The following article was submitted by Michael Stark, market analyst at Exness.

The focus of economic data for forex markets this week is on GDP growth in the eurozone, Canada and the UK. American inflation and retail sales are also likely to have significant effects on markets in the second half of the week.

Last week’s action in markets continued to be dominated by the coronavirus, with oil posting more losses and various ‘risk-on’ currencies losing ground. Non-farm payrolls on Friday came in much better than expected, printing 225,000 against the expectation for around 155,000. Last month’s figure was also revised upward to 147,000. This led to a degree of positivity returning during the last American session of the week.

Central banks were pretty active last week as well. The biggest surprise was the Bank of Thailand’s move to cut its repo rate to 1% against all expectations. So far, the baht has reacted by testing new lows against the dollar. The Reserve Bank of Australia stayed still at 0.75%, despite expectations for a cut in some quarters, and the National Bank of Poland also kept its reference rate still at 1.5%.

This week’s biggest events among central banks are meetings of the Reserve Bank of New Zealand, the Sveriges Riksbank and the Banco de Mexico. Only the BdeM is expected to make a change with a possible cut to 7%.

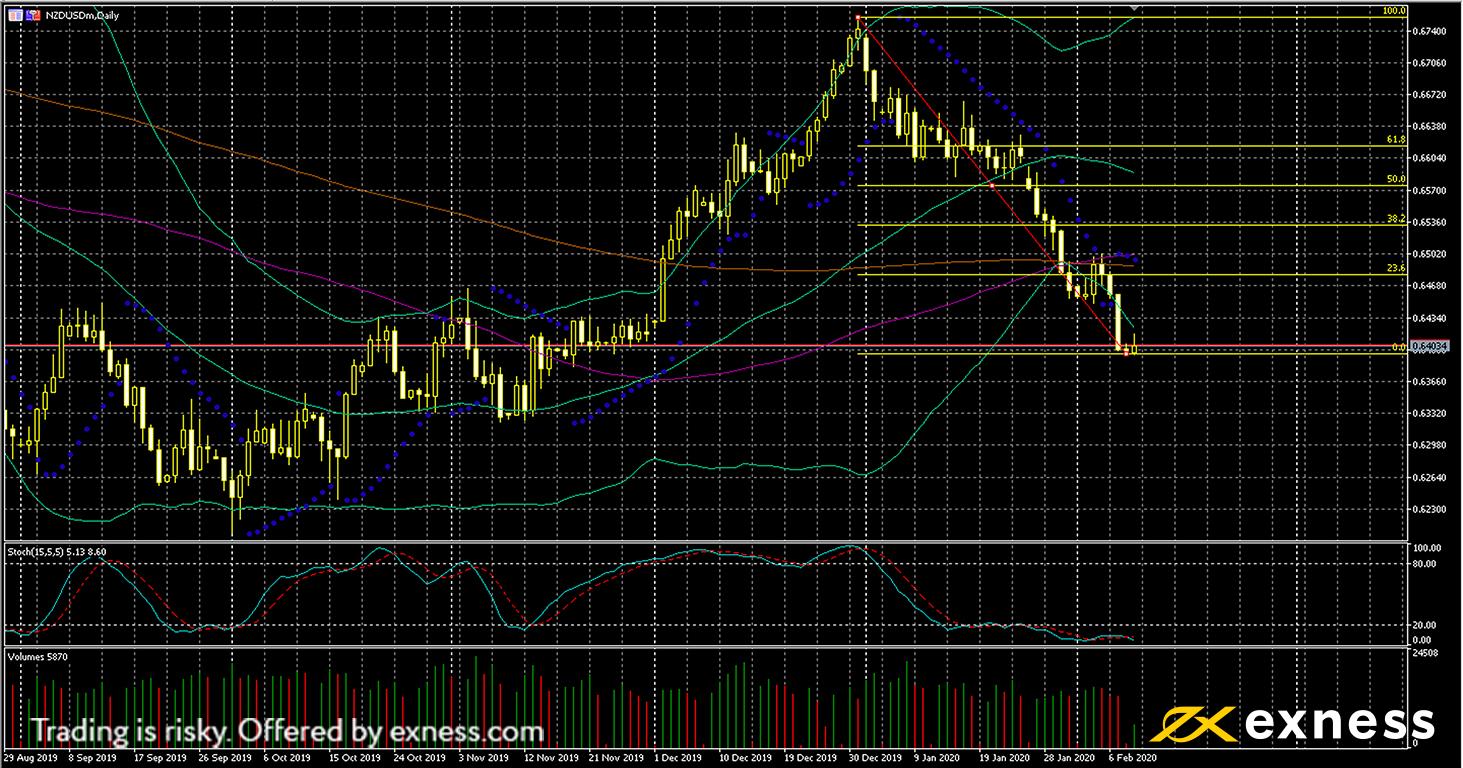

New Zealand dollar-US dollar, daily

The Kiwi dollar’s losses against its American counterpart seem to have slowed since last week. While NZD did finish in the red here on Friday night, there was an attempt to move up in the first half of the week. The likely economic effect of the coronavirus for the next quarter or two is important here given that China is New Zealand’s main trade partner. However, quarterly Kiwi employment change at 0% on Tuesday of last week was also weaker than the consensus. Friday’s very strong NFP gave the US dollar a boost here as in many other pairs.

The most obvious feature of this chart is saturation. NZD-USD has been very strongly oversold for nearly a fortnight now, with the slow stochastic close to zero and price closing several times outside the lower deviation of Bollinger Bands. The conditions seem to be there for the Kiwi dollar to retrace fairly significantly if the news from the RBNZ isn’t very negative on Wednesday morning.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 11 February, 15.00 GMT: JOLTs job openings (December) – consensus 7.1 million, previous 6.8 million

- Wednesday 12 February, 1.00 GMT: meeting of the RBNZ

- Thursday 13 February, 13.30 GMT: American annual core inflation (January) – consensus 2.2%, previous 2.3%

- Thursday 13 February, 13.30 GMT: American annual inflation (January) – consensus 2.5%, previous 2.3%

- Friday 14 February, 13.30 GMT: American retail sales (January) – consensus 0.3%, previous 0.3%

Pound-peso, four-hour

The pound’s losses against the peso slowed down significantly in the second half of last week. Fairly decent data from the UK didn’t do much to dispel ongoing negativity in markets around the British government’s likely hard line in upcoming trade negotiations with the EU. Mexican inflation also met expectations on Friday at 3.24%.

It looks as though GBP-MXN is setting up for a consolidation around the current area. The sequence of dojis and near-dojis within oversold in the second half of last week would suggest little demand for further selling from this area. Equally, though, the large wick on Friday morning around the 23.6% Fibonacci retracement area might mean that there is a resistance here. Ultimately, it’s the meeting of the BdeM that’s most likely to bring more impetus (in either direction).

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 11 February, 9.30 GMT: British balance of trade (December) – consensus -£2.6 billion, previous £4.03 billion

- Tuesday 11 February, 9.30 GMT: British annual GDP growth (preliminary, Q4) – consensus 0.8%, previous 1.1%

- Tuesday 11 February, 9.30 GMT: British quarterly GDP growth (preliminary, Q4) – consensus 0%, previous 0.4%

- Thursday 13 February, 19.00 GMT: meeting of the BdeM

American light oil, four-hour

USOIL posted its fifth straight weekly loss on Friday night. OPEC+ failed to reach any significant agreement on cutting production in response to the coronavirus’ effects on Chinese demand. With many factories in China closed and travel restricted in central parts of the country, the outlook for consumption of oil in the world’s biggest importer still looks much weaker than had been expected before the outbreak.

The overall loss for oil last week was notably smaller than over successive weeks before. Selling saturation here and on the daily timeframe as well has been important, as has the key psychological support of $50 a barrel. Any retracement is likely to be capped in the short term by the area of 38.2% from the Fibonacci fan. To the downside it seems likely that $50 will hold unless this week’s regular stock data is especially bad.

Key data points

Bold indicates the most important releases for this symbol.

- Tuesday 11 February, 21.30 GMT: API crude oil stock change – consensus 4.5 BBL/million, previous 4.18 BBL/million

- Wednesday 12 February, 15.30 GMT: EIA crude oil stock change – consensus 3.2 million, previous 3.36 million

- Friday 14 February, 18.00 GMT: Baker Hughes rig count (oil) – previous 676

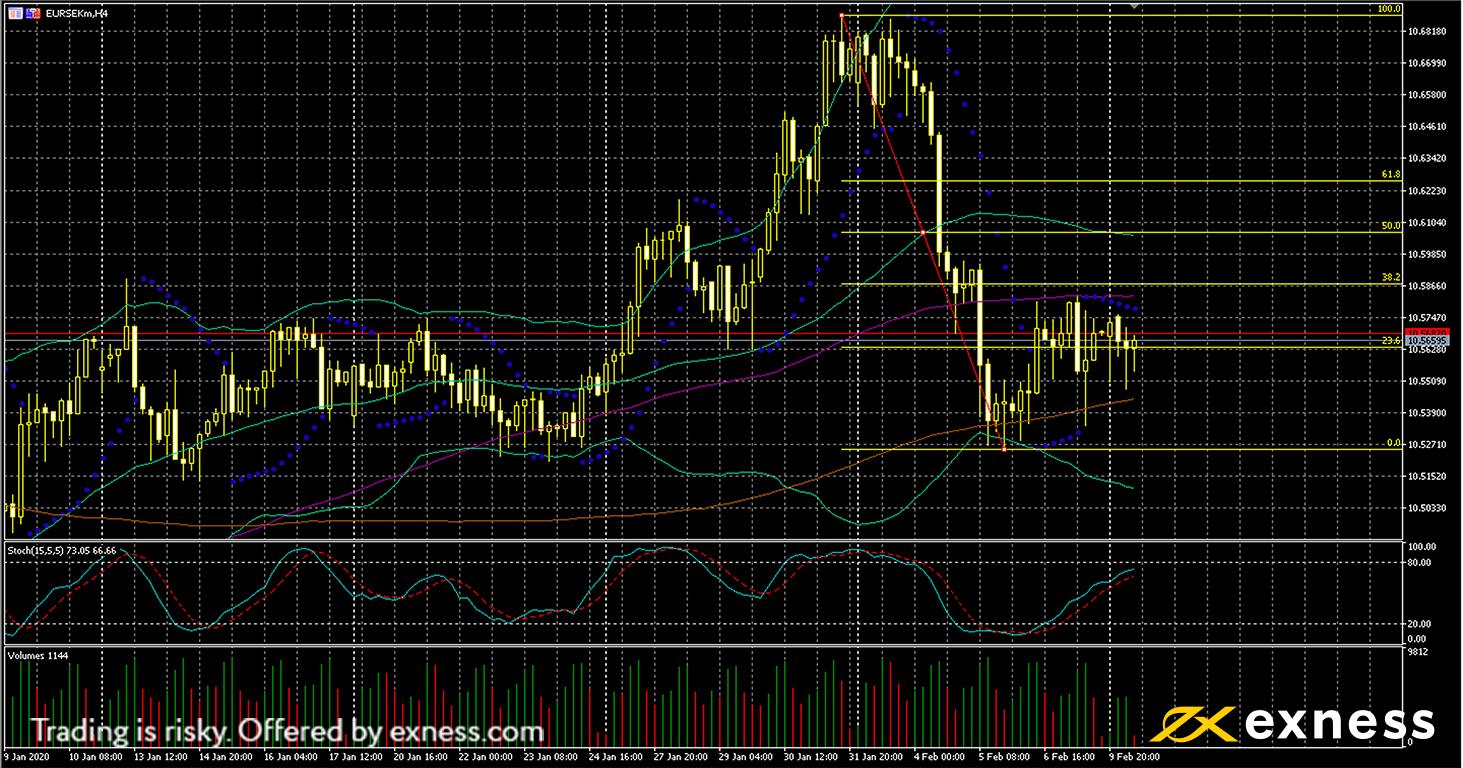

Euro-krona, four-hour

EUR-SEK also seems to have settled into a tentative range since the second half of last week. German data – both factory orders and balance of trade – was slightly weaker than expected, but Swedish figures were mostly worse as well. Annual and monthly industrial production as well as annual new orders all declined by at least double the consensus. New orders from Sweden were the worst of them at negative 4.7%. Service PMI on the other hand was up to 52.5. The key factor in the coming months is what the Riksbank makes of this and the possible effects of the coronavirus on Sweden’s trade-sensitive economy.

Price bounced fairly strongly last week from the area of the 200 SMA and the lower deviation of Bands. However, there have been only lukewarm attempts to move above the 100 SMA. This ‘value area’ between the two moving averages is likely to be more important because it also coincides with the 23.6% Fibonacci retracement area more-or-less in the middle. The comments from the Riksbank on Wednesday morning are likely to be crucial for further direction.

Key data points

Bold indicates the most important releases for this symbol.

- Wednesday 12 February, 8.30 GMT: meeting of the Riksbank

- Thursday 13 February, 7.00 GMT: German annual inflation (final, January) – consensus 1.7%, previous 1.5%

- Friday 14 February, 7.00 GMT: German annual GDP growth (flash, Q4) – consensus 0.4%, previous 0.5%

- Friday 14 February, 7.00 GMT: German quarterly GDP growth (flash, Q4) – consensus 0.1%, previous 0.2%

- Friday 14 February, 10.00 GMT: eurozone annual GDP growth (second estimate, Q4) – consensus 1%, previous 1.2%

Disclaimer: opinions are personal to the author and do not reflect the opinions of Exness or LeapRate.