This article was submitted by Stanislav Bernukhov, a Senior Trading Specialist at Exness.

Energy markets have been on the rise during the previous quarter: Crude oil skyrocketed after OPEC’s decision to cut production, and the overall revival in the energy sector is reflected in the increase of XLE: ETF for energy markets. Such companies as Exxon Mobil, Chevron, and their peers were lucrative for investors so far.

What about natural gas itself?

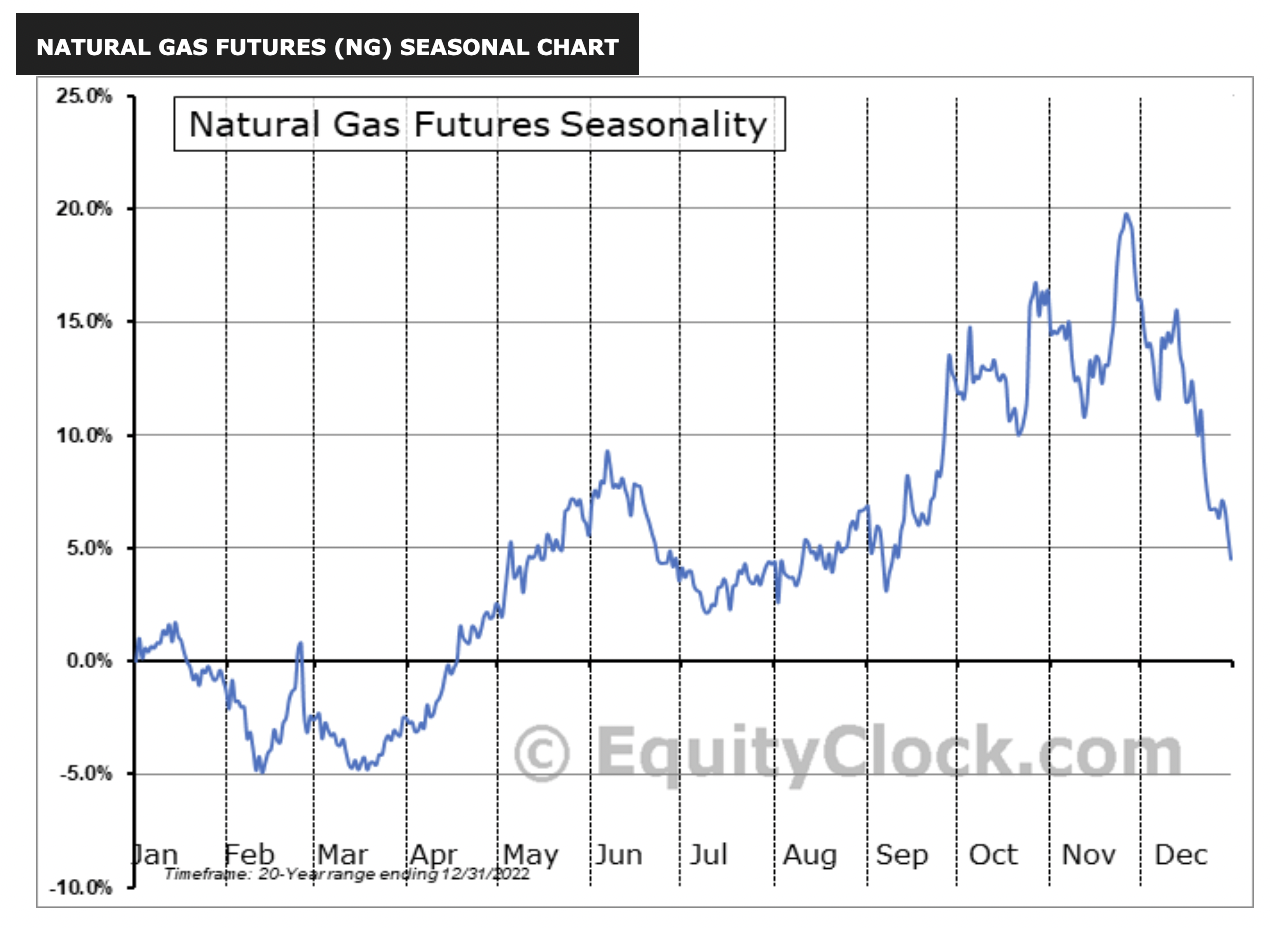

First, XNGUSD is a spot CFD contract, which mirrors the performance of futures contract NG (Natural gas futures delivered to the Henry Hub in Louisiana). There might be an interesting investment opportunity for this market, and here’s why:

Supply/demand:

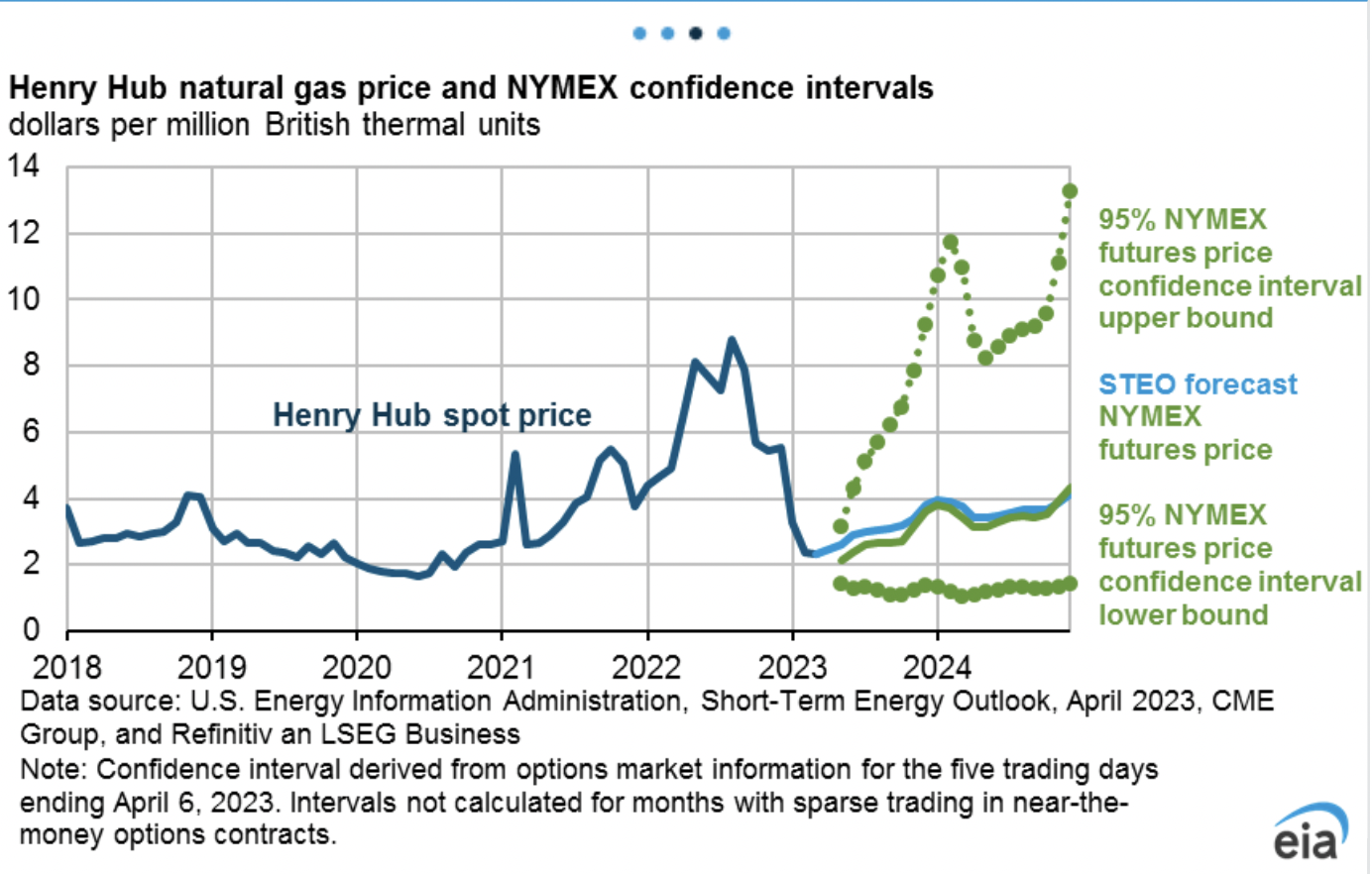

The disruption between supply and demand had caused the diminishing consumption of natural gas by Europe (due to geopolitical tensions between Europe and Russia), but even considering that the fair price for Natural gas futures with the delivery in Winter is around $4, with the current $2.5 per 10000 Mmbtu.

The gloomy scenario for natural gas points to a trading range between $1.6 and $1.8 per 10 thousand Mmbtu, which might happen with the heavy recession and substantial cut in the consumption of electricity. This scenario is minor, and the realistic expectation for natural gas prices is above $4.