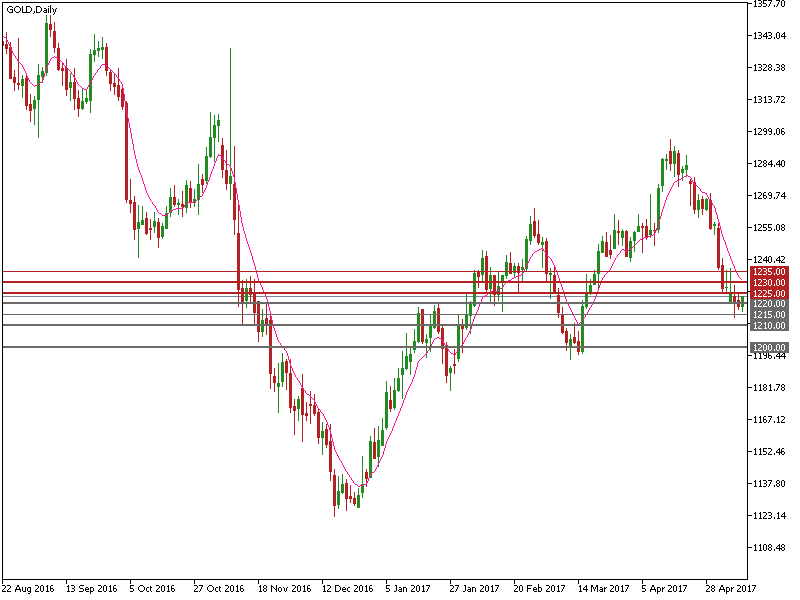

Spot gold has seen a substantial 5% retracement since mid-April as it neared a significant resistance level at $1300.

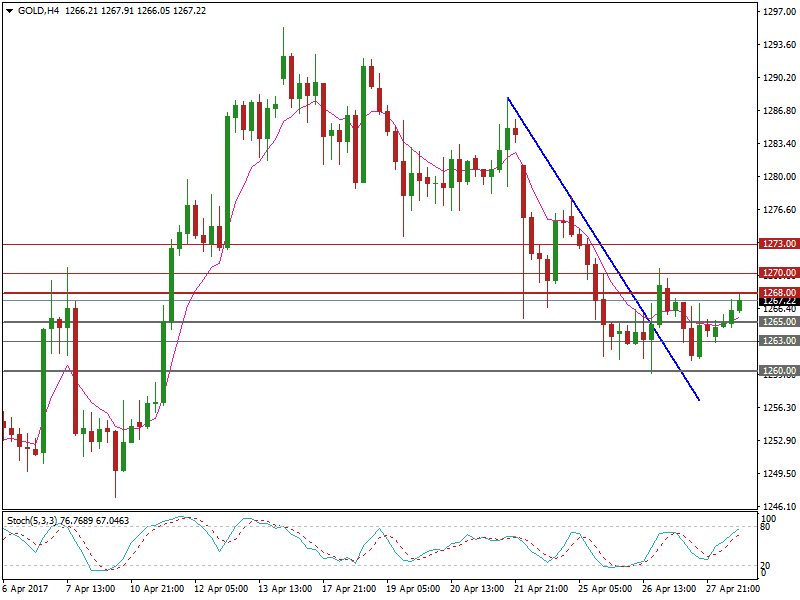

The French election outcome has lifted markets’ “risk-on” sentiment and resulted in safe heavens retreating which has weighed on gold prices.

The dollar has been strengthening over the past three days adding further downward pressure on the price of gold.

Spot gold hit a low of $1214.15 on Tuesday May 9th; a level last seen on March 15.

After reaching this low, gold prices rebounded and have consolidated; in part to the significant support zone between $1200 and $1210. The markets are looking for further upward movement from this zone.

On the 4-hourly chart, the price has been moving from the lower band to the middle band of the Bollinger Band indicator which suggests bearish momentum has been waning.

Be aware that the upside pressure is still heavy.

The resistance level is at 1225, followed by 1230 and 1235.

The support line is at 1220, followed by 1215 and 1210.

Keep an eye on the crucial US data for April, to be released at 13:30 BST on Friday May 12, including retail sales, core retail sales, CPI and core CPI. It will likely affect gold prices.