GBP has been the strongest currency over past three weeks.

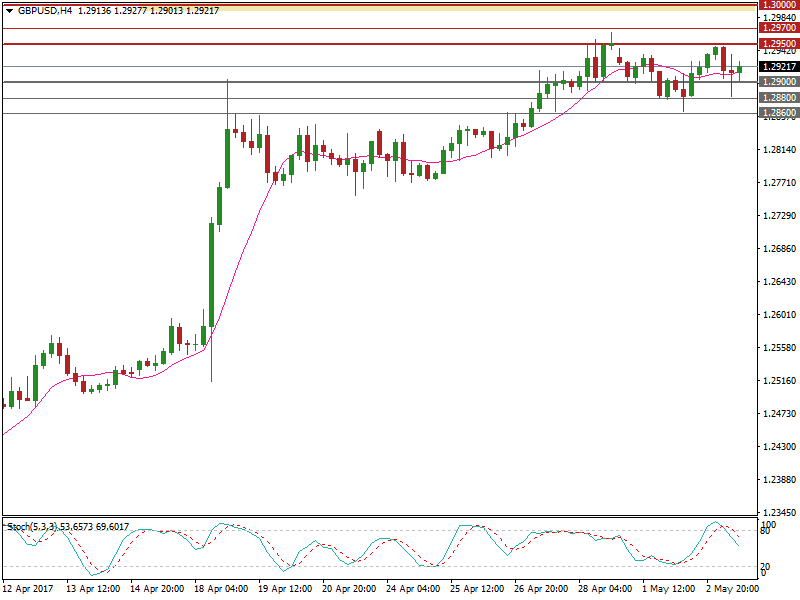

GBP/USD has seen a 4.6% rise since April 10, largely because of UK Prime Minister Theresa May’s sudden announcement of a snap general election on April 18.

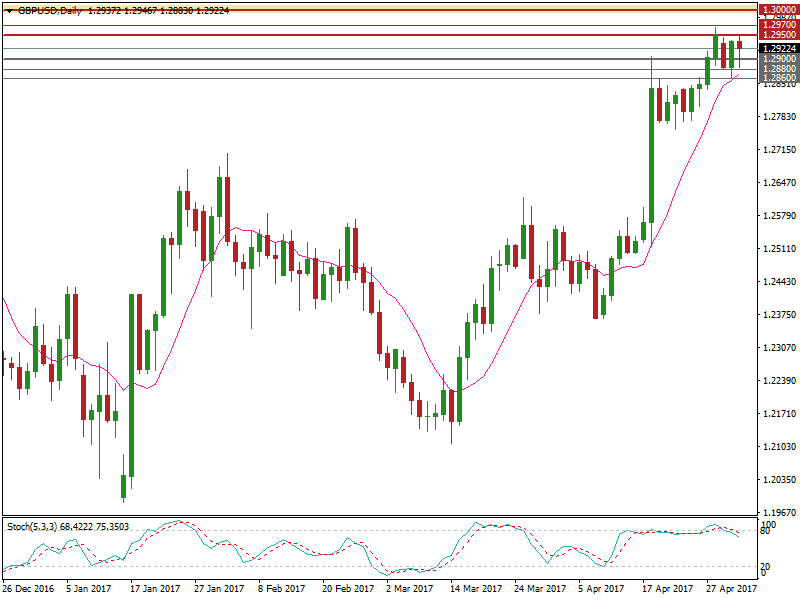

On the daily chart, the price is still holding above the downside 10-day SMA support.

Nevertheless, the bullish momentum has turned weaker over the past week as Cable nears the significant psychological resistance level at 1.3000; where there is heavy selling pressure.

UK construction PMI for April, released this morning was 53.1, which surpassed expectations of 52.0, and hitting the highest level this year.

GBP/USD didn’t respond much to this improved figure mainly because of the reduced bullish momentum and lack of subsequent market drivers fundamentally.

The daily Stochastic Oscillator is around 70, suggesting a correction.

The resistance level is at 1.2950, followed by 1.2970 and 1.3000.

The support line is at 1.2900, followed by 1.2880 and 1.2860.

Keep an eye on the FOMC monetary policy statement to be released this evening at 19:00 BST, the UK Markit Services PMI (Apr) at 09:30 BST on Thursday, and the crucial US non-farm payroll (Apr) at 13:30 BST on Friday. The figures will likely cause volatility for GBP and GBP crosses.