FCA regulated social trading focused broker Ayondo has announced results for its publicly traded arm Ayondo Ltd., indicating growing Revenues but a large loss in the first quarter of 2018.

Ayondo’s Q1 results release mark its first as a public company. Ayondo went public on the Singapore Exchange in March in a $16 million IPO.

On the top line, Ayondo reported Revenue of CHF 7.3 million (USD $7.3 million) in Q1-2018, up 68% as compared to Q1-2017. In all of 2017 Ayondo averaged quarterly Revenues of CHF 5.2 million.

However the company posted a large loss of CHF 6.3 million (USD $6.3 million) in Q1. The loss included one-time items of Costs of Financing Debt of CHF 3.0 million, relating to conversion of outstanding convertible bonds at the time of the company’s IPO in March 2018, and IPO Costs of CHF 1.9 million. Without the one-time items, as well as a one-time employee share option plan charge of CHF 0.4 million, the company’s Loss before Tax in Q1 would have been reduced to CHF 1.2 million ($1.2 million).

We’d also note that while Revenues were up 68% in Q1, as noted above, the company’s largest individual cost item – Fees, rebates, and client bonuses – nearly doubled from CHF 2.1 million in Q1-2017 to CHF 4.2 million in Q1-2018, representing a whopping 57% of Revenues. This was predominantly due to increased rebates as a higher amount of Ayondo’s business was conducted with partners, which has a lower profit margin.

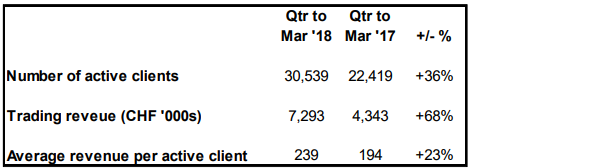

The company said that Q1-2018 results reflect strong revenue growth through its B2B and B2C channels, including expansion of the total number of active clients and revenue per active client.

Trading revenue increased by 68% from CHF 4.34 million for Q1 2017 to CHF 7.29 million in Q1 2018 as a result of an increase in the number of active clients from 22,419 in Q1 2017 to 30,539 in Q1 2018. Average revenue per active client increased from CHF194 in Q1 2017 to CHF239 in Q1 2018 due to increased trading activity as market volatility increased in Q1 2018.

Robert Lempka, Ayondo

Robert Lempka, CEO of the Ayondo Group stated:

Our maiden report as an SGX listed company shows excellent progress and we will continue to focus on the expansion of our B2B and B2C business. We continue to remain vigilant around cost management while investing in product innovation and customer acquisition as part of our FinTech growth strategy.

Ayondo’s full Q1-2018 financial report can be seen here.