This article was submitted by Aaron Hill from FP Markets.

UK Inflation

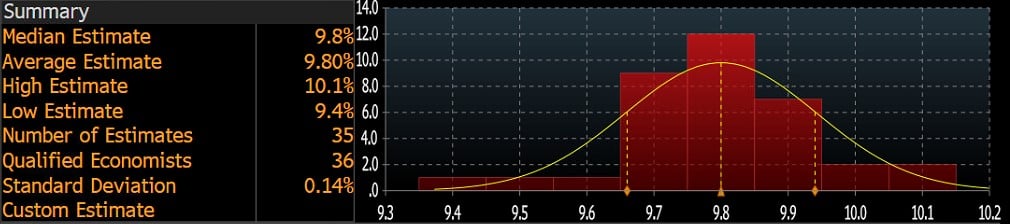

7:00 am GMT+1 on Wednesday will see the latest UK inflation data released by the Office for National Statistics (ONS). Economists’ estimates call for a nudge back into single digits for the YoY measure for March, with Bloomberg’s median estimate at 9.8%. Yet, the estimate range spans between a high of 10.1% and a low of 9.4%. Core UK inflation (excluding the volatile food, energy, alcohol, and tobacco items) also shows that the median Bloomberg consensus heading into the event forecasts core inflation to cool to 6.0% in the twelve months to March, down from February’s 6.2% rate. The forecast range sits between a high of 6.3% and a low of 5.6%.

UK Jobs Data

The inflation print comes a day after the UK’s unemployment rate rose 0.1 percentage points to 3.8% in the three months to February, up from 3.7%. Vacancies also dipped for a ninth successive month, and average pay—excluding bonuses—was higher than expected at 6.6% in the three months to February (economists called for a decline in wage growth at 6.2% [the forecast range sat between 6.3% and 6.0%; therefore, the release came in above the maximum forecast]).

BoE Rate Hike?

Markets are pricing in an 80% probability of another 25 basis-point increase at the next BoE meeting on 11 May over a 20% chance of the central bank pressing the pause button. Should the BoE hike rates, this will pull the Bank Rate to 4.5%. However, the noted probabilities will likely change following tomorrow’s inflation print, particularly if the headline or core releases print outside the aforementioned estimate ranges.

Charts: TradingView

Charts: TradingView