UK online trading leader IG Group Holdings plc (LON:IGG) revealed results of its #ReplytoESMA website survey, indicating a very strong anti-ESMA stance among the more than 14,000 replies.

As we reported earlier this week, ESMA has come under a lot of pressure to alter its plans to enforce a maximum leverage cap of 30x for Forex pair and CFD trading in Europe. ESMA’s proposals also go farther than that, with the 30x cap applying only to major currency pairs which have relatively low historical volatility. A lower cap of 20x would be enforced for non-major currency pairs, major equity indices, and for Gold CFDs. An even lower maximum of 10x would apply to CFDs in commodities other than gold, and for CFDs in minor equity indices. For individual equities and ‘anything else’ – such as cryptocurrency CFDs – a leverage limit of 5x would apply.

Back to the survey results….

In all, there were 14,605 responses received to the #ReplytoESMA survey held at special website replytoesma.trading, with the site receiving 108,905 pageviews during the survey period. Of those responding (after weeding out duplicate responses), 98.1% were firmly against ESMA’s proposals. About 1% of respondents were for the proposals, while 1% indicated a ‘neutral’ stance.

The survey did more than give traders and others who would be affected a forum to complain. On the side of constructive criticism, the survey asked what other measures would be helpful in actually protecting traders’ interests. The leading issues along those lines were:

- 55% of respondents were in favour of an optional guaranteed stop loss, allowing traders to get out of a trade at a guaranteed price.

- 45% were in favour of negative balance protection on an account basis.

- 41% favoured a margin close-out on an account basis.

Less favoured proposals included margin close out on a position-by-position basis (just 7% of respondents were in favour), and requiring guaranteed stops on positions (19%).

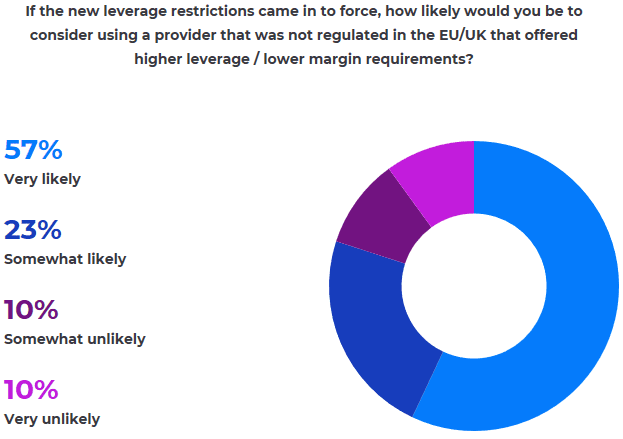

The most revealing part of the survey, in our view, was that 57% of the respondents – more than half! – stated that they would be likely to consider trading with a offshore broker offering higher leverage and lower margin requirements,

From a qualitative basis, reading through the written submissions of many of the respondents a very common thread emerged, and it is one which has been stated by a number of leading brokers from both in Europe and outside the continent – the enforcement of such low leverage levels will open the door for offshore, unregulated brokers. ESMA’s proposals, while well-intended, will end up hurting the people they are trying to help by pushing them into the arms of brokers over which they have no jurisdiction.

ESMA has so far moved very quickly – it first announced its plans in mid December, just as traders and financial industry types were heading out on winter break, and left its formal consultation period open for just two and a half weeks from January 18 to February 5, versus a customary several-months period for similar planned legislative action in the past.

The full results of the #ReplytoESMA survey can be seen here.