LeapRate Exclusive… LeapRate has learned via regulatory filings that FCA regulated retail FX and CFDs broker Infinox Capital Limited has had a very successful first year after it rebranded from Go Markets UK.

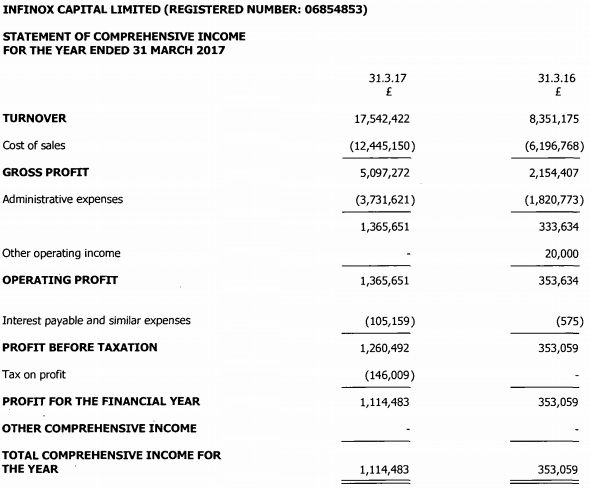

Revenues at Infinox more than doubled during 2017 (the company has a March 31 fiscal year end) to £17.5 million (USD $24 million), up 110% from £8.4 million in 2016.

On the bottom line, a doubling of operating and administrative expenses meant that Net Profits were held to a modest £1.1 million. The growth in expenses were led by a large push to grow the company’s business in China including the opening of an office in Shanghai during the year.

But nevertheless, the company’s profit for the year helped reverse an accumulated Retained Earnings deficit of £600,000. The company reported £1.6 million of capital as at March 31, 2017.

Robert Berkeley, Infinox

As mentioned above, 2017 marks the first year that the company operated under the new ‘Infinox’ brand. The company was originally established in 2009 by CEO Robert Berkeley as Blu-Hill Financial Limited, and first licensed the Vantage FX brand (an Australia based ASIC licensed broker) before switching to license the Go Markets brand (another Australian FX broker) in 2015. Go Markets UK rebranded to Infinox Capital in July 2016.

While the company didn’t provide any geographic breakdown of its client base, we believe that a lot of the volume growth at Infinox came from China based clients. The company has strong ties to the Chinese FX market dating to its previous Australia brokerage relationships with Vantage FX and Go Markets. And, the company’s ultimate controlling shareholder is Chinese national Xeuniu Zhang, via Seychelles holding company Victoria and Emily (Pty) Ltd.

Infinox’s 2017 income statement follows: