This article was submitted by Exness.

The new summer week in the financial markets would be formative for the next several months, as FOMC will announce its interest rate decision – it will supposedly be the first time the interest rate won’t be raised for more than one year.

Markets usually accurately predict the interest rate itself, while the most intrigue will happen during the press conference of Jerome Powell, following 30 minutes after the publication. Another important publication would be the publication of CPI for the United States on Tuesday.

Crypto markets have taken a large hit last week, as SEC sued Binance exchange, though the overall markets fear remains low with stock indices consolidating around most recent highs.

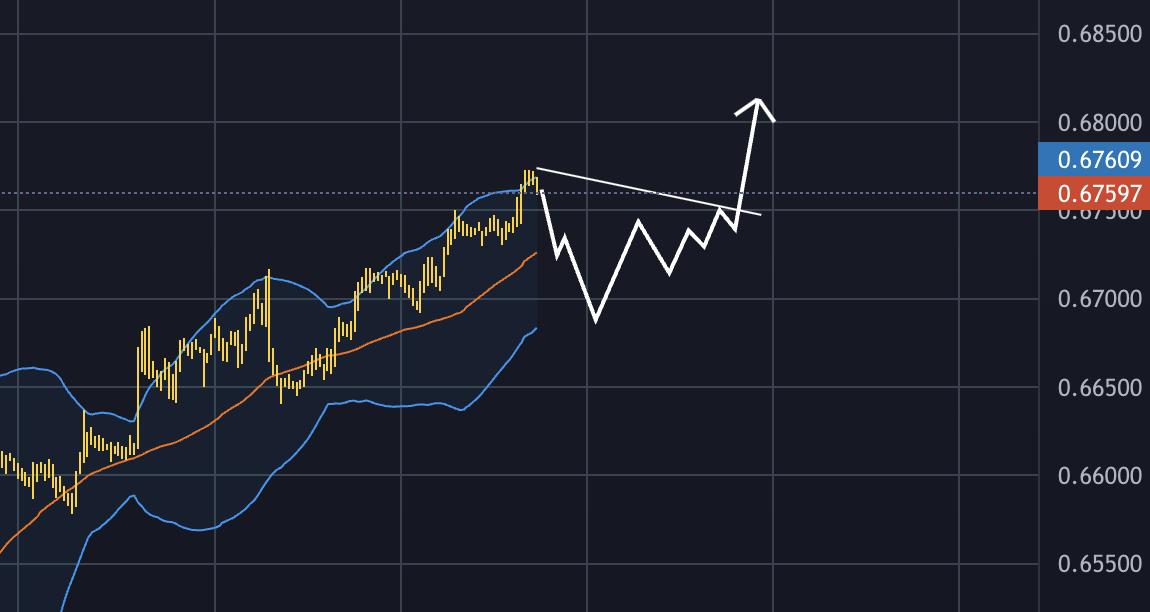

What are the main narratives for this week? Commodity currencies are at the center of attention after RBA and the Bank of Canada raised the interest rates, through Euro, British Pound and the US dollar tend to stabilize amid consolidating their long-term bond yields. That’s why, in this report, we will focus on EURUSD and AUDUSD.