The Bank for International Settlements (BIS) has noticed a growing trend of large bank platforms over the past three years to send less foreign exchange volume into the network for processing. A new report cites low volatility as reason that large banks in the Interbank system are “internalizing” more of their customer client capital flows on their own platforms. These efficiencies have actually reduced volume to $368 billion per day in 2019, a 7% drop from similar volumes in 2016.

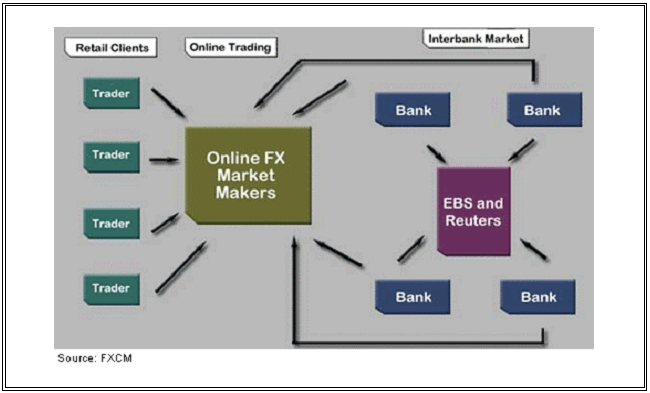

The BIS report singles out low volatility as the impetus for large banks to get better at “netting” internal flows and thereby reduce fee exposures on an overall basis. The declines, per the report, are not having an impact on price discovery in the market, but there are declines on the major backbone platforms, owned by Thomson Reuters (NYSE:TRI) and EBS, part of the CME Group (NASDAQ:CME) among others. The following diagram reflects how these systems fit into the scheme of things:

According to reporting from Reuters:

This decline in trading has been driven by the growing trend of “internalization”, where dealers temporarily warehouse risk arising from client trades on their books until it is offset against opposing client flow, reducing the need to use the broader market platforms.

The quarterly report from the BIS also noted that currency volatility has dropped to levels not seen for two decades. One example has been the “EUR/USD” currency pair, the highest traded pair in the entire global system. Trading in the pair over the last week was within ranges that were “the narrowest in two decades”.

The volume declines had no effect on current city center rankings. London and New York are still the largest trading centers, with London still retaining its top spot. As you might expect, the largest incidences of “internalization” occurred at these two venues:

BIS data showed banks reporting in the United Kingdom and the United States registered some of the largest declines in electronic trading on anonymous inter-dealer venues and also posted some of the highest internalization ratios for cash trading.

As this “internalization” trend evolves, the consequence has been that forex volumes are concentrating among a few very large banks. Per the BIS:

The falling share of inter-dealer trading has gone hand-in-hand with a handful of banks coming to dominate FX volumes.

In a separate report, the BIS also noted a decline over the past seven years in the number of correspondent banking relationships in the overall network. In order to consummate cross-border payments, banks have historically set up banking relationships with other correspondents in numerous other jurisdictions. These relationships have fallen by nearly 20%, as large banks have also brought efficiency to the process, which has traditionally resulted in tying up capital and adding administrative reconcilement burdens.

Surprisingly enough, transaction volumes have escalated by 40% over the same seven-year period. The inference is that volume is being concentrated over fewer channels. Industry observers see these efficiencies increasing even more so with the advent of cryptocurrency systems like Ripple that eliminates the need for a multitude of intermediaries for each cross-border payment transaction. Conventional foreign exchange flows today, however, dwarf any volumes through crypto platforms.