CLS Group, the market infrastructure provider of risk mitigation services to the global FX market, today published a report in which they examine the impact of the UK general election on the foreign exchange (FX) spot market, using data published by CLS on Quandl.

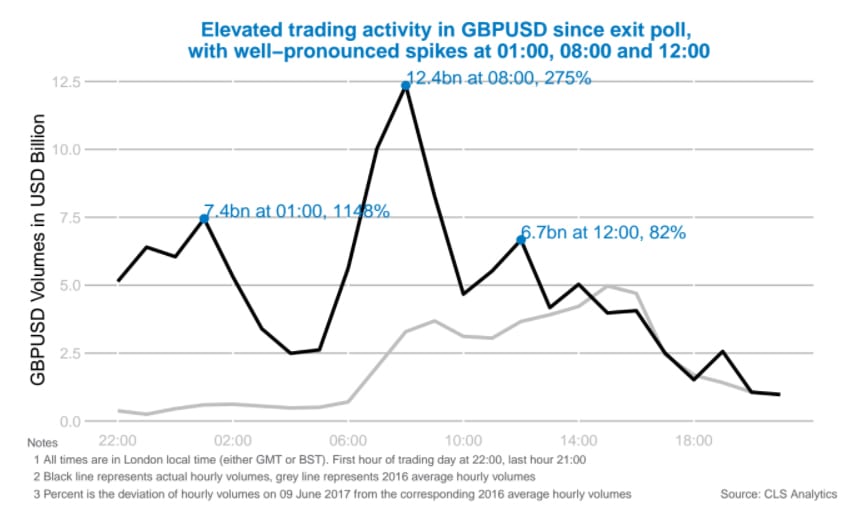

CLS do this by comparing GBPUSD hourly volumes on 09 June 2017, the first business day following the election, to the corresponding 2016 average GBPUSD hourly volumes.

The GBPUSD traded down sharply after the exit poll was released right after voting ended last Thursday.

The rest of the report reads as follows:

The chart below compares the hourly GBPUSD volumes on 09 June 2017 to the GBPUSD 2016 average hourly volumes:

Elevated GBPUSD trading activity since exit poll

The exit poll at 22:00 produced a surprise outcome with the Conservative party expected to win just 314 seats, far less than previous polls and 12 seats short of an overall majority. This resulted in an elevated trading activity in GBPUSD at 22:00.

As results were being announced during the night, the unexpected exit poll was becoming more credible and GBPUSD volumes remained much higher than the 2016 average. By 6:00, there were only two seats remaining to be counted (Richmond and Kensington) and thus the second peak in GBPUSD trading activity at 08:00 probably reflected the wider market reaction as the European session commenced.

The third spike at 12:00 is perhaps due to the news headline that Theresa May is going to form a government with the Democratic Unionist Party –

Northern Ireland (DUP).