On 07 May 2017, Emmanuel Macron won the French presidential election by 66% of the vote, more than polls had predicted.

In this report CLS assess whether the two rounds of the French presidential elections had a significant impact on the foreign exchange (FX) spot market, using data published by CLS on Quandl, an on-line marketplace for financial and economic data.

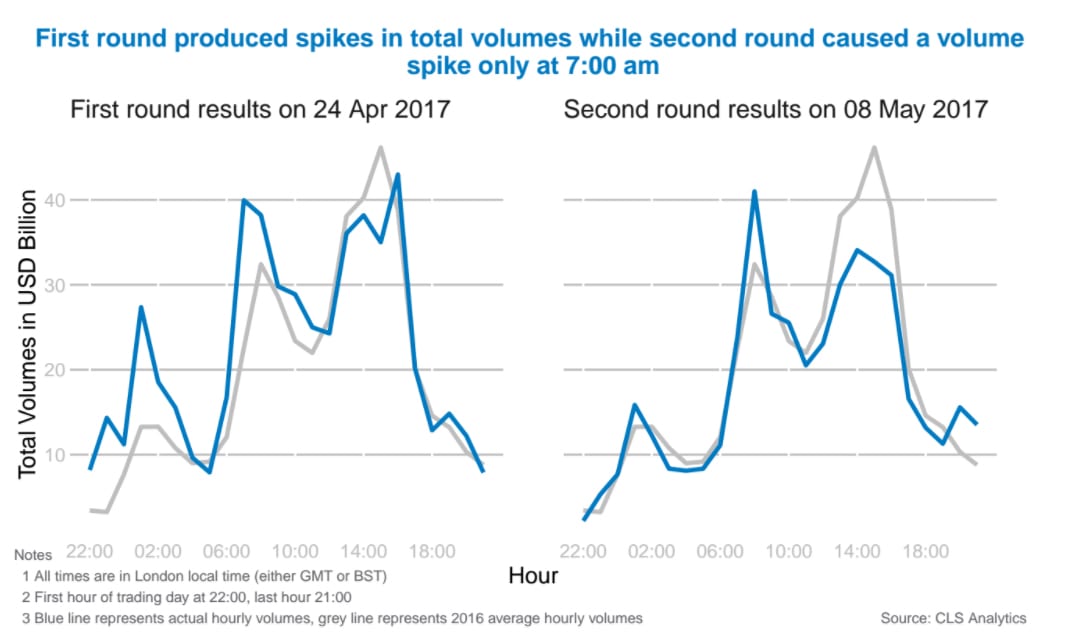

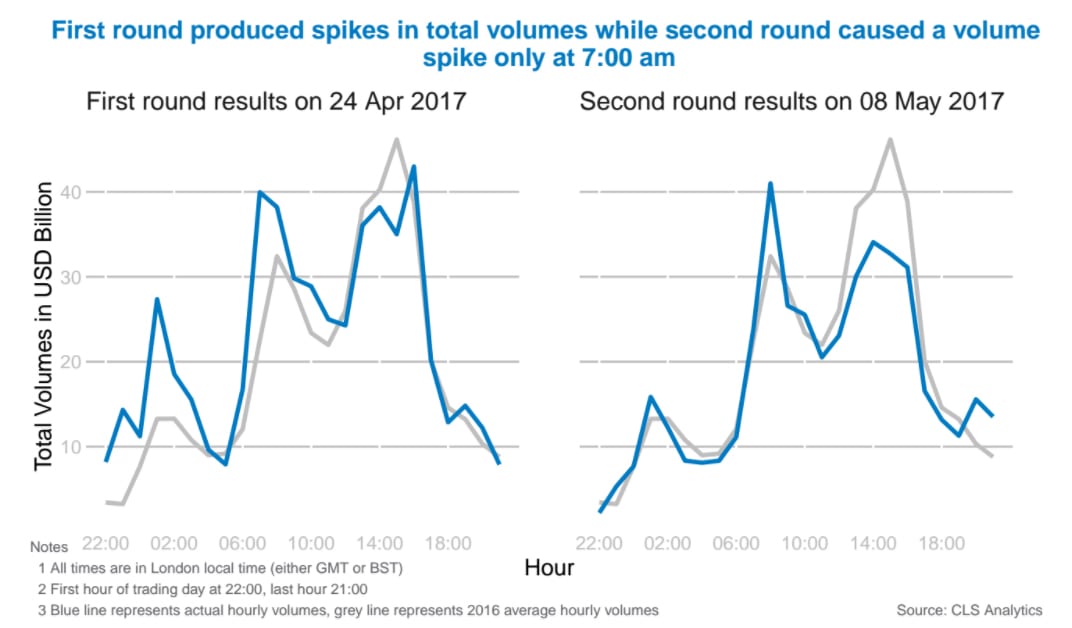

CLS do this by comparing hourly volumes on the first business day following each round to the corresponding 2016 average hourly volumes.

Foreign exchange activity

The chart below shows the hourly volumes for all currency pairs on Quandl on the day following each round compared to 2016 average hourly volumes:

The difference was more pronounced in the EURUSD currency pair. The chart below compares the hourly EURUSD volumes following the results of each round to the EURUSD 2016 average hourly volumes:

24 April 2017: First round results. The market reaction was stronger after the first round. With polls showing a statistical tie for the top four candidates, the first round results were more uncertain.

Before polling was suspended by law on Friday 21 April 2017, Bloomberg’s composite of French polls showed Macron in the lead with 24.5 percent and Le Pen in second place with 22.5 percent of the vote. While Fillon and Melenchon had the backing of 19.5 percent and 18.5 percent of the electorate respectively, the margins of error left room for upset. Market participants were worried that the two EU-sceptic candidates (Le Pen and Melenchon) could have won the first round.

On the first day of trading 24 April, the market reaction to the first round results led to the highest daily volumes for April 2017.

08 May 2017: Second round results. Volumes didn’t react so much to the results from the second round. CLS believe this is because Macron’s victory over Marine Le Pen was, to a great extent, already priced in following the first round – a snap poll released on 23 April suggested that Macron would defeat Le Pen by more than 20 percentage points in the second round and this polling difference between the two candidates stayed relatively constant until the second round.

Conclusion

A further examination of the FX rate confirms the above conclusion that there was a much stronger reaction to the first round results.

Following the first round results, EURUSD opened with a gap of 1.5 figures (in the case of EURUSD, figures = cents) (Friday’s close at 1.0731 and Monday’s open at 1.0859) and later reached a daily high of 1.0937.

Following the second round, EURUSD appreciated from Friday’s close at 1.0998 to 1.1023 during the first two hours of trading and then declined to a close at 1.0921, following a “buy the rumour, sell the fact” pattern.