The following is based on research by Ilya Spivak, Senior Currency Strategist at DailyFX, a unit of IG Group Holdings plc (LON:IGG). More of Ilya’s research can be seen at DailyFX.com.

Talking Points:

- US Dollar drops as yields decline amid “Trump trade” unwind

- Yen soars, buoyed by risk aversion across most Asian bourses

- Information vacuum acutely increases knee-jerk volatility risk

Ilya Spivak, DailyFX

“Trump trade” unwinding is back in force at the start of the trading week. The US Dollar is trading broadly lower against its major counterparts. Risk appetite has soured, with the perennially anti-risk Japanese Yen rising alongside US Treasury bond futures while stocks across most Asian bourses fell alongside contracts tracking the S&P 500.

This is not surprising. The inauguration of the 45th US President has come and gone but greater fiscal policy clarity seems to be nowhere in sight. As argued in our weekly forecast, this has encouraged investors to scale back exposure to bets on richer corporate earnings and a steep Fed rate hike cycle envisioned after last year’s surprise election outcome.

Looking ahead, a sparse offering of scheduled economic news-flow in European and US trading hours hints that overnight momentum faces few barriers to continuation. With that in mind, the information vacuum largely responsible for current conditions is also likely to make for acute knee-jerk volatility risk as investors just from one stray headline to the next, attempting to divine direction.

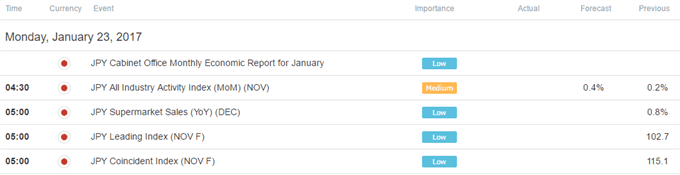

Asia Session

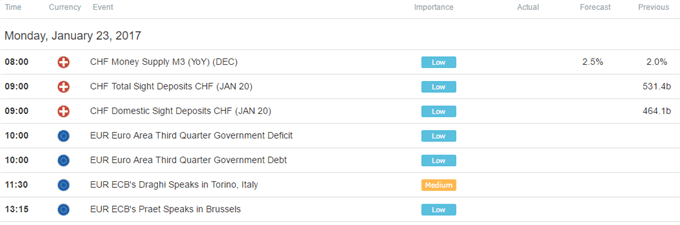

European Session