ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for May 20, 2019.

EURUSD

The euro fell on Friday, closing at 1.1158(-14 pips) against the greenback. However, the greenback was underpinned by local data and persistent US-Sino trade tensions during earlier sessions. These last couple of days, the US administration announced it will delay imposing tariffs on European cars’ imports, also that it reached an agreement with Canada and Mexico to remove tariffs on steel and aluminum, as President Trump is deterred to close the trade balance gap with the Asian giant.

The EU released April inflation data at the end of the week, which resulted in line with the market’s expectations, with a modest uptick in core yearly inflation to 1.3% from the previous 1.2%. The number, however, was overshadowed by the US Michigan Consumer Sentiment Index, as the preliminary estimate for May came in at 102.4, the highest level in fifteen years and well above the expected 97.5.

This new week will be mostly light in terms of macroeconomic releases, with the most relevant release being FOMC Meeting’s Minutes next Wednesday. This Monday, Germany ill release April PPI, while the EU will post an update on Current Account. The US will publish the Chicago Fed National Activity Index for April, while a couple of Fed authorities will offer different speeches.

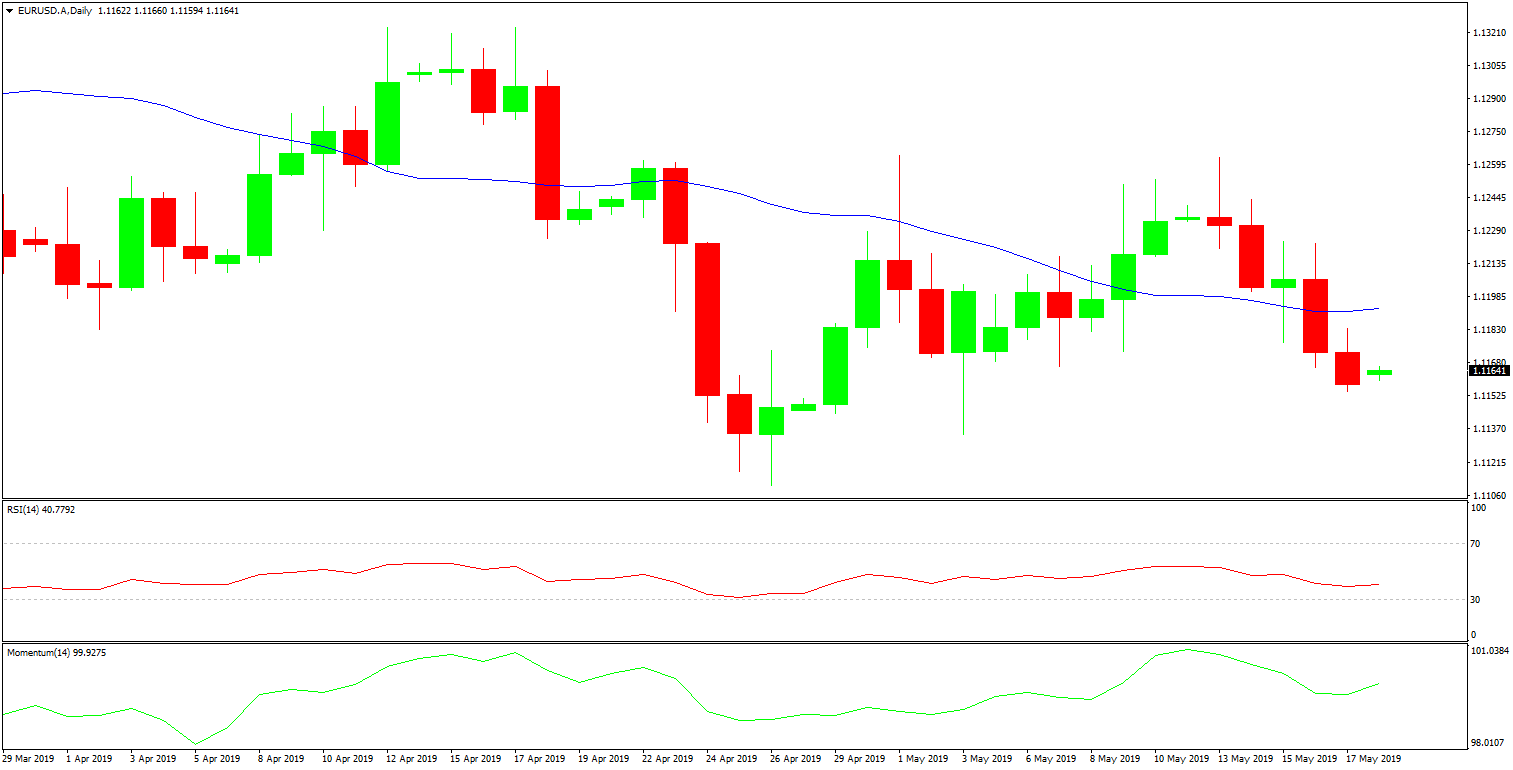

EURUSD Daily Chart

In the chart above, the pair currently trades below its 20 SMA(Blue Line) accelerating its decline below the larger ones, reflecting the strength of the bearish momentum. Technical indicators in the mentioned chart have extended their declines within negative levels, skewing the risk to the downside.

GBPUSD

The Pound closed lower on Friday, closing at 1.2715(-81 pips) against the greenback. News emerged that the Brexit cross-party talks ended without an agreement, adding extra pressure on the pound. Both parts, PM Theresa May and Labour opposition leader, Jeremy Corbyn, announced the end of talks amid the absence of a “common position,” according to PM May. Mr. Corbyn, on the other hand, said that the government hadn’t moved its position fundamentally.

The clock keeps ticking, as PM May said she would set a timetable for leaving her position after the Houses vote for a fourth time on her withdrawal deal. In the meantime, EU’s Parliamentary elections will take place this week, with the UK being forced to participate, another negative factor for the Pound. The UK calendar doesn’t include any relevant data at the beginning of the week, although inflation will take center stage this week, with the Inflation Report Hearings scheduled for Tuesday and April CPI for Wednesday.

GBPUSD Daily Chart

The GBP/USD pair has been on a franc decline ever since hitting 1.3176 on May 3, extremely oversold after losing roughly 450 pips without an interim correction, yet technical readings continue to indicate that more declines are likely. In the daily chart, the Momentum indicator is at its lowest since mid-May, maintaining its bearish strength while the RSI indicator also heads sharply south, currently at around 27.

Major Economic Events happening this week (AEST Time Zone)

| Economic event (Date) | Previous | Forecasted | Actual |

| JP- GDP Growth Rate QoQ Prel (20 May) | 0.5% | -0.1% | TBA |

| AU- RBA Meeting Minutes (21 May) | N/A | N/A | N/A |

| EA- Consumer Confidence Flash May (22 May) | -7.9 | -7.6 | TBA |

| JP- Balance of Trade April (22 May) | ¥529B | ¥203.2B | TBA |

| GB- Inflation Rate YoY April (22 May) | 1.9% | 2.2% | TBA |

| US- FOMC Minutes (23 May) | N/A | N/A | N/A |

| DE- GDP Growth Rate QoQ Final Q1 (23 May) | 0% | 0.4% | TBA |

| DE- Markt Manufacturing PMI Flash May (23 May) | 44.4 | 44.8 | TBA |

| DE- Ifo Business Climate May (23 May) | 99.2 | 99.0 | TBA |

| JP- Inflation Rate YoY April (24 May) | 0.5% | 0.4% | TBA |

| US- Durable Goods Orders MoM April (24 May) | 2.7% | -2% | TBA |

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.