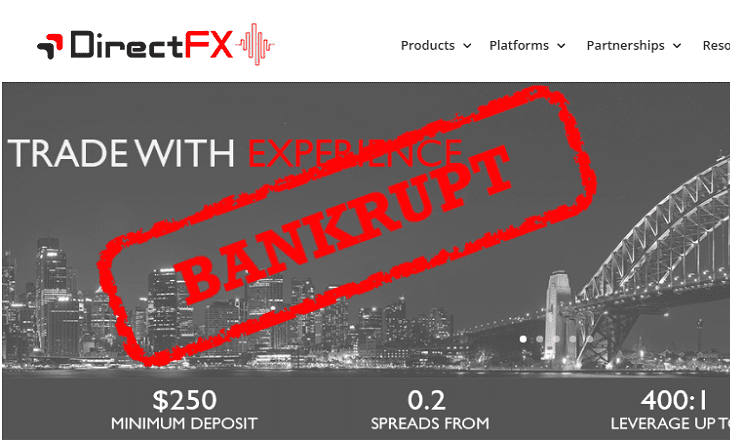

LeapRate Exclusive… LeapRate has learned that embattled Australia based Retail FX broker Direct FX Trading Pty Ltd has been placed into liquidation. The move became effective as of October 11.

Jason Tracy, Deloitte

Jason Tracy, a Partner in the Financial Advisory group of Deloitte’s Restructuring Services arm in Australia was named as Liquidator. The liquidator’s plans are apparently to fully wind up the business, and return any remaining cash to clients and other Direct FX creditors.

Direct FX had its ASIC license suspended by the Australian regulator back in April for what ASIC said were a number of compliance failures, including not having sufficient cash and cash equivalents to comply with its requirements on multiple occasions, and a failure to replace key persons named on its license.

Since then, the company has had the following notice posted on the top of its website:

Important Notice: Direct FX Trading Pty Ltd is not currently accepting new customers. Also, existing customers are only allowed to trade to the extent required to close their positions with us. All advising, dealing and market-making activities are currently suspended until we re-launch the business, subject to approval from the Australian Securities and Investments Commission (ASIC). It will be at least 10 weeks before we relaunch the business. If you are an existing customer and require assistance in closing your account or unwinding positions, please contact us on [email protected] and our team is here to help you. We apologies for this inconvenience.