ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for June 12, 2019.

EURUSD

The euro appreciated to 1.1328(+11 pips) against the greenback. The mostly traded pair was supported by a better market sentiment, as China announced more stimulus measures aimed to support the local economy, which include easing financing rules to boost domestic government spending on infrastructure and public works. Nevertheless, the advance stalled following the release of June Sentix Investor Confidence Index, which came in at -3.3, well below the 2.9 expected and the previous 5.3. According to the official source, sentiment deteriorated due to collapsing US-China trade talks, and the escalation in their trade dispute.

Additionally, the report indicated that the situation in Germany deteriorated further, sliding into negative territory for the first time since March 2010, lifting odds of a recession. The US released May Producer Prices, up monthly basis by 0.2% and by 1.8% when compared to a year earlier, with the latter missing the market’s expectations of 2.0%. On Wednesday, the main economic events include a speech from ECB President, Mario Draghi, and the US consumer price index for May (1.9% for the main index and 2.1% for the core expected).

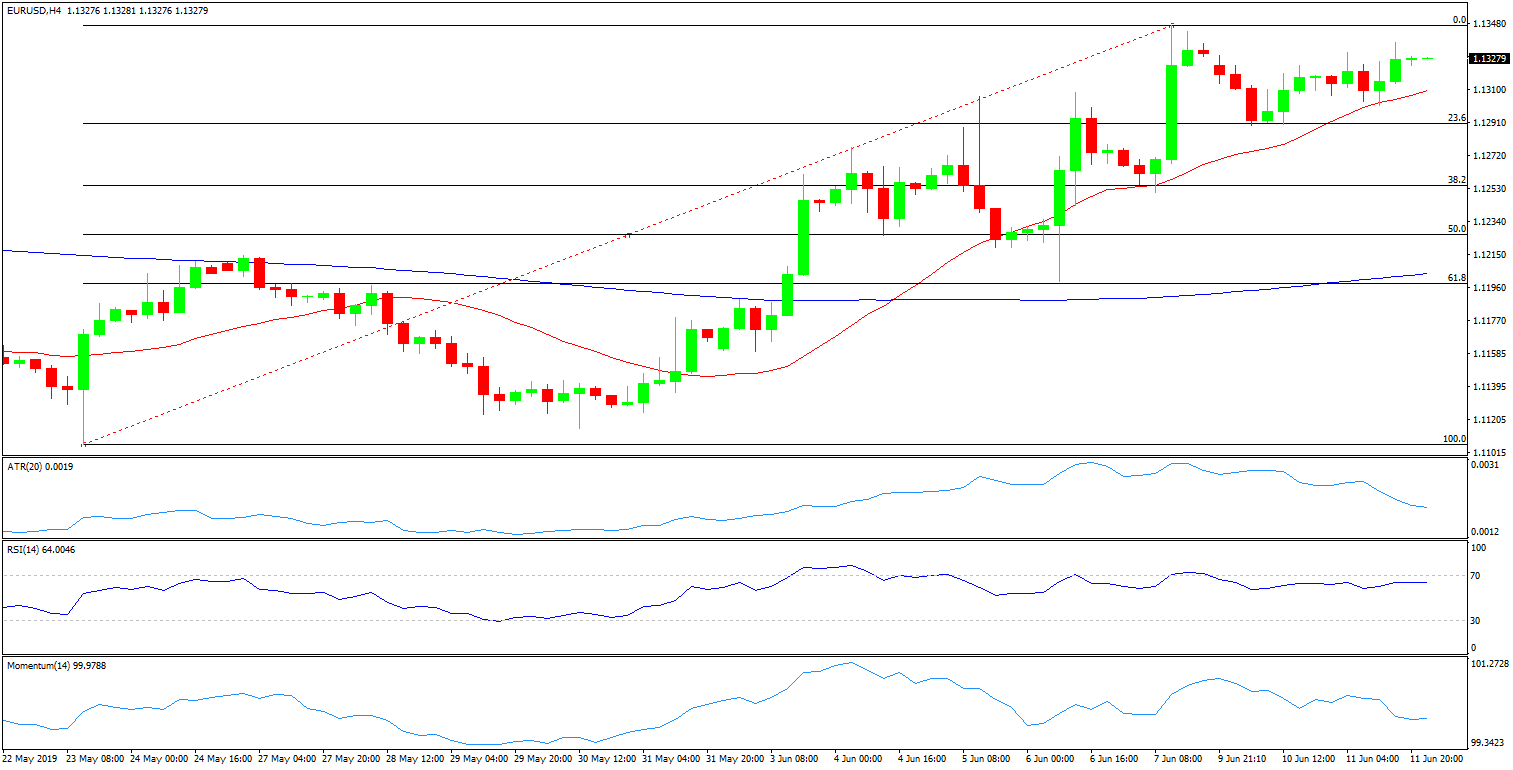

EURUSD 4 Hour Chart

From a technical view, the 20-SMA in 4-hour charts has acted as dynamic intraday support, keeping pullbacks in check. Although the picture remains overall positive for the pair, the Momentum indicator has turned south in 4-hour charts while the RSI is approaching overbought territory, suggesting EUR/USD might lack the strength to clearly break above last week highs, at least in the very short-term. Should the pair overcome the mentioned level, next resistance is seen at 1.1366 (200-day SMA) and not much until 1.1460. On the other hand, a clear break below 1.1290 (23.6% Fibo retracement of the 1.1107/1.1347 rally) could mount pressure on EUR/USD, with the 1.1210/1.1190 as next target, where different supports collude.

GBPUSD

The cable pair made gains on Tuesday, closing at 1.2723(+33 pips) against the greenback. The main catalyst of the increase was due to the release of UK’s latest employment stats, which showed that the employment sector remains resilient although wages surged by more-than-anticipated, lifting odds for a rate hike in the UK.

Different BOE members were on the wires throughout the London session, with Vlieghe signaling that data since May has been disappointing, therefore the downside risks have intensified. Broadbent then stated that, while the markets understand the BOE very well, the fact is that nobody can say which way rates could go in a no-deal Brexit scenario. During European trading hours, Germany’s Roth was on the wires, repeating that the EU won’t renegotiate the withdrawal agreement with the UK, regardless of who the next PM is. The UK doesn’t have relevant data scheduled for this Wednesday.

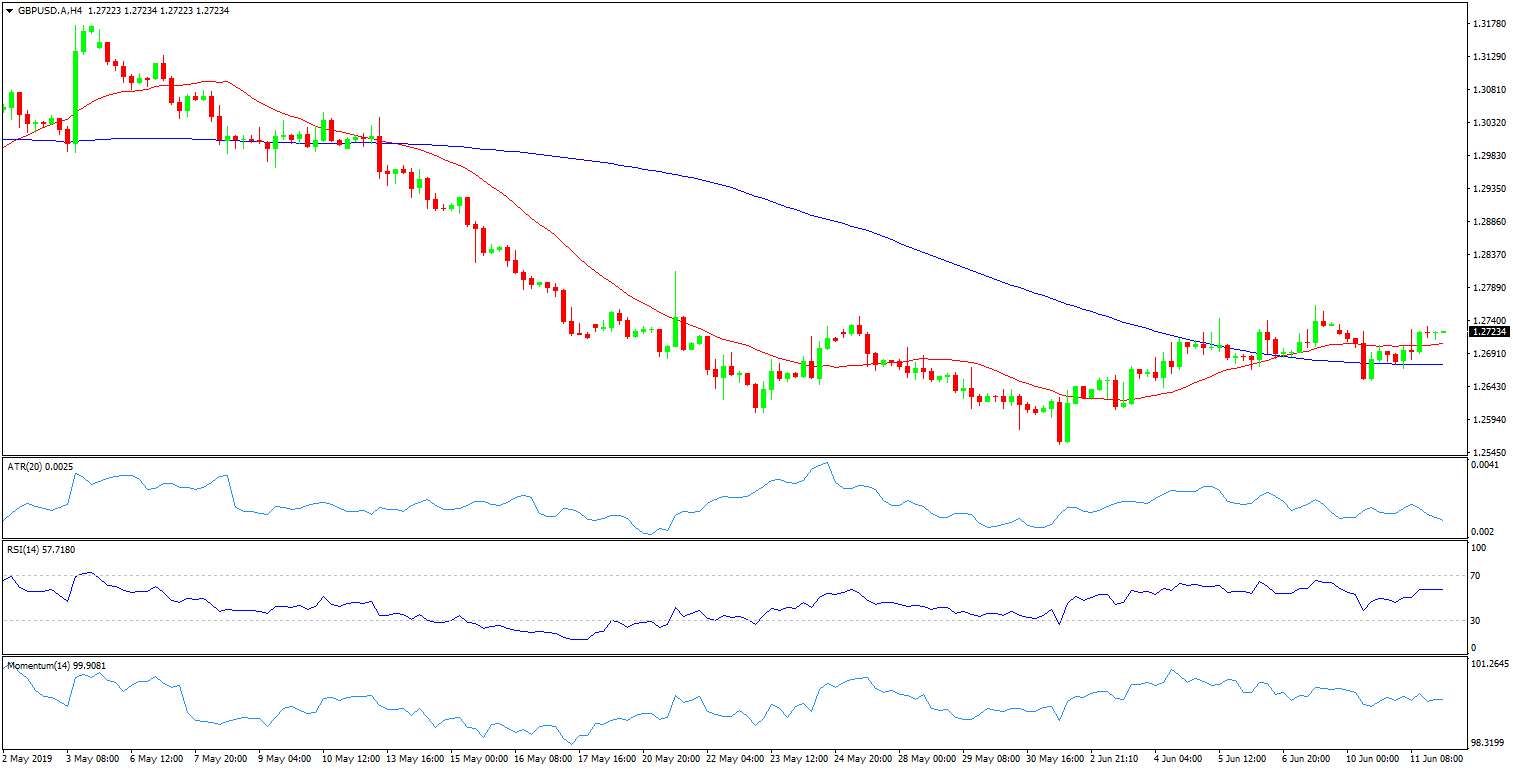

GBPUSD 4 Hour Chart

Technically speaking, GBP/USD managed to shrug off the immediate bearish pressure, with indicators showing more positive signs in short-term charts. However, the Sterling needs to regain the 100-SMA in 4-hour charts around 1.2825 to stand a chance of a steeper recovery with 1.2900 in sight. On the downside, the loss of 1.2650 could allow a retest of the 1.2560 support area (May lows).

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.