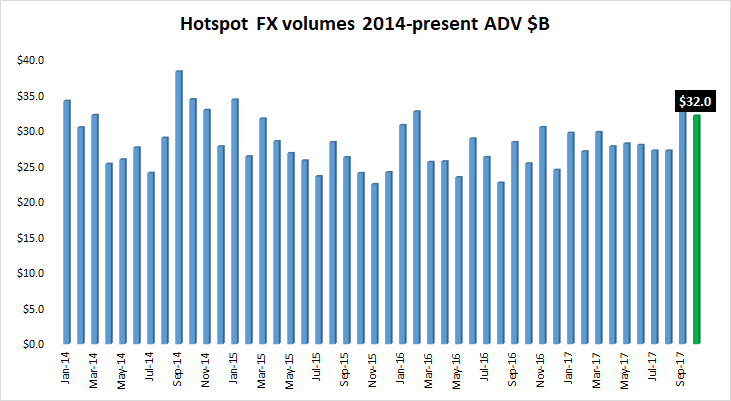

Beginning our peek into October 2017 trading volumes at leading eFX trading platforms, data from institutional Forex ECN Hotspot FX – recently rebranded as CBOE FX Markets – indicates that October was a very good month, although not quite as good as September.

FX trading volumes at Hotspot FX averaged $32.0 billion daily in October, down 3% from September’s $33.1 billion – which was Hotspot’s best month since the Swiss Franc spike driven month of January 2015. October’s results were still well above the $27-29 billion ADV volumes Hotspot had been seeing throughout most of the the year to date.

October 2017 marks the eighth month that Hotspot FX was operating under the corporate umbrella of its new owner, CBOE Holdings Inc. (NASDAQ:CBOE). CBOE acquired control of Hotspot FX via its $3.2 billion takeover of Bats Global Markets Inc at the end of February. CBOE initially rebranded its Forex ECN unit as: Hotspot – a CBOE company. And now, as noted above, it has been re-rebranded as CBOE FX Markets, with an apparent plan to phase out the ‘Hotspot’ brand at some point.