This article was submitted by Aaron Hill from FP Markets.

Following the Bank of Canada (BoC) hitting the pause button on policy tightening, the Reserve Bank of Australia (RBA) followed suit at its previous meeting. This saw the central bank hold the Official Cash Rate at 3.6%, following ten consecutive rate hikes from May 2022, totalling 350 basis points.

Key Points Out of the RBA Statement:

Key Points Out of the RBA Statement:

The Board recognises that monetary policy operates with a lag and that the full effect of this substantial increase in interest rates is yet to be felt.

Growth in the Australian economy has slowed, with growth over the next couple of years expected to be below trend.

The labour market remains very tight. The unemployment rate is at a near 50-year low and underemployment is also low.

The Board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target. In assessing when and how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.

The minutes from the latest RBA meeting will likely emphasise the above points, though traders will keep a close eye on the text for insights regarding future rate moves.

Regarding STIR markets, there is currently around an 80% probability of the RBA holding rates unchanged at its next meeting at the beginning of May.

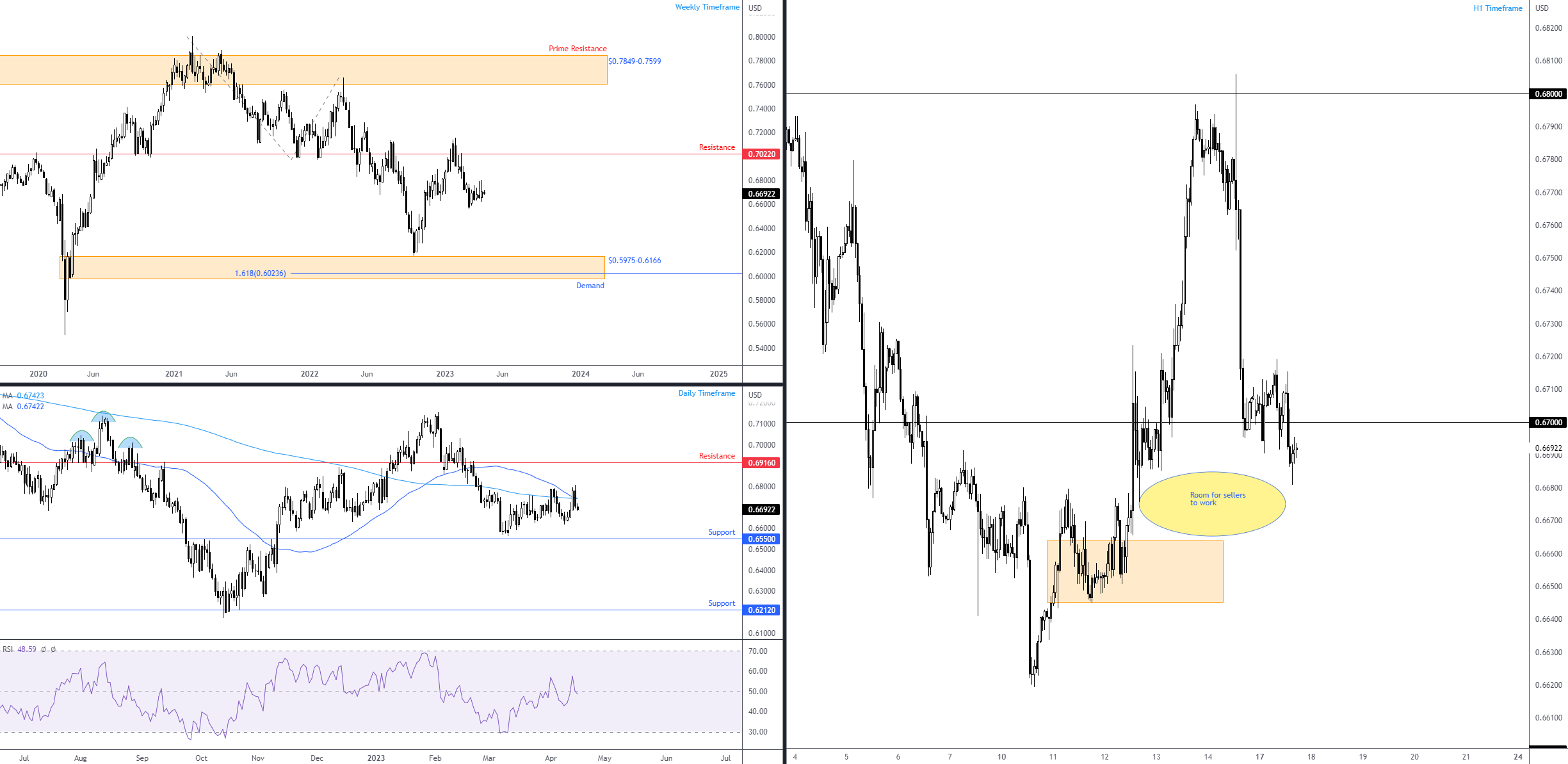

Charts: TradingView

Charts: TradingView