The following article was submitted by Michael Stark, market analyst at Exness.

Markets are now entering their fourth week of ‘panic mode’ as the coronavirus and measures to tackle its spread seem set to cause a recession around the world this year. This week’s most important regular data is claimant count change from the UK tomorrow. As before, though, it’s likely that this and other releases will take a back seat to correlations and news of the virus.

Central banks were exceptionally active last week and this morning in attempting to mitigate the expected economic downturn. The Bank of Canada and the Norges Bank both cut their rates by 0.5% on Friday. In an extraordinary move, the Fed cut to 0-0.25% yesterday and announced a new programme of quantitative easing. The Reserve Bank of New Zealand also made a large cut of 0.75% to its cash rate, taking it to 0.25%, the lowest ever.

A number of central banks have also scheduled meetings this week. The most important of these are the Fed, the BoJ, the SNB, the Norges Bank, the CBRT, the SARB and the CBRF. The PBoC also meets to set its loan prime rate on Friday morning GMT. More cuts are possible at these meetings in addition to the emergency measures already taken by many authorities. Traders should prepare for very high volatility throughout this week and especially around these meetings.

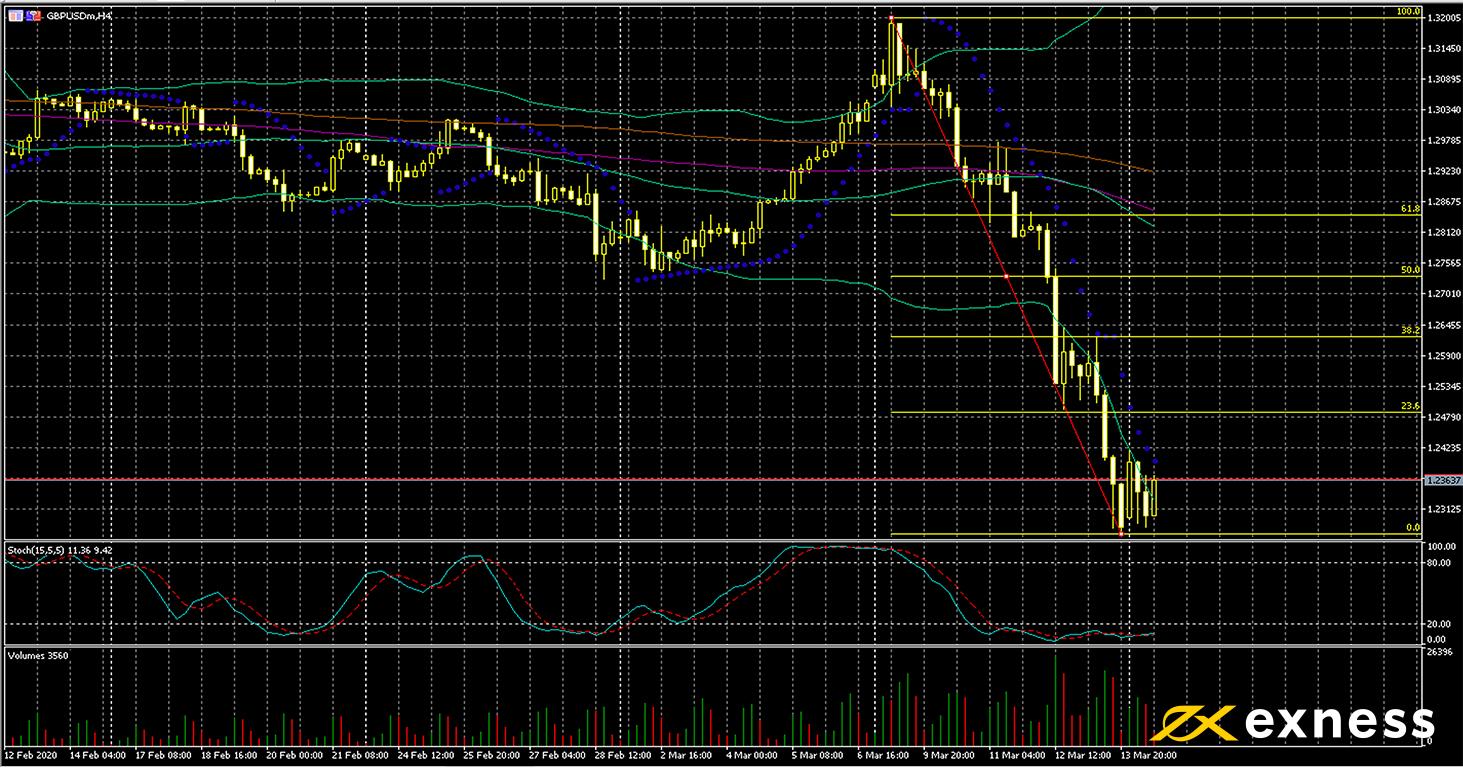

Cable, four-hour

The pound has lost strength against most major currencies since last week. As elsewhere, previously pressing concerns (in this case trade negotiations between the UK and the EU) have been replaced by the effect of the virus on the economies of the UK and the USA. The British government’s strategy against the virus is widely perceived to be very risky, whereas the USA doesn’t seem to have a coordinated strategy of any kind at the moment. On the other hand, markets seem to be expecting the BoE to cut rates again or significantly expand QE in the near future.

From a technical perspective, further losses would seem to be capped by strong selling saturation. Since the middle of last week, the slow stochastic has printed readings below 10 and price has consistently closed outside the lower deviation of Bollinger Bands. Momentum lower today has also been weaker despite volatility remaining high. Most new sellers might consider waiting for a retracement upward, either to the 23.6% Fibonacci area of somewhere not far below this.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 17 March, 9.30 GMT: claimant count change (February) – consensus 21,400, previous 5,500

- Tuesday 17 March, 12.30 GMT: American retail sales (February) – consensus 0.2%, previous 0.3%

- Wednesday 18 March, 18.00 GMT: meeting of the Federal Open Market Committee

- Thursday 19 March, 12.30 GMT: initial jobless claims (14 March) – consensus 218,000, previous 211,000

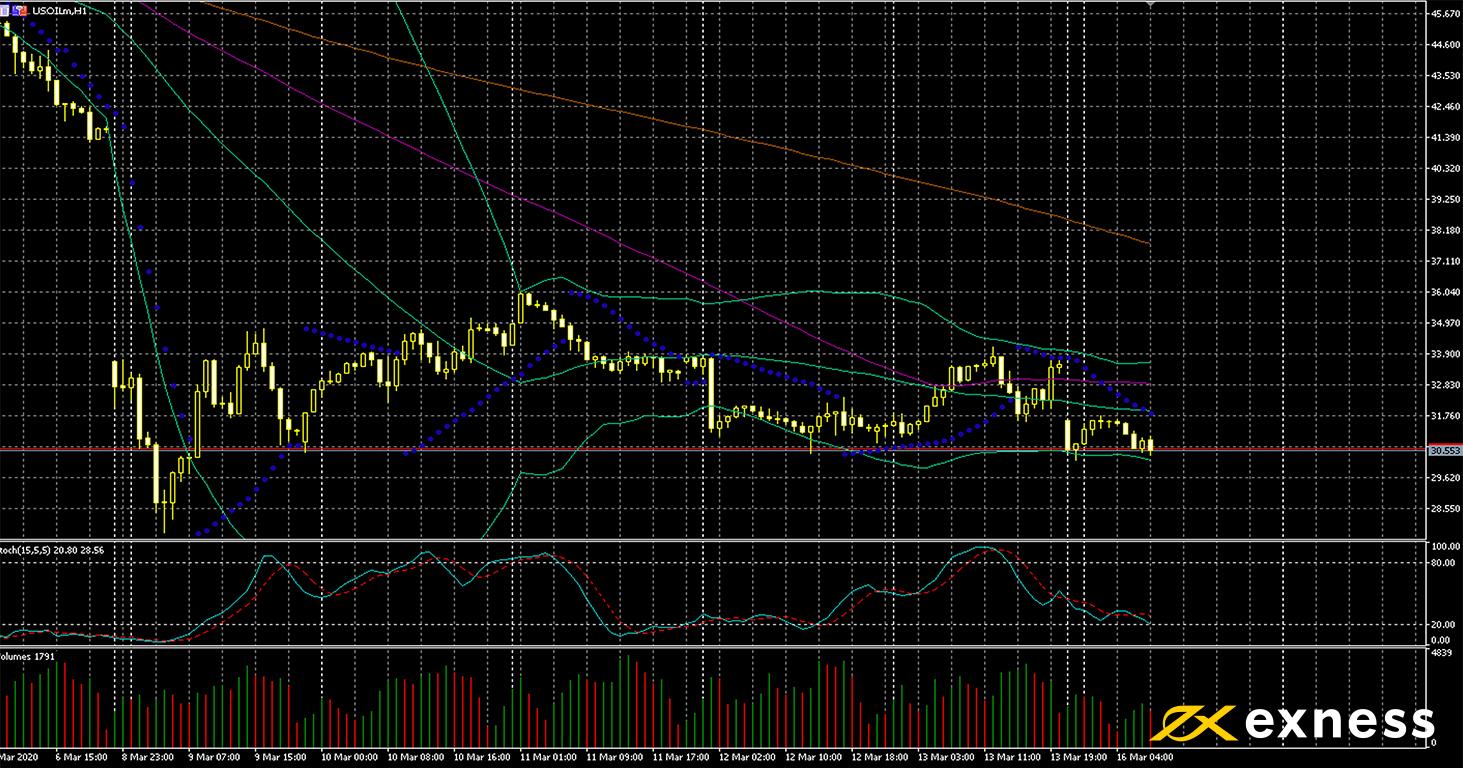

USOIL, hourly

Oil opened significantly lower this week, with both Brent and WTI down more than 5%. There are major negatives on the sides of both supply and demand, with the ongoing price war driving supply up and selling price down plus the coronavirus around the world hitting demand. The decline in air travel, which is expected to worsen further over the coming weeks, has had a particularly strong impact on demand.

$30 seems to be a key support for WTI. Price bounced very strongly from this area several times in the second half of last week. The retest of this zone in the early morning GMT today was also rejected, although more weakly than last week. Bollinger Bands have contracted since the middle of last week, suggesting that relative stability could continue. On the other hand, crude oil’s generally high volatility and dependence on news means that TA should not be relied upon too heavily during such times of crisis.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 17 March, 20.30 GMT: API crude oil stock change – previous 6.41/million

- Wednesday 18 March, 14.30 GMT: EIA crude oil stock change – previous 7.66 million

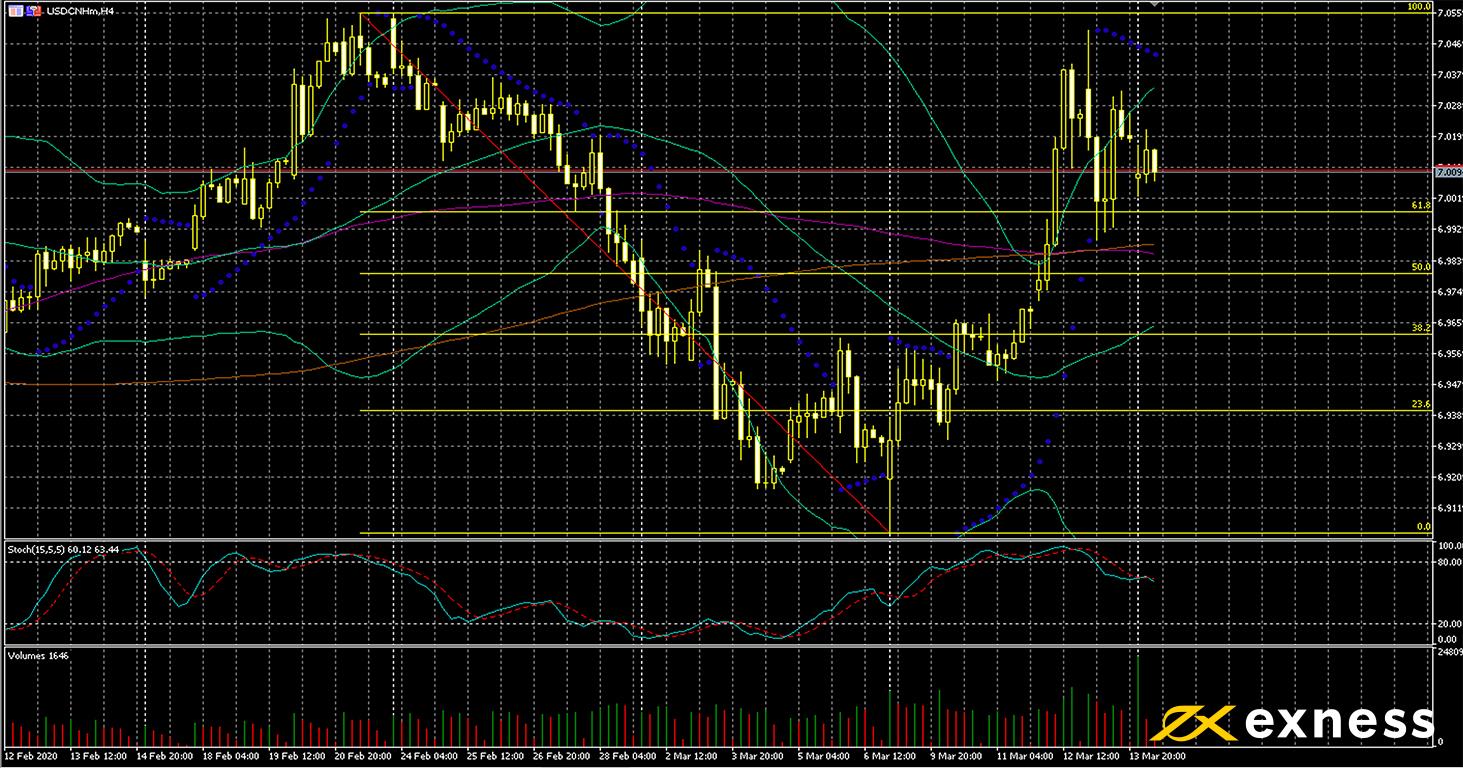

Dollar-yuan, four-hour

USD-CNH has risen since the middle of last week in what appears to be a flight to (relative) safety. This morning’s Chinese releases were also abysmal: annual industrial production was down 13.5% and annual retail sales down more than 20%. Despite the fact that the worst immediate effects of covid-19 on China are over, the yuan has remained above the important area of ¥7 to the dollar.

For the time being, the 61.8% Fibonacci retracement seems to be a strong area of support, with an extended test of this zone rejected on Friday night GMT. The slow stochastic has moved out of overbought and is currently closer to neutral at 63. Buying volume also spiked during the first period today. From a technical standpoint, more gains seem to be likely for dollar-yuan this week. Having said that, the meetings of the Fed and the PBoC this week could make the opposite direction more likely depending on the outcomes.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 17 March, 12.30 GMT: American retail sales (February) – consensus 0.2%, previous 0.3%

- Wednesday 18 March, 18.00 GMT: meeting of the Federal Open Market Committee

- Thursday 19 March, 12.30 GMT: initial jobless claims (14 March) – consensus 218,000, previous 211,000

- Friday 20 March, 1.30 GMT: meeting of the People’s Bank of China

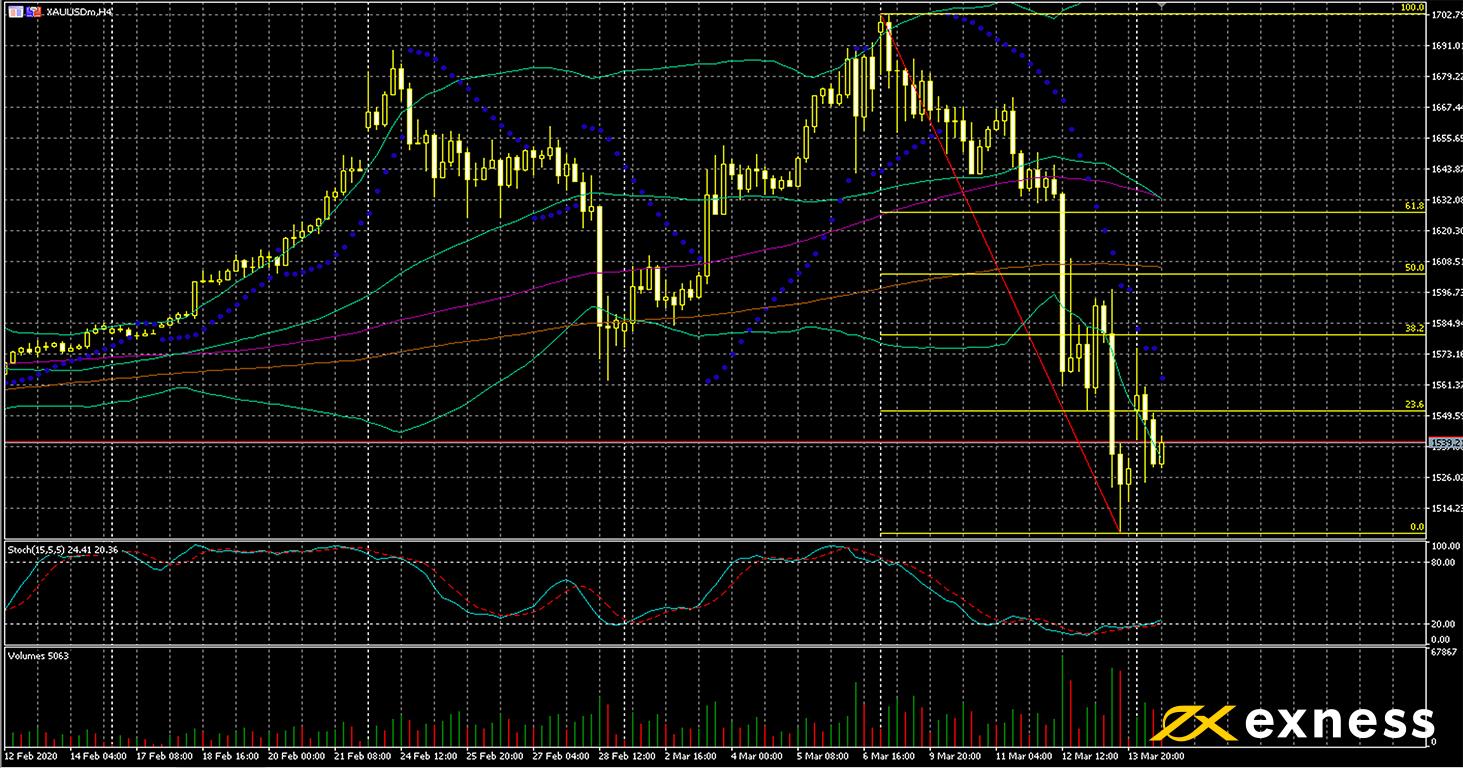

Gold-dollar, four-hour

Gold’s volatility against most currencies has continued so far this week. Despite some initial gains this morning GMT after the Fed’s latest decisions, prices have now returned almost to where they ended on Friday night.

Price is approaching the important psychological support of $1,500. A bounce would be likely in the short term at least if this zone were to be tested this week. One can also note that the 50 SMA from Bands is about to complete a death cross of the 100 SMA. Oversold is not indicated by the slow stochastic, but price has closed repeatedly outside the lower deviation of Bands. Realistically, though, TA’s utility is likely to be limited for XAU-USD’s longer timeframes given the overall mood in markets. What the Fed says (and possibly does) on Wednesday night will probably be crucial for ongoing direction.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 17 March, 12.30 GMT: American retail sales (February) – consensus 0.2%, previous 0.3%

- Wednesday 18 March, 18.00 GMT: meeting of the Federal Open Market Committee

- Thursday 19 March, 12.30 GMT: initial jobless claims (14 March) – consensus 218,000, previous 211,000

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.