The Bank of Canada (BoC) will announce its rate decision and monetary policy statement this afternoon at 15:00 BST. Be aware that it will likely cause volatility for CAD and USD crosses. Market consensus is that the BoC will keep rates unchanged at 0.5%.

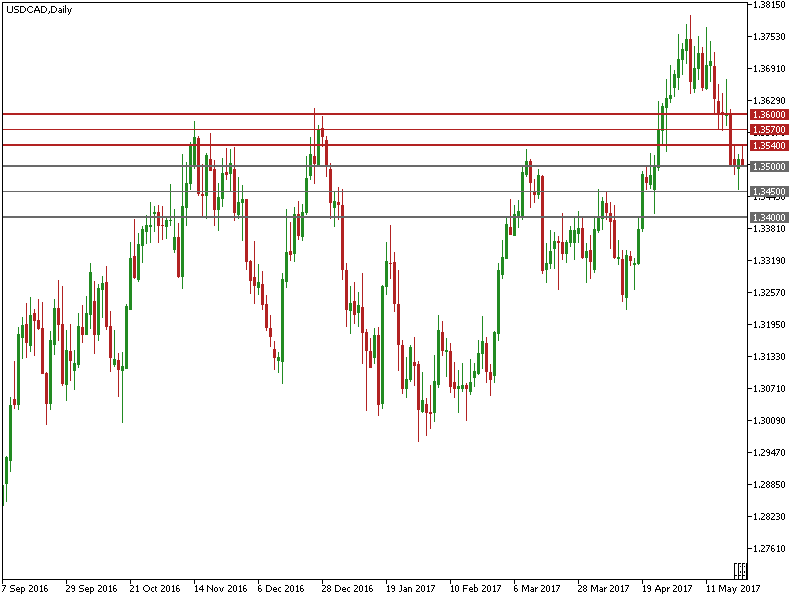

USD/CAD has seen a substantial 1.7% retracement since May 5th caused by rising oil prices. USD/CAD bulls retreated after testing the significant resistance level at 1.3800.

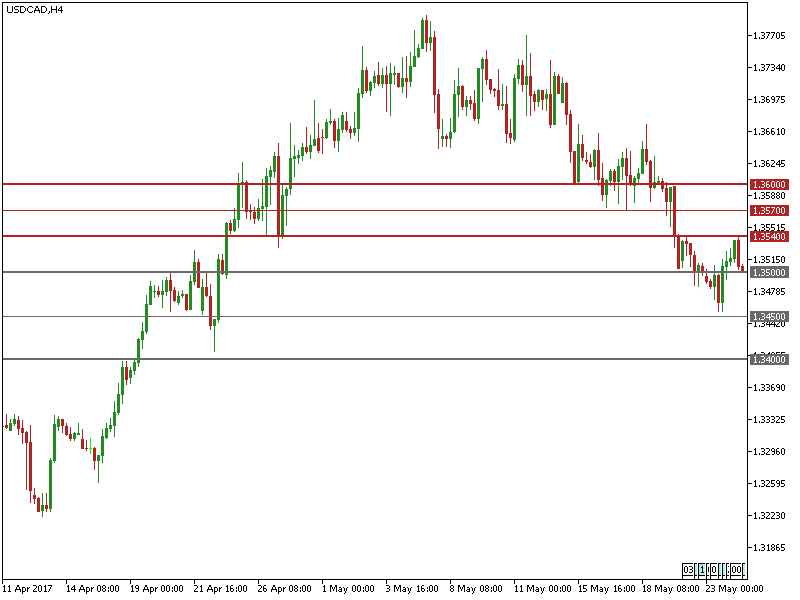

The downtrend has held above the significant support line at 1.3500 since Tuesday May 23rd helped by the USD rebound after the release of the 2018 US budget plan.

1.3500 is likely to provide a stronger support.

The daily Stochastic Oscillator is below 20 suggesting a rebound.

The resistance level is at 1.3540, followed by 1.3570 and 1.3600.

The support line is at 1.3500, followed by 1.3450 and 1.3400.

Keep an eye on the FOMC Minutes, to be released at 19:00 BST. We will likely get further clues about a June rate hike and updated economic outlook. Be aware that it will likely cause volatility for USD/CAD.

If USD keeps on rallying, we can expect USD/CAD to rebound at this level. Conversely, if USD falls again, it will likely weigh on USD/CAD and test supports.

OPEC meeting will be held tomorrow May 25th in Vienna discussing whether to extend the existing output cut agreement. Market consensus is that OPEC will extend it so be aware that the outcome will likely cause volatility to USD/CAD.