Information giant Thomson Reuters (NYSE:TRI) just announced that it has hit a new record in FX trading volumes in January following the successful onboarding of its buy-side clients and liquidity providers onto its enhanced Multilateral Trading Facility (MTF), post-MiFID II implementation.

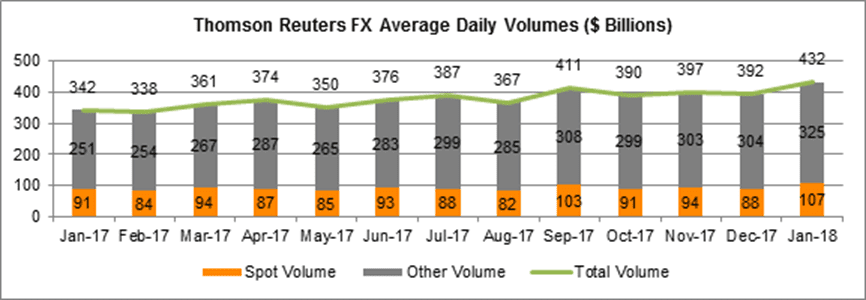

Average daily volumes (ADV) across Thomson Reuters FX platforms totaled $432.1 billion in January 2018, with ADV for spot trading at $107.9 billion. This total reflects trading volumes on Thomson Reuters Matching and FXall in all transaction types, including spot, forwards, swaps, options and non-deliverable forwards (NDFs).

Following preparation for and then implementation of one of the most complex regulatory initiatives in a generation, our success over the last month reflects the value we place in listening to our clients and ensuring our solutions meet their MiFID II needs,” said Neill Penney, co-head of Trading, Thomson Reuters. “As the market evolves, we are committed to making additional enhancements across our trading businesses, including enriched analytics and algo trading capabilities.

Thomson Reuters FXall is a dealer-to-client FX marketplace used by over 2,300 institutional clients and 180 market makers. Thomson Reuters Matching is an anonymous electronic trade matching system for FX used by thousands of market participants in every region of the world to access and trade on deep liquidity in over 80 currency pairs. Collectively, Thomson Reuters FX platforms support an average daily trading volume of over $407 billion.

Thomson Reuters completed enhancements to its MTF in July 2017 to ensure its clients remain fully compliant with MiFID II execution requirements for FX derivatives, which went into effect on January 3, 2018. The enhancements enable Thomson Reuters MTF-support for FX forwards, swaps, NDFs and options trading on FXall as well as continue support for swaps trading on Thomson Reuters Matching. Thomson Reuters meets its obligations as an MTF-operator for trade reporting by partnering with Tradeweb for APA services.