The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning 12 Dec: Japan tankan, FOMC decision, SNB & Bank of England meetings

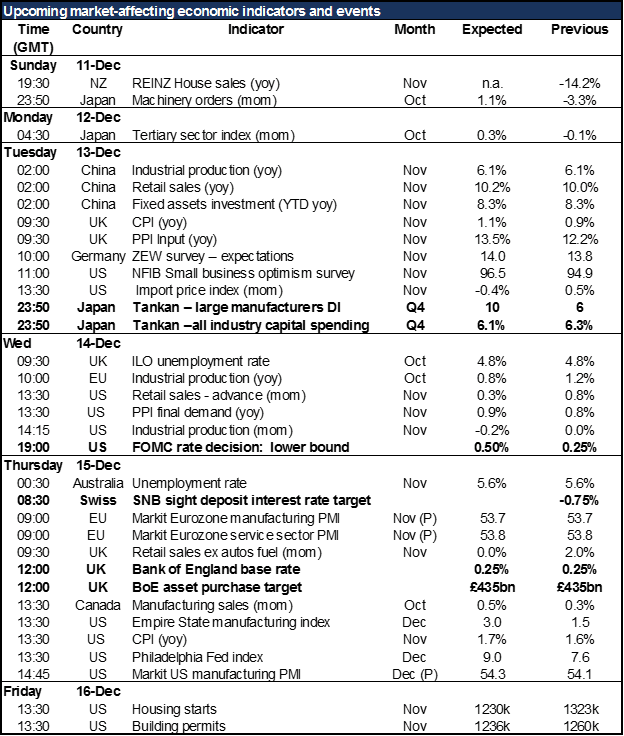

There’s still quite a lot going on as the year draws to a close: meetings of the FOMC, Swiss National Bank (SNB) and Bank of England (BoE); the Bank of Japan’s quarterly tankan survey, and the preliminary PMIs for December, as well as several important Chinese indicators.

For the FOMC, the market sees a rate hike of 25 bps as a sure thing. The focus then will be on what the Committee expects for the future pace of rate hikes. As usual, the dot plot will hold the key: do they still expect two rate hikes in 2017 and three each in 2018 and 2019? Has their view of the long-term equilibrium level of rates changed – perhaps even been revised upwards? Given the good performance of the US economy recently, I expect them to take a more optimistic view of the economy and an even more hawkish view on rates. That’s likely to boost the dollar further, in my view.

The big question then is what the Fed decision means for risk sentiment. The markets are in a “risk on” mood and I think even a more aggressive rate path from the Fed would be interpreted as a vote of confidence in the US economy and a return to normality. What people hear often depends on what they want to hear.

The SNB will probably be a non-event. With the CHF weakening on a trade-weighted basis, the SNB probably doesn’t feel the need to move rates further into negative territory. On the other hand, after the ECB decided to extend its QE program, now wouldn’t be a good time to start normalizing policy either. In addition to no change in rates, I expect little change to the statement and hence little change to CHF either.

There’s more controversy surrounding the BoE. There are several hawks on the Monetary Policy Committee (MPC) who may take a fairly aggressive stance against the background of the UK economy’s robust performance. Thus while rates are likely to be unchanged, the minutes could include comments about the risks of letting inflation get out of hand, particularly if Tuesday’s UK CPI & PPI figures show inflation accelerating further, as expected. Such comments could prove GBP-supportive.

Japan’s tankan is forecast to show continuing improvement in sentiment among the large companies. Capital spending may be revised down slightly though. This kind of report is likely to be negative for the yen as stock prices would normally rise, and the yen tends to weaken when stocks rise.

The preliminary PMIs for December for the major industrial economies come out on Thursday. The Eurozone PMIs are expected to remain at a fairly healthy level. That could boost EUR.

Other important data for the EU are the ZEW survey on Tuesday and EU-wide industrial production on Wednesday. The results are expected to be mixed, with the ZEW survey showing some improvement but IP growth slowing.

China releases its November industrial production, retail sales and fixed asset investment data Tuesday. They’re expected to show the Chinese economy continuing to expand at a steady pace. That could add to the risk-on sentiment and help to support stocks and the risk-sensitive currencies, such as SGD, ZAR, NZD and AUD.

The big day for US data is Wednesday, when retail sales, producer prices and industrial production are released. Retail sales is an especially important indicator. But with the FOMC meeting a few hours later, I don’t expect these indicators to make as much of an impact as they normally would. Then on Thursday we get the Empire State and Phili Fed indices, the preliminary Markit manufacturing PMI, plus CPI. They’re all expected to improve, which should keep USD well bid.