This article was submitted by Aaron Hill from FP Markets.

Euro area, UK and US manufacturing/services PMIs are in focus today.

The euro area PMIs are scheduled to be released in early European cash trading at 9:00 am GMT+1, followed by UK PMIs 30 minutes later at 9:30 am GMT+1, and then US PMIs in the early hours of US cash trading at 2:45 pm GMT+1.

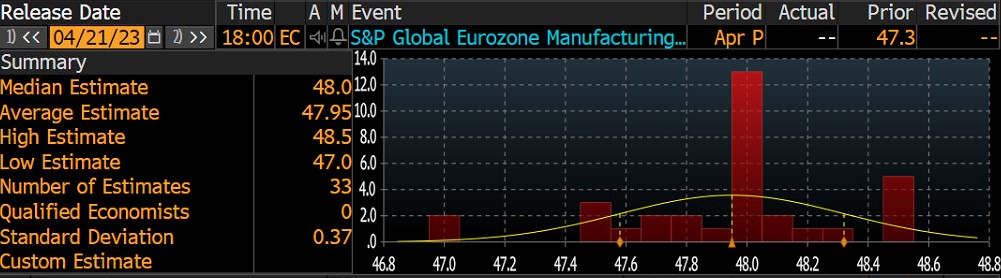

Bloomberg Estimates:

Euro area manufacturing PMI has a median estimate of 48.0 vs 47.3 prior, with a forecast range between 48.5 and 47.0.

UK manufacturing PMI has a median estimate of 48.4, from 47.9 prior and a forecast range between 49.4 and 47.5.

US manufacturing PMI has a median estimate of 49.0, from 49.2 prior and a forecast range between 49.5 and 47.5.