This article was submitted by Aaron Hill from FP Markets.

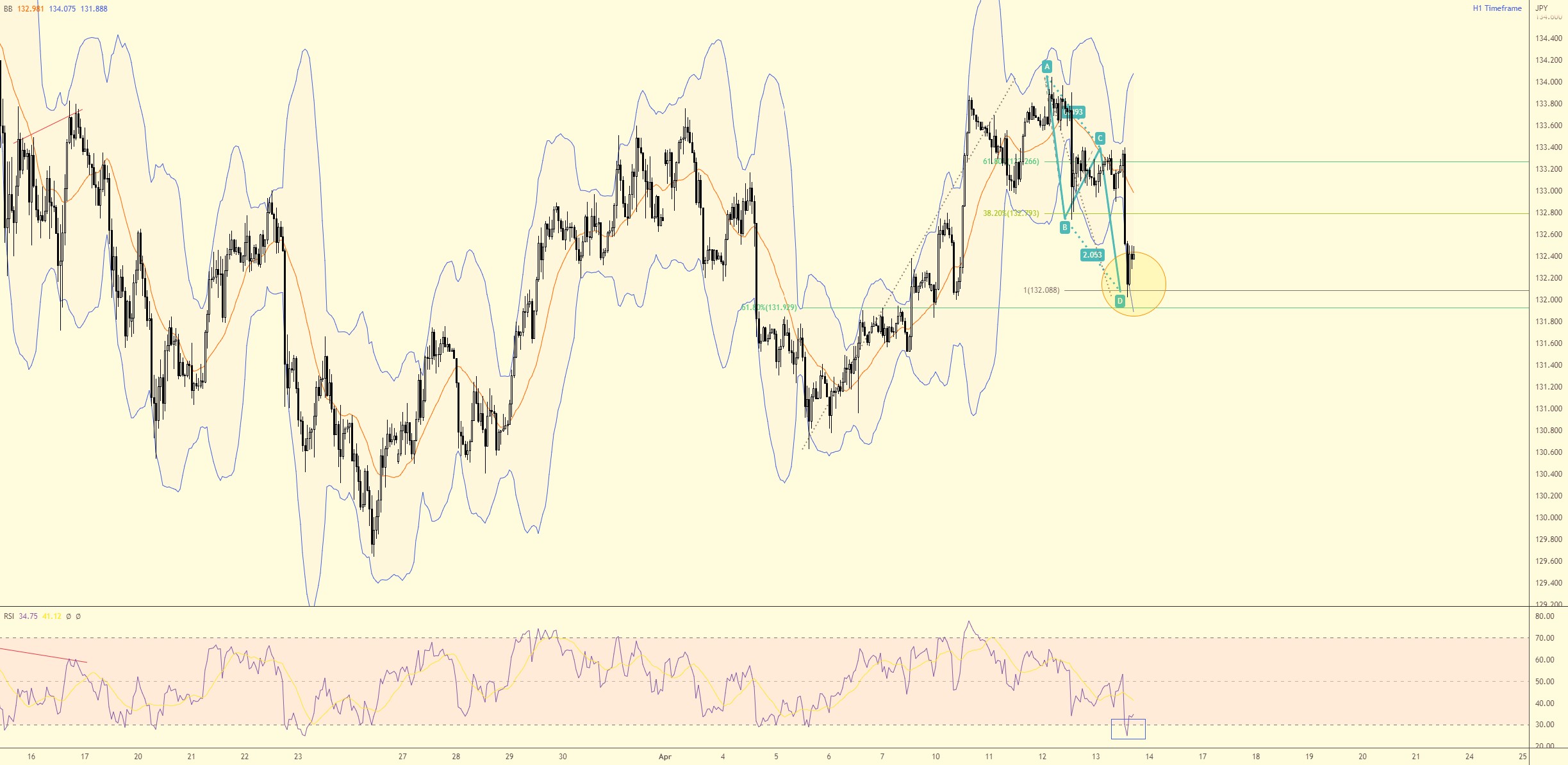

One of the simpler harmonic patterns is the AB=CD equivalent configuration, which graced the H1 chart of USD/JPY in recent trading.

Active AB=CD Pattern

Denoted through a 100% projection at ¥132.09, we can see that short-term price action rebounded from the AB=CD termination point in recent trading in a market echoing an uptrend. Regarding upside targets, many Harmonic traders will be watching the 38.2% and 61.8% Fibonacci retracement ratios, derived from legs A-D at ¥132.79 and ¥133.27, respectively.

Charts: TradingView

Charts: TradingView