The following article was written by Ramy Abouzaid, ATFX (AE) Head of Market Research.

Today, March 24, the prelim reading of US Manufacturing PMI will be released for March, as a continuation of the shocking state in the global economy, it is expected that we will witness further decline in the index reading. But to be more realistic, in the current circumstances, who cares?

The focus of the markets and investors around the world is now mainly on every news related mainly to Covid-19 virus. Tell me about the number of newly discovered cases, tell me about prevalence rates and outbreak areas, but do not talk to me about economic indicators now. naturally the markets will return to these traditional indicators later when the storm subsides.

The month of March recorded the largest acceleration in the outbreak of COVID-19 across the United States until now, to the extent that the US administration declared New York State a disaster area, in addition to the increasing cases in each state. And we are witnessing every day new developments in the situation constantly regarding government procedures and policies that clearly indicate to what extent that the performance of companies in such times is unstable.

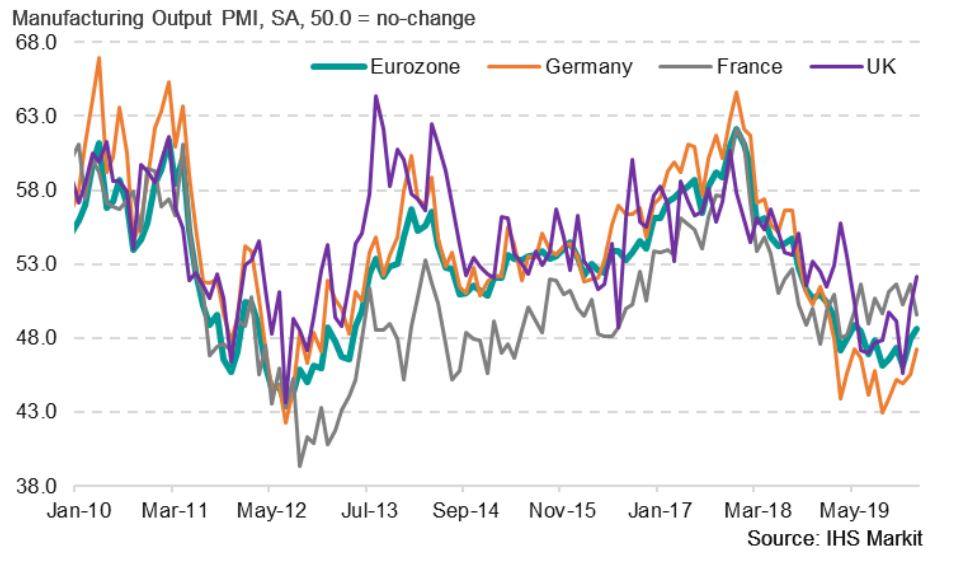

In addition to the consumer confidence survey data, the release of the “Initial” PMI for March is expected to indicate the performance of the industrial sector and will provide insight into the extent and depth of the turmoil.

In addition to the consumer confidence survey data, the release of the “Initial” PMI for March is expected to indicate the performance of the industrial sector and will provide insight into the extent and depth of the turmoil.