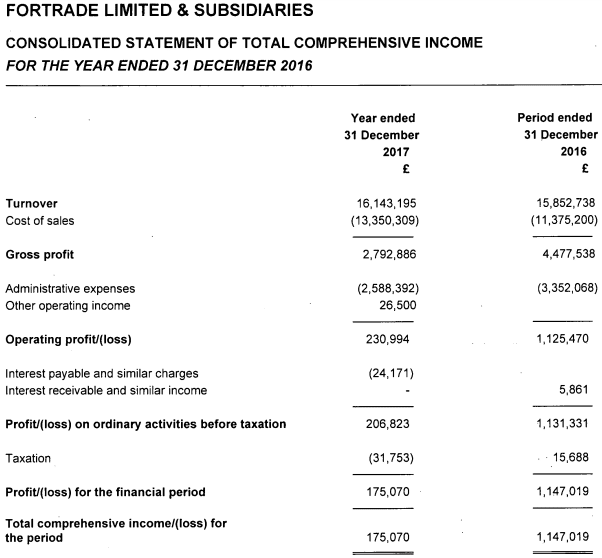

LeapRate Exclusive… LeapRate has learned via regulatory filings that FCA regulated retail FX and CFDs broker Fortrade Limited had a fairly flat year in 2017, after tripling its revenue and activity base in 2016.

Fortrade popped up on the UK CFD scene in 2016, as noted nearly tripling its revenue that year to £15.9 million, while reporting a profit of £1.1 million. However in 2017 seems things to have stalled somewhat, with Revenues coming in at £16.1 million (up 1.8%), and net profit falling to just £175,000.

We’d note that Fortrade has not yet introduced leveraged trading in cryptocurrencies, which drove a lot of volume and new client acquisitions for a number of UK online brokers toward the latter half of 2017, and into 2018.

Nick Collison, Fortrade

Fortrade was incorporated in 2013, and was growing slowly until bringing on board CEO Nick Collison in early 2015, replacing Simon Roberts. Mr. Collison came from the proprietary trading world, having founded and run Saxon Financials, an international proprietary trading company dealing in listed exchange traded derivatives, equities and FX. The Saxon group had offices in London, Gibraltar, Madrid, Dublin, Montreal, Chicago, Singapore and Warsaw.

Fortrade is organized and run somewhat differently than most other FCA regulated CFD brokers. The company has few employees in its FCA regulated entity, with just two admin employees and two directors. The company outsources a lot of the operational and marketing functions to its subsidiary in Israel, Fort Securities Israel Ltd., as well as Australian sub Fort Securities Australia Pty Ltd.

The company pushes its own Fortrader platform with a desktop, mobile and web version, in addition to MT4.

Fortrade’s 2017 income statement follows: