FCA regulated Retail Forex, CFDs and Spread Betting broker London Capital Group Holdings plc (NEX:LCG) has announced its financials for the first half of 2018, reporting its best results in a number of years.

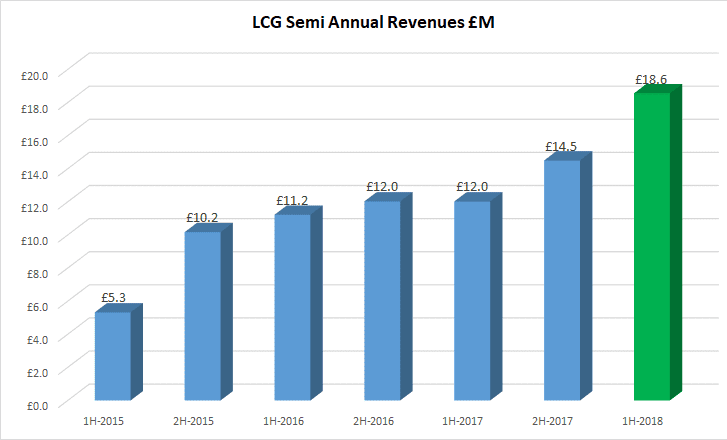

Overall, LCG brought in £18.6 million in Revenues in the first 6 months of 2018, up by 28% over the second half of 2017.

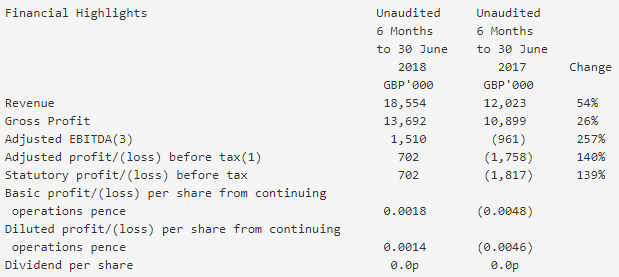

The company reported EBITDA of £1.5 million and turned its first net profit in years at £702,000.

Monthly trading volumes at LCG came in at $38.2 billion in the first half of 2018, up from $28 billion monthly in 2017.

Mukid Chowdhury, LCG

Commenting on the results, Mukid Chowdhury, LCG Group Chief Executive, said:

The senior management team and I are pleased that the investment in the business and the restructuring efforts of previous periods have continued to deliver improved results and that these efforts have now seen LCG return to profitability.

The results are extremely encouraging and a clear demonstration of how LCG’s performance has improved following its commitment to driving excellence in technology, product offering, customer service and people. This improving performance continues to be achieved against the backdrop of challenging trading conditions and regulatory uncertainty. Despite these challenges, the Group has seen strong revenue growth primarily due to increased client acquisition and participation as well as revenue capture compared to prior periods. Inspite of these demanding conditions we are pleased to announce such positive results.

The outlook for the industry continues to remain uncertain given the changing regulatory landscape. The changes introduced will have an impact on the industry and affect the services that can be offered to clients, particularly with regard to the levels of leverage that can be offered. LCG remain confident in its ability to deal with the new regulatory measures. LCG remains committed to ensuring the highest standards of regulatory compliance and welcomes changes that will improve and protect client outcomes.

LCG will continue with its objective to return the business to profitability through best in class technology and client service and together with investment and the hard work by the senior management team and its people, we will continue to deliver long term sustainable growth and drive increased shareholder value.

LCG, as one of the leading providers in the industry with an established history of over 20 years and with a loyal client base and a brand that is synonymous with first class service, is well placed to benefit and continue its growth trajectory in this changing environment. The ability to capture and take advantage of trading opportunities means that the Group is well positioned to be resilient during periods when trading conditions are weak and we remain fully focused on our goal of being able to benefit from and adapt with the changing regulatory environment.

LCG stated that trading conditions have again been affected by lower market volatility and intense regulatory scrutiny of the CFD industry by both domestic and European regulators. However, against this backdrop, LCG said that it has continued to deliver increased revenues and together with the hard work across the business to drive efficiency, has delivered positive results. LCG demonstrated that it remains on track to deliver its objective of increasing client acquisition, client activity and returning the Group to profitability.

In such challenging conditions, the Group has continued its upward trajectory in delivering increased revenues compared with previous periods, whilst ensuring that it continues to invest and innovate. The Group’s efforts to improve its technology, sales and marketing as well as retain and add to the quality of its people means that the Group remains on the path of improvement. The Group is now far better placed to derive both a steady revenue stream when trading conditions are weak and be in a position to take full advantage when conditions are favourable.

Charles-Henri Sabet

LCG went private soon after the end of the first half of the year, with operations of the brokerage transferred to a private company controlled by Charles-Henri Sabet, called SLCG International DMCC. The publicly traded company now retains 8.5% of the issued share capital of LCGL (the brokerage), which SLCG International DMCC has the option to purchase. The publicly traded company (on the NEX Exchange) is now classified as an investment vehicle for the purposes of the NEX Rules and stated that it will seek acquisitions and investments in the financial technology sector.

Financial highlights for LCG in 1H-2018: