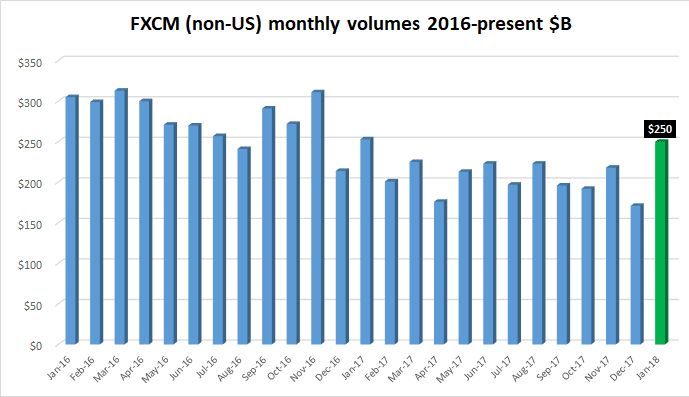

Continuing the spate of strong volume results shown by leading retail and institutional FX trading venues and brokers to start off the year, FXCM Group has reported its best client trading metrics since last January, with FX trading volumes coming in at $250 billion.

FXCM’s best month of 2017 was also January, at $253 billion, but that was the month before then-CEO Drew Niv and the company were banned from the US Forex industry for fraud involved in how the company had structured and marketed its market making services. So, the strong start to 2018 is a very good indication that the current management team at FXCM Group led by London-based CEO Brendan Callan seem to have things moving well in the right direction.

For comparison purposes, FXCM did on average $207 billion of monthly customer volume in 2017.

Back to the January 2018 numbers at FXCM….

Customer trading volume of $250 billion in January 2018 was 46% higher than December 2017 and 1% lower than January 2017.

Average customer trading volume per day of $11.4 billion in January 2018 was 27% higher than December 2017, and 5% lower than January 2017.

An average of 352,867 client trades per day were placedin January 2018, 18% higher than December 2017 and 28% lower than January 2017.

Active accounts of 114,893 as of January 31, 2018 was a decrease of 1,369, or 1%, from December 31, 2017, and a decrease of 17,203, or 13%, from January 31, 2017.

Tradeable accounts of 95,223 as of January 31, 2018, was a decrease of 716, or 0.7%, from December 31, 2017, and a decrease of 10,983, or 10%, from January 31, 2017.