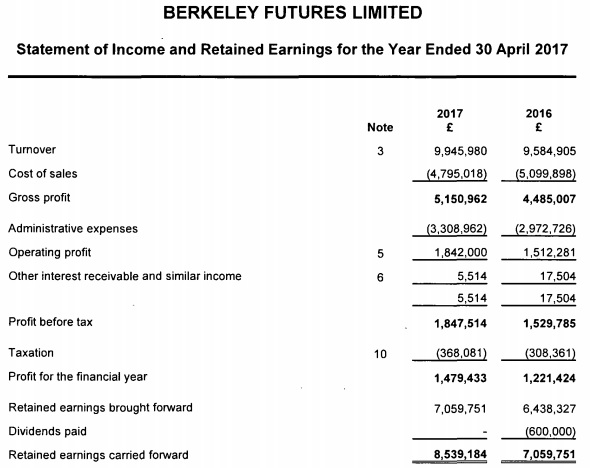

LeapRate Exclusive… LeapRate has learned via regulatory filings that FCA licensed futures, options and spot forex broker Berkeley Futures Limited has seen a nice turnaround in its business, reporting a modest 4% increase in Revenues in its 2017 fiscal year (ended April 30 2017) to just under £10 million.

Last year, in 2016, Berkeley Futures saw an 11% drop in business, and a drop in profitability.

As far as the bottom line goes, Berkeley reported a 21% rise in net profits to £1.48 million.

Client assets held grew by more than 25%, from £99.6 million last year to £125.0 million.

Berkeley Futures is controlled by longtime partners Christopher Thompson and Andrew Woodward. The two brought in Australia’s Macquarie Group Ltd (ASX:MQG) as an investor in the company in 2008. Berkeley uses the broking services of Macquarie Bank Limited.

Berkeley offers access to a wide variety of products both online and via telephone including futures, options, forex, bullion, Contracts for Difference (CFDs), and equities. Forex trading is offered via the FlexTrade platform. The company is a member of the Dubai Gold & Commodity Exchange (DGCX), the London Metal Exchange (LME), the London Stock Exchange and FIA Europe.

Berkeley Futures’ 2017 income statement follows: