ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for May 9, 2019.

EUR/USD

The EUR was also 0.01% lower overnight, last at $1.119 as the USD remained flat throughout Wednesday as FX traders held off from making big moves until definitive news is released on the trade talks between the United States and China which resume on Thursday.

Further, a cause for a stagnate EUR is that traders remained undecided on the inflationary outlook in the euro zone economy and the latest developments are neither here nor there.

Markets have generally been muted since Monday’s tweet by President Donald Trump, that he would raise tariffs on Chinese imports by Friday if a deal was not reached.

It is now known that the primary reason behind the threat was because China had backtracked late last week on almost all aspects of a draft trade agreement, threatening to blow up the negotiations (Reuters).

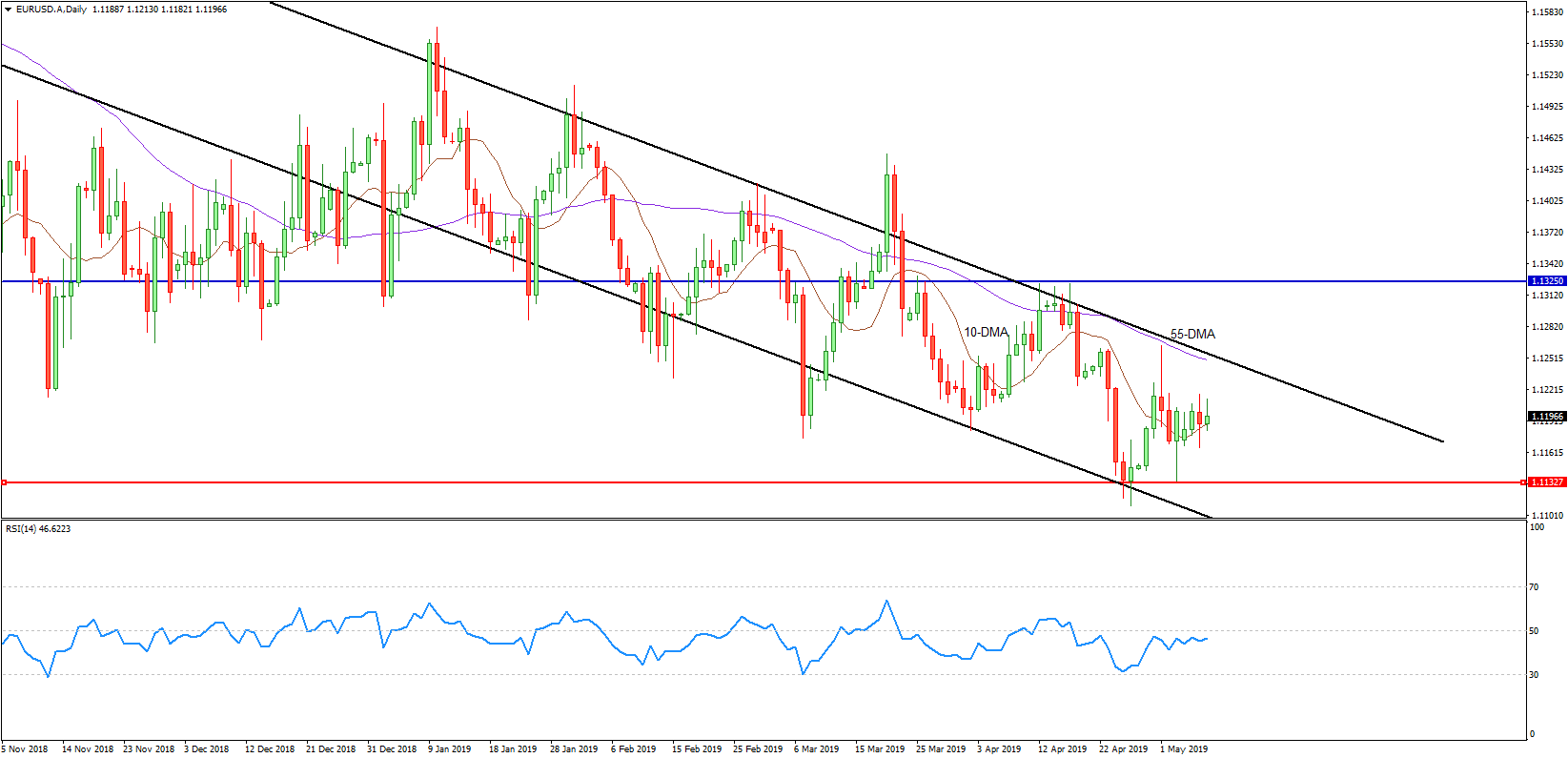

EUR/USD Daily Chart

The downward channel seems to hold the pair in check and support from the 10-DMA and rising daily RSI provide short-term techicals a bullish bias. Falling monthly RSI and monthly dojis for May and April contradict daily signals, therefore it is difficult to find a clear direction for this pair, so it would be best to stand aside for now.

USD/JPY

Safe-haven currency, Japanese Yen, has benefited slightly more from the rising trade tension than the dollar. The JPY was last 0.1% better at 110.05 per U.S. dollar and the Swiss franc was

last 0.04% stronger at $1.020.

With the larger moves out of the way, traders are now waiting to hear further news from the Chinese talks on trade. Top Chinese negotiator Vice Premier Liu He will head to Washington for talks on Thursday, and some investors have interpreted Trump’s tariff threats as a negotiating tactic.

Data earlier showed China’s trade surplus with the United States, which has become a major irritant for Washington, expanded to $21.01 billion in April from a month ago, a factor that might provoke a hardening stance from U.S. officials.

The Chinese yuan in the offshore market edged 0.21% lower to 6.809 and was within striking distance of a four-month low hit on Monday. With Exports figures and the Balance of Trade coming in under expectations there will be some concern for Chinese Officials and the demand for their goods. Inflation Data to be released today at 11.30AM (AEST).

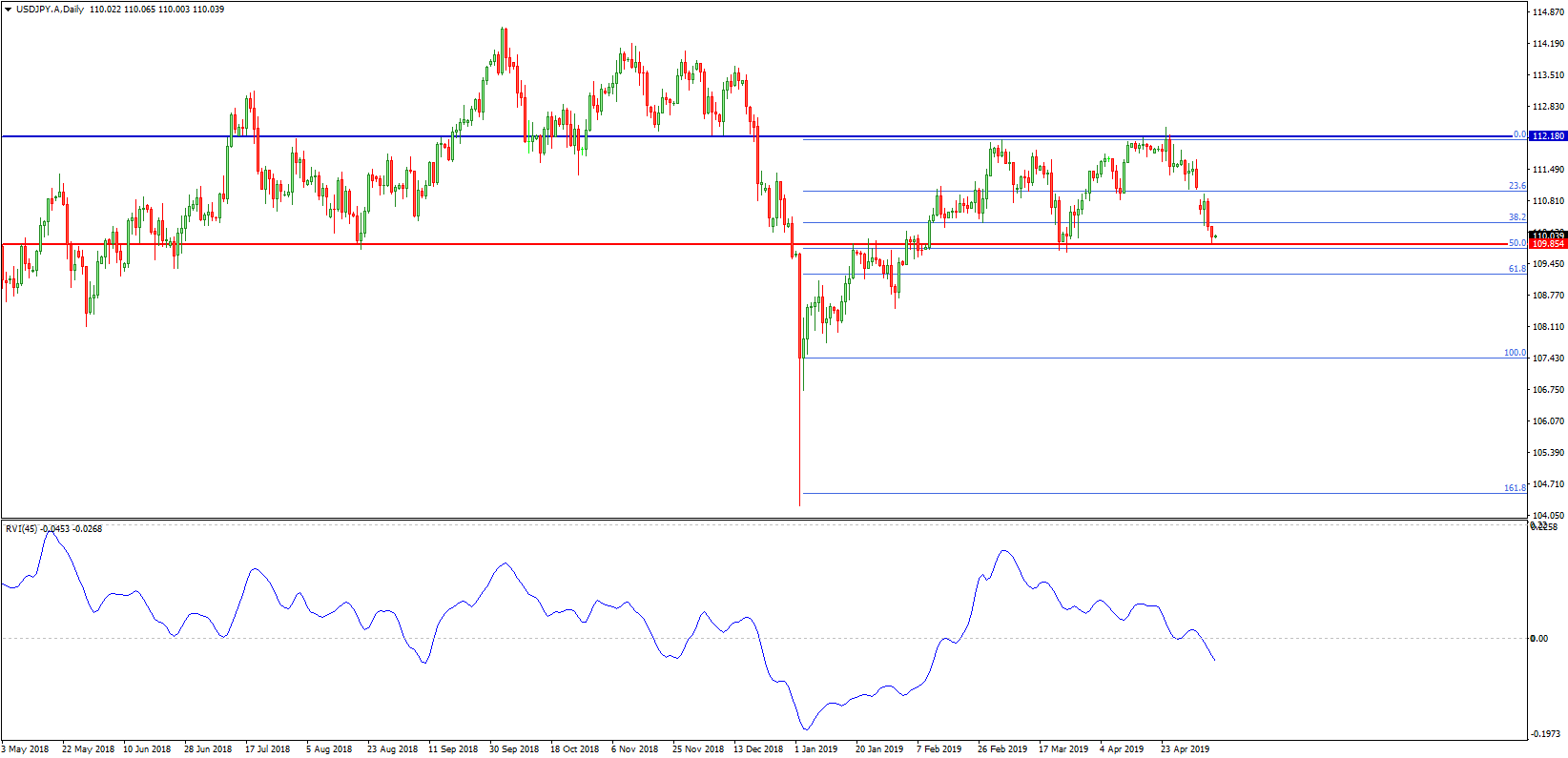

USD/JPY Daily Chart

USD/JPY closed Tuesday below the daily Cloud base at 110.31 and yesterday failed to even reach the Cloud base, pointing to a further slide to the March low and 161.8% Fibo-projected low at 109.70 next. If that support is broken, the weekly cloud base at 109.54 is next. On weekly charts, that’s 61.8% of the 107.77-112.40 rally in the weeks following the January flash crash week.

Major Economic Events happening this week (AEDT Time Zone)

| Economic event (Date) | Previous | Forecasted | Actual |

| AU – Balance of Trade (7 May) | A$4.801B | A$4.25B | A$4.949B |

| AU – RBA Interest Rate Decision (7 May) | 1.5% | 1.5% | 1.5% |

| CA – Ivey PMI (8 May) | 54.3 | 51.1 | 55.9 |

| CN – Balance of Trade (8 May) | $32.67 | $35 | $13.84B |

| CN – Exports YY (8 May) | 14.2% | 2.3% | -2.7% |

| CN – Imports YY (8 May) | -7.6% | -3.6% | 4% |

| CN – Inflation Rate YY (9 May) | 2.3% | 2.5% | – |

| CA – Balance of Trade (9 May) | C$-2.9B | C$-2.3B | – |

| US – Balance of Trade (9 May) | $-49.4B | $-51.4B | – |

| DE – Balance of Trade (10 May) | €17.9B | – | – |

| GB – Balance of Trade (10 May) | £-4.86B | – | – |

| US – Core Inflation Rate YY (10 May) | 2% | 2.1% | – |

| US – Inflation Rate YY (10 May) | 1.9% | 2.1% | – |

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.