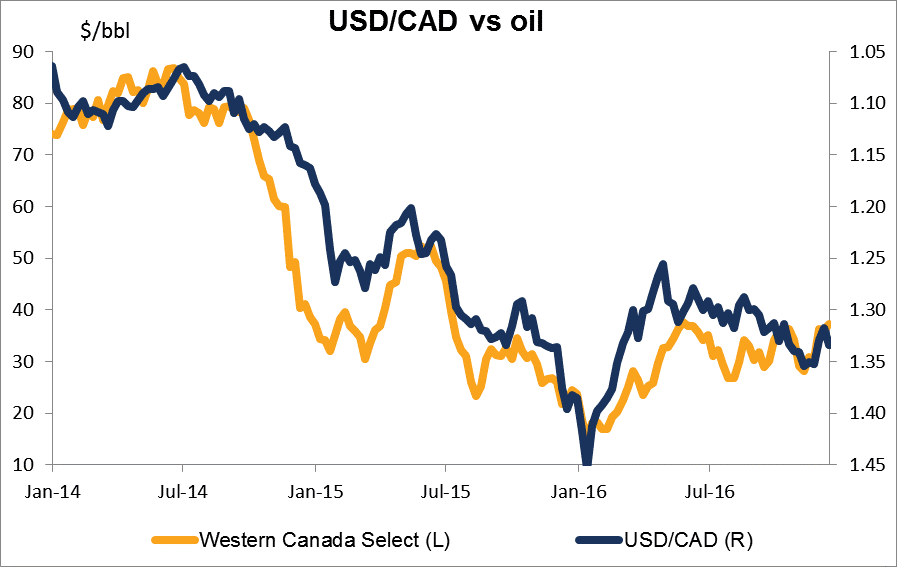

Finally, Canada releases several important indicators later in the week: retail sales, CPI and November GDP. Oil probably will remain the key for the currency, however. If WTI can remain over $50 a barrel, then the slight slowdown in inflation and drop in activity that the market expects might not matter for the currency.