Thursday May 11th is a crucial day for GBP traders with the release of a series of UK economic data at 09:30 BST. Followed by the Bank of England’s (BoE) interest rate decision and monetary policy minutes at 12:00 BST and the NIESR GDP estimate (Feb to April) at 13:00 BST.

Recent UK economic data has been soft, lowering market expectations for a rate hike. The general election will be held on June 8 and, with the Brexit procedure ongoing, the BoE is unlikely to take any actions at least before the election result; therefore, they are likely to keep policies steady until the Brexit negotiation deal has a clear outline.

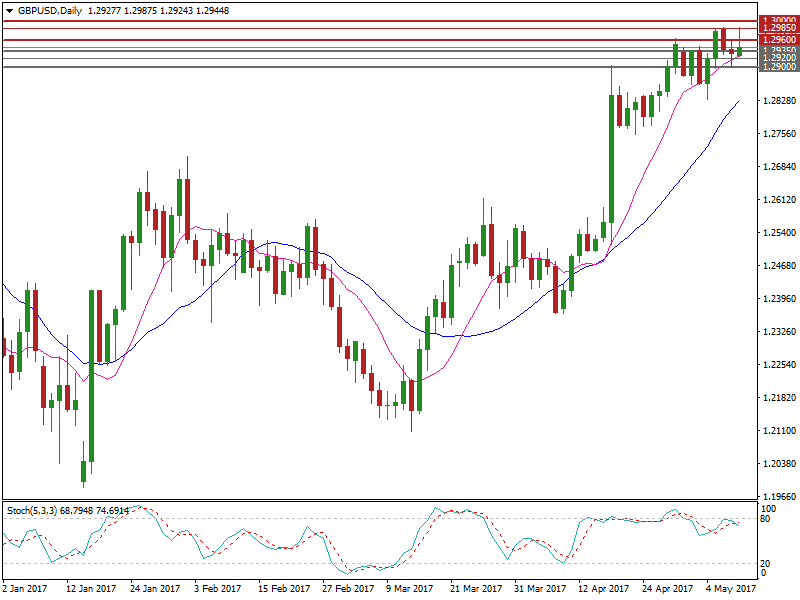

GBP/USD has rallied approximately 3% since Theresa May’s announcement of a snap general election on April 18. On Monday May 8 GBP/USD hit a 7-month high of 1.2988, trading just below the significant psychological level at 1.3000.

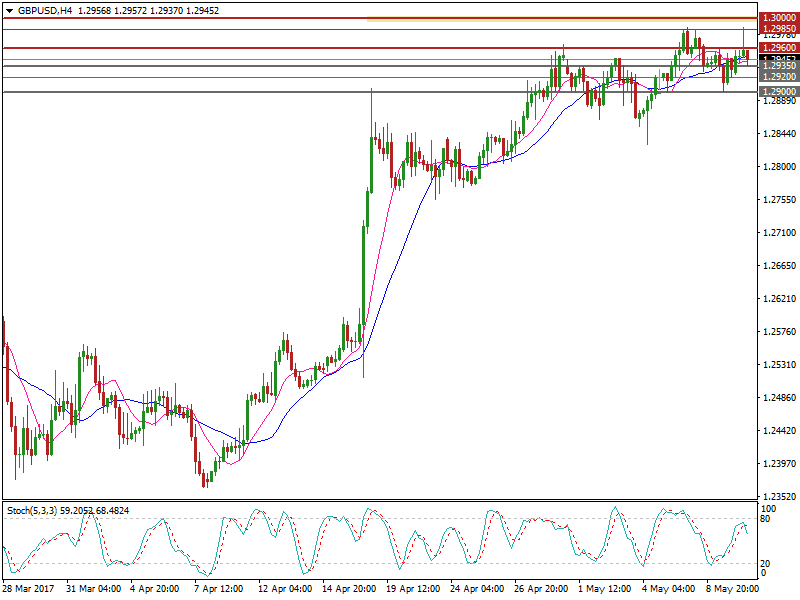

This morning, during early European session, GBP/USD retraced around 50 points, as it was nearing the level at 1.3000, where there is heavy selling pressure.

The BoE’s announcement will likely cause a move to GBP and GBP crosses. With a hawkish comment GBP/USD will likely test the level at 1.3000 again. Conversely, with a dovish comment, we will likely see a correction downward.

On the 4-hourly chart, the 10 SMA has crossed over the 20 SMA, suggesting the bullish momentum has been waning.

The daily Stochastic Oscillator reading is around 70, suggesting a pullback.

The resistance level is at 1.2960, followed by 1.2985 and 1.3000.

The support line is at 1.2935, followed by 1.2920 and 1.2900.