ActivTrades’ Market Analysts prepared their daily commentary on traditional markets for February 28, 2020. This is not a trading advice. See details below:

FOREX

Fears of a global recession caused by the coronavirus pandemic are increasing as more cases are declared in new countries. This has triggered a flight to safety by investors spooked by the uncertainty over the duration and severity of the crisis. It is therefore not surprising to see the yen and the Swiss franc strengthening across the board, noticeably against the US dollar, with gains of 0.8% and 0.2% respectively.

The recent strength of the euro versus other majors is also worth noting. The single currency is trading at $1.1041 at the opening of European markets, having climbed more than 2.4% against the greenback over the last seven days (see attached chart). This may be indicative of returning flows to the eurozone by investors that, facing a crisis of unknown proportions, are repatriating the proceeds of positions alienated elsewhere.

EURUSD chart

Ricardo Evangelista – Senior Analyst, ActivTrades

EUROPEAN SHARES

The global sell-off continued on stocks on Friday as market sentiment keeps on being weighed down by the latest developments on the struggle against the deadly coronavirus.

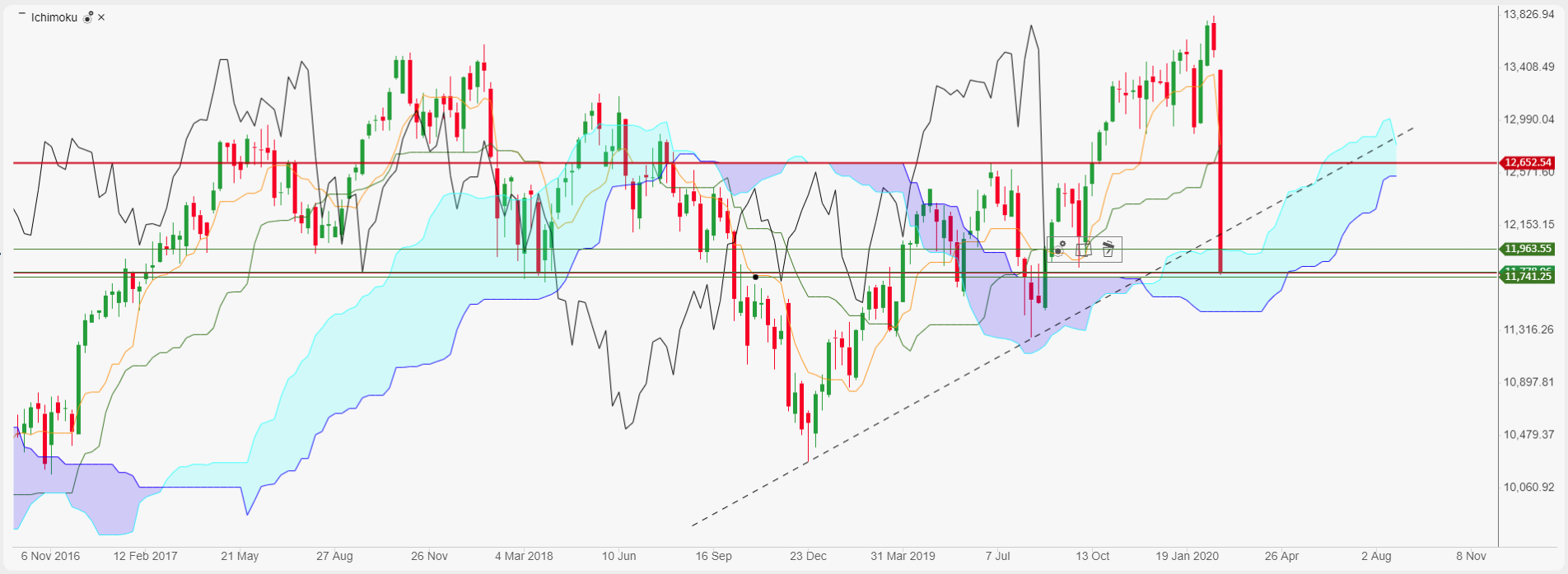

Despite the number of cases slowing down in China, the surge of outbreaks on all continents has clearly impacted investors’ risk appetite this week, causing one of the biggest sell-offs since the 2008 financial crisis. Strong volatility spikes combined with the massive bearish moves on most benchmarks (-2000pts on the DAX-30 since last week) suggest market participants are in a “panic mode” selling everything at almost any price.

Stock traders, particularly energy shares investors, also have to factor in rising geopolitical tensions in the Middle East after Russia reportedly killed 33 Turkish soldiers in a bombing in northern Syria. However, as the current sell-off remains mostly driven by fears over the economic impact of the virus, a sharp trend reversal could take place if the situation were to improve, even slightly, or if nations and central banks were to propose solid financial plans to sustain growth everywhere. In the meantime, health care and materials are the most impacted sectors of the Stoxx-50 Index with companies like Fresenius and Sanofi among the top movers.

The DAX-30 Index remains the most impacted eurozone index of with the market now trading well below 12,000pts (see attached chart). A slight bullish correction may take place today as bear traders may want to take some profits ahead of the weekend which could send prices back to 12,000pts today. However, a fall through the 11,750 zone could extend the current bearish move to 11,450pts-11,500pts.

DAX-30 Index chart

Pierre Veyret– Technical analyst, ActivTrades