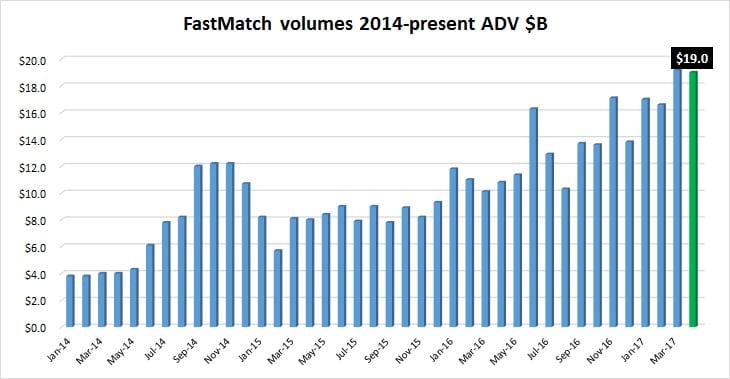

Forex ECN FastMatch is reporting that volumes in its system decreased slightly by 1% MoM in April, to average $19.0 billion ADV for the month.

That makes April 2017 one of FastMatch’s best ever months for trading volumes, given that March’s $19.2 billion ADV was by far the company’s best ever, well ahead of the $17.1 billion ADV previous record set in November 2016.

In fact, looking at just the second half of April (April 18-30) post Easter break, FastMatch volumes averaged nearly $25 billion daily.

FastMatch’s good results come at a very good time for Global Brokerage Inc (NASDAQ:GLBR), formerly known of course as FXCM, which we understand has been actively looking to sell its stake in the company.

FastMatch is jointly owned by Global Brokerage Inc and commercial banks Credit Suisse Group AG (ADR) (NYSE:CS) and BNY Mellon Corp (NYSE:BK). Global Brokerage Inc / FXCM has been actively monetizing assets to pay down its high interest loan from Leucadia National Corp (NYSE:LUK) – most recently selling its DailyFX research and news site to IG Group Holdings plc (LON:IGG) for $40 million, and its US clients to the Forex.com unit of rival retail forex broker Gain Capital Holdings Inc (NYSE:GCAP).