The following article was submitted by Michael Stark, market analyst at Exness.

Asian and European shares have posted some gains so far this week as lockdowns continue to be eased. HK50 was very volatile in today’s session though as protesters took to the streets again in Hong Kong against what they see as increasing control by Beijing in Hong Kong’s affairs. Oil has also consolidated so far today, with Brent holding above $35.

South Africa, Turkey and Thailand’s central banks all cut their rates as expected last week. This week’s most important monetary meetings take place in Israel, Hungary and Poland. Each of these three central banks is expected to keep its rate on hold, with the first two already close to zero.

Some of the most important regular data this week come from the USA and Canada. Second estimate GDP data from the USA is due on Thursday afternoon GMT, then Canada, France, Turkey and Italy among others release their latest GDP figures on Friday. German annual GDP meanwhile was announced to have dropped 2.3% this morning, the worst result in more than a decade.

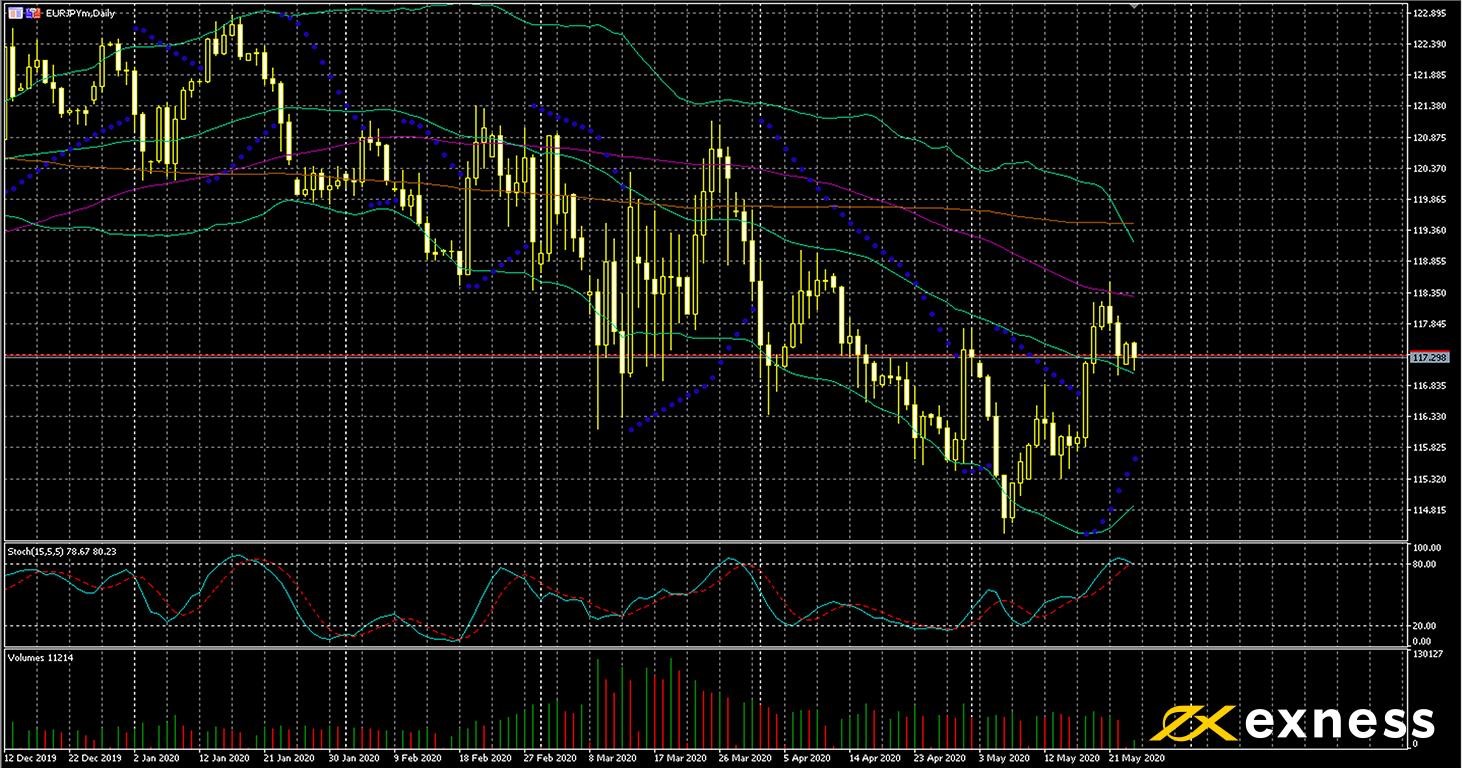

Euro-yen, daily

The euro has retreated somewhat against other major currencies today. Weak German data this morning in line with expectations is one factor, but disagreement among EU countries as to whether the Recovery Plan should involve grants or loans is another factor. Ongoing tension between the USA and China, this time over the latest bout of protests in Hong Kong, has boosted demand somewhat for havens like the yen.

The chart itself of EUR-JPY seems to have hit a bottom for now around ¥115-114.80. The bounce from this area over the last fortnight has been reasonably strong. Now that price is within the first value area between the 50 and 100 SMAs, consolidation seems to be possible. Friday’s a bumper day of data for euro-yen, though, so surprises in these figures could bring more direction. Traders will also probably monitor events in stock markets this week given the yen’s inverse correlation with JP225.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 26 May, 6.00 GMT: GfK consumer confidence (June) – consensus -18.9, previous -23.4

- Thursday 28 May, 9.00 GMT: eurozone business confidence (May) – consensus -3, previous -1.81

- Thursday 28 May, 23.30 GMT: Japanese unemployment (April) – consensus 2.7%, previous 2.5%

- Friday 29 May, 5.00 GMT: Japanese consumer confidence (May) – consensus 25.1, previous 21.6

- Friday 29 May, 6.00 GMT: German annual retail sales (April) – consensus -14.5%, previous -2.8%

- Friday 29 May, 6.45 GMT: French quarterly GDP growth (Q1, final) – consensus -5.8%, previous -0.1%

- Friday 29 May, 8.00 GMT: Italian annual GDP growth (Q1, final) – consensus -4.8%, previous 0.1%

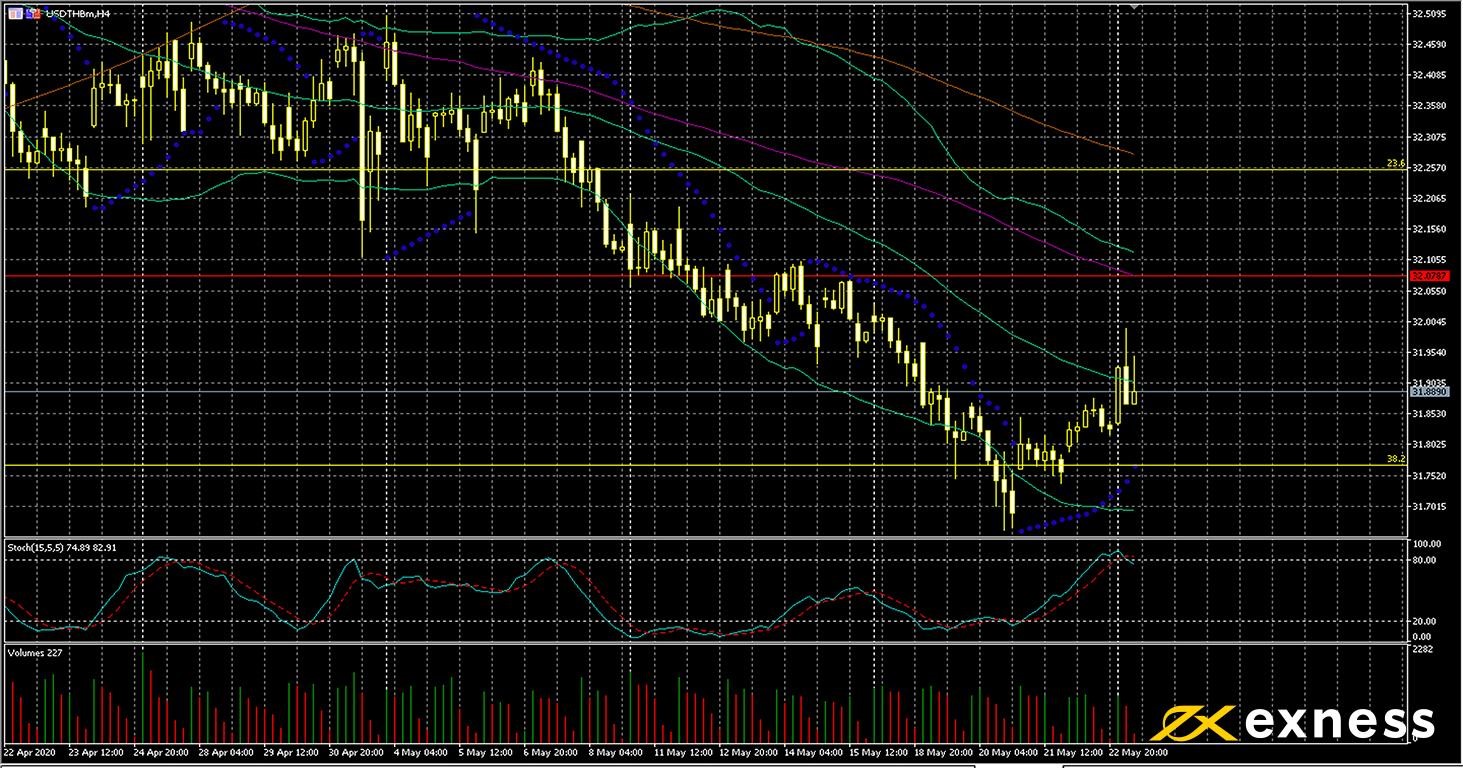

Pound-Canadian dollar, four-hour

GBP-CAD is still languishing near two-month lows so far this week. As oil has continued to make gains over the last few weeks, the loonie has found fundamental support. The ongoing effects of covid-19 on the British economy also remain significant. Last week’s claimant count change was especially bad: more than 850,000 was easily the worst release since the beginning of official statistics in 1971.

More losses in the near future seem to be possible based on TA. The downtrend is still active, although momentum has slowed somewhat. There’s no sign of saturation from either Bands or the stochastic, with the latter at 39 closer to neutral than oversold. Volume though has been low so far this week: many traders other than those who focus on the short term might be waiting for Canadian GDP data on Friday afternoon. If the consensus of a full 10% decline is correct, the loonie will probably face headwinds at least in the immediate future. Before this release, though, there will probably be a number of short-term opportunities in both directions.