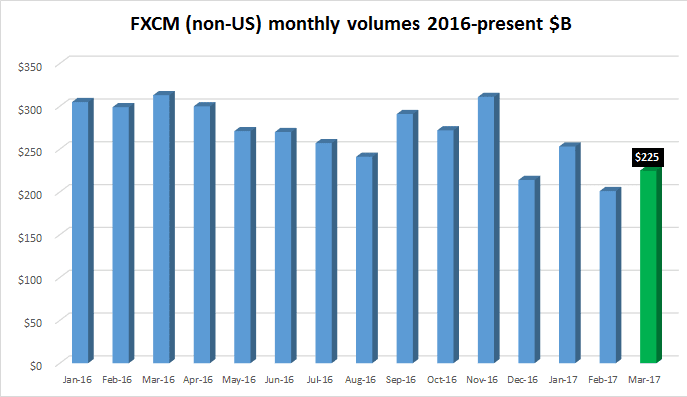

One of March’s most anticipated forex trading volumes reports is now in, with FXCM reporting a healthy 12% MoM rise in activity. Overall, March volumes came in at $225 billion at FXCM, versus $201 billion in February.

(We’d note however that on a daily-average-volume basis, FXCM customer trading activity was actually down 3% MoM in March, coming in at $9.8 billion ADV).

The results of course represent trading volumes outside the US. FXCM sold its US clients to the Forex.com unit of rival Gain Capital Holdings Inc (NYSE:GCAP) in February, after the company and now ex-CEO Drew Niv were banned from the US forex market.

While trading volumes at most retail and institutional eFX venues were also up nicely in March, there was much speculation in FX circles as to how FXCM would do – and whether the reputational damage the company suffered in the US (not to mention the departure of Mr. Niv and other members of senior management) would spill over to the company’s international operations.

So far though, it seems, FXCM is not seeing any significant dropoff in activity in Europe and Asia.

FXCM (the operating company which reports the figures) is owned 50.1% by Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, and 49.9% by Leucadia National Corp (NYSE:LUK).

FXCM’s full report on Customer Trading Metrics reads as follows:

Customer trading volume of $225 billion in March 2017, 12% higher than February 2017 and 28% lower than March 2016.

Average customer trading volume per day of $9.8 billion in March 2017, 3% lower than February 2017 and 28% lower than March 2016.

Customer trading volume for the first quarter 2017 was $679 billion, 15% lower than the fourth quarter 2016, and 26% lower than the first quarter 2016.

Volume from indirect sources was 37% of total trading volume in the first quarter 2017.

An average of 387,815 client trades per day in March 2017, 5% lower than February 2017 and 23% lower than March 2016.

Active accounts of 130,832 as of March 31, 2017, an increase of 314, or 0.2%, from February 28, 2017, and a decrease of 1,794, or 1%, from March 31, 2016.

Tradeable accounts of 109,080 as of March 31, 2017, a decrease of 53, or relatively unchanged, from February 28, 2017, and a decrease of 3,628, or 3%, from March 31, 2016.