8 Securities, an Asia-Pacific robo-advisor with licensed offices in Hong Kong and Tokyo, launched its investing app ‘Chloe’ on Google Play and the Apple Store today. The service is free for accounts under HK $8,888 (USD $1,145). Back in May, LeapRate reported on the launch of 8 Securities, and their commission-free investment accounts.

How does the app ‘Chloe’ work?

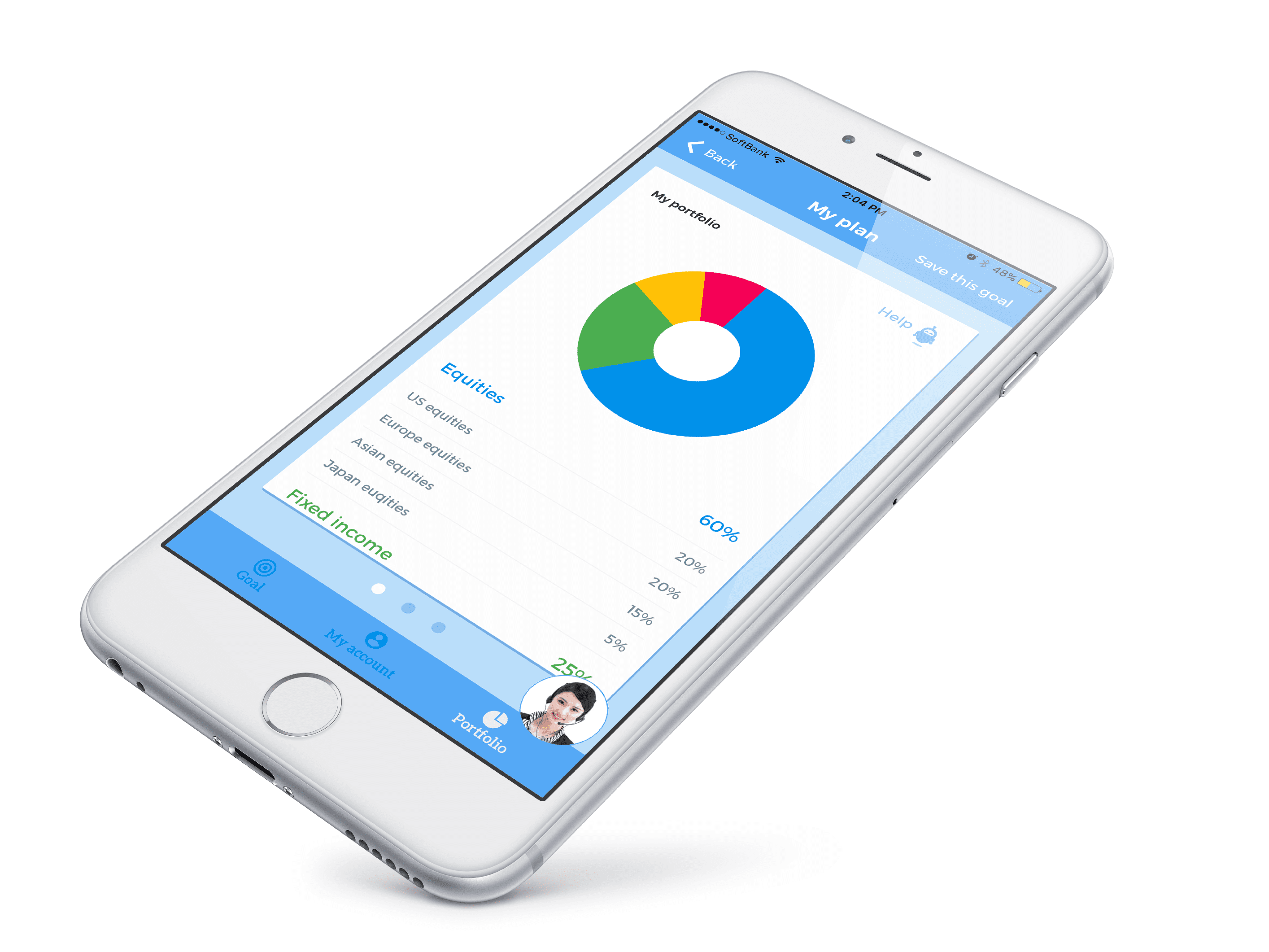

Customers start by answering a short survey to set goals and a target date to achieve them. Each dollar the customer deposits is intelligently invested into a diversified global portfolio of exchange traded funds.

Chloe monitors and optimizes the investment on a daily basis to help customers stay on track. Chloe becomes more intelligent over time by using machine learning to better predict customers’ goals and how much they need to save.

“We believe Chloe holds many advantages over private banks and wealth management firms whose investment minimums and costs make such services out of reach to 90% of the population,” said a spokesman at 8 Securities. “We recognize customers want mobility, simplicity and transparency when it comes to their money.”

On a global basis, customers are expected to deposit over USD $600 billion in robo-advisors by 2017.

Hong Kong is expected to grow from USD $400 million to over USD $20 billion by 2020 based on a research by Aite Group.

Features of Chloe

- Low Cost – Customers can start investing in their personal goals with as little as HK$ 1,000 (USD $128). The service is free for accounts under HK $8,888 (USD $1,145) and 0.88% annually above HK $8,888 (USD $1,145).

- Flexible – Unlike other advisory services and mutual funds, customers are free to deposit or withdraw their money anytime with no fees and no questions. Chloe gives you a flexible solution to save for the future with the power of investing.

- Global – Each customer’s personal portfolio is diversified across as many as 28 countries, 34 industries and 1,637 stocks and bonds using exchange traded funds.

- Adaptive – Chloe monitors each customer’s goals and optimizes the investment portfolio by partnering with well-known advisors. Machine learning improves goal prediction and its values over time.