Two very important speeches on the horizon today which are likely to affect FX markets, and in particular the GBP. British PM Theresa May will speak outlining the official UK government position on Brexit. And China’s Xi Jinping will become the first Chinese leader ever to address the annual Davos World Economic Forum, ironically as an unlikely advocate of Free Trade.

How might all this affect FX markets?

John Hardy, Head of FX Strategy at Saxo Bank explains. More of John’s research can be seen at Saxo Bank’s TradingFloor.com.

- USD pairs nervous amid massive US policy uncertainty

- USDJPY plunges to new local lows as EURUSD trends higher

- There might be a sell-the-rumour, buy-the-fact reaction to May’s speech

John Hardy, Saxo Bank

The US dollar weakened further overnight on no apparent catalyst, market acitivity that looked suspiciously like a triggering of resting orders, as there was no obvious catalyst for fresh flows overnight and the US is just emerging from the other side of a three day weekend. Certainly, however, the energy in USD pairs remains nervous as policy uncertainty is easily the greatest it has been since the global financial crisis. The novel aspect this time around is that the uncertainty comes amid relatively peaceful markets and relatively positive economic data, rather than during a raging financial panic.

USDJPY plunged to new local lows after working through the liquidity in the are just below 114.00 and EURUSD was back higher. Despite all the talk of a weak sterling, the sterling actually outperformed the US dollar overnight, trading well off the lows from early Monday.

Today’s Brexit speech from UK prime minister May will spell out the government’s negotiation priorities for the Brexit process. As these have been endlessly covered in the run up to this speech, and given the longer-term uncertainty of the Brexit timeline, is the market over-anticipating here?

At stake is first, the expressed willingness to leave the customs union (this has always been a clear risk), and the expressed intent to try for an interim deal. This latter issue is a bit more novel and, depending on whether the UK is able to engineer some kind of interim deal while the longer term Brexit negotiation and implantation timetable is put in place, could be the difference between the “hard Brexit” and what one article yesterday called the “hard and dirty Brexit”. We have no crystal ball, but suspect that we may see a sell-the-rumour, buy-the-fact reaction to today’s speech.

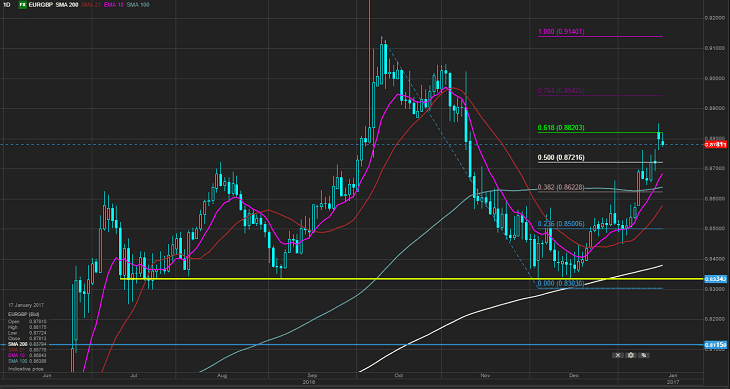

Chart: EURGBP

The EURGBP rally has taken the pair into the last important Fibonacci retracement levels above 0.8800 top open this week. This is an important level for those looking to confirm that the recent large-scale reversal after hitting 0.9000+ was a topping formation. If sterling selling accelerates again, it would throw this scenario into doubt and the best the sterling hopefuls might expect is a double top set-up here. We’ll certainly know more tomorrow.

Source: SaxoTraderGO

The G-10 rundown

USD – the US dollar continues to wobble, with no real catalyst other than raw sentiment as the market is desperately unsure what the Trump era will bring in real policy initiatives and how the rest of the world will respond. At current levels, volatility risk pendulum is swinging in favour of USD upside.

EUR – The European Central Bank meeting on Thursday is the chief focus, though the euro can’t escape volatility on today’s Brexit speech. An especially vicious sterling rally could pressure the euro broadly via EURGBP and vice-versa on any notable plunge in sterling.

JPY – USDJPY nudged below the local support and this theoretically opens up for 112.00 and even lower if we look at Ichimoku cloud levels, though we wonder whether the arrival of Trump on Friday could serve as a pivot point for the USD.

GBP – see above our thoughts on today’s Brexit speech from PM May. Technically, important for sterling to take a stand here, or the abyss awaits in GBPUSD. EURGBP is at last-gasp retracement levels as well ahead of the 0.9000+ recent highs, so it is a stand-or-fall kind of day for sterling. As of this writing, no time has been established for May’s speech, so traders need to stay on their toes for timing today.

CHF – no fresh impressions to go on – note in USDCHF that 1.0000/50 looks like a key zone of support if the USD is going to make a stand at some point.

AUD – AUDUSD executing almost a perfect test of the arguably the final resistance level ahead of the 0.7800+ highs from 2016 at the 61.8% Fibonacci near 0.7540. Employment data up on Thursday.

CAD – USDCAD trading around the 200-day moving average as CAD looks weaker in the crosses, likely due to its association with the wobbly greenback. Little anticipation of tomorrow’s Bank of Canada meeting, though the outlook could prove a bit more positive on higher commodity prices and the outlook for the US.

NZD – NZD overachieving here again, piggybacking the AUD gains against the US dollar. The action looks locally overdone and all of the previous, similar rallies faded sharply again – will this time be any different? Next catalyst on January 25 with Q4 CPI.

SEK – SEK needs to follow through lower here, otherwise, we begin to suspect a case of momentum divergence that could risk spoiling the SEK rally. It’s a key window over next couple of session for the krona.

NOK – EURNOK continues to press the snooze button amid a lack of catalyst from energy markets or central bank policy/economic event risks.

Upcoming Economic Calendar Highlights (all times GMT)

1145 – UK Prime Minister Theresa May delivers Brexit speech

0930 – UK Dec. CPI/RPI/PPI

1000 – China President Xi to Speak at Davos

1000 – Germany Jan. ZEW Survey

1330 – US Jan. Empire Manufacturing Survey

1345 – US Fed’s Dudley to Speak