SIX Swiss Exchange just announced that March was the strongest month so far this year in terms of both trading turnover and the number of transactions. However, in January there were two and in February three fewer trading days than in March. But even when this factor is taken into account, the two figures are still the highest in 2017 to date.

Here are the highlights:

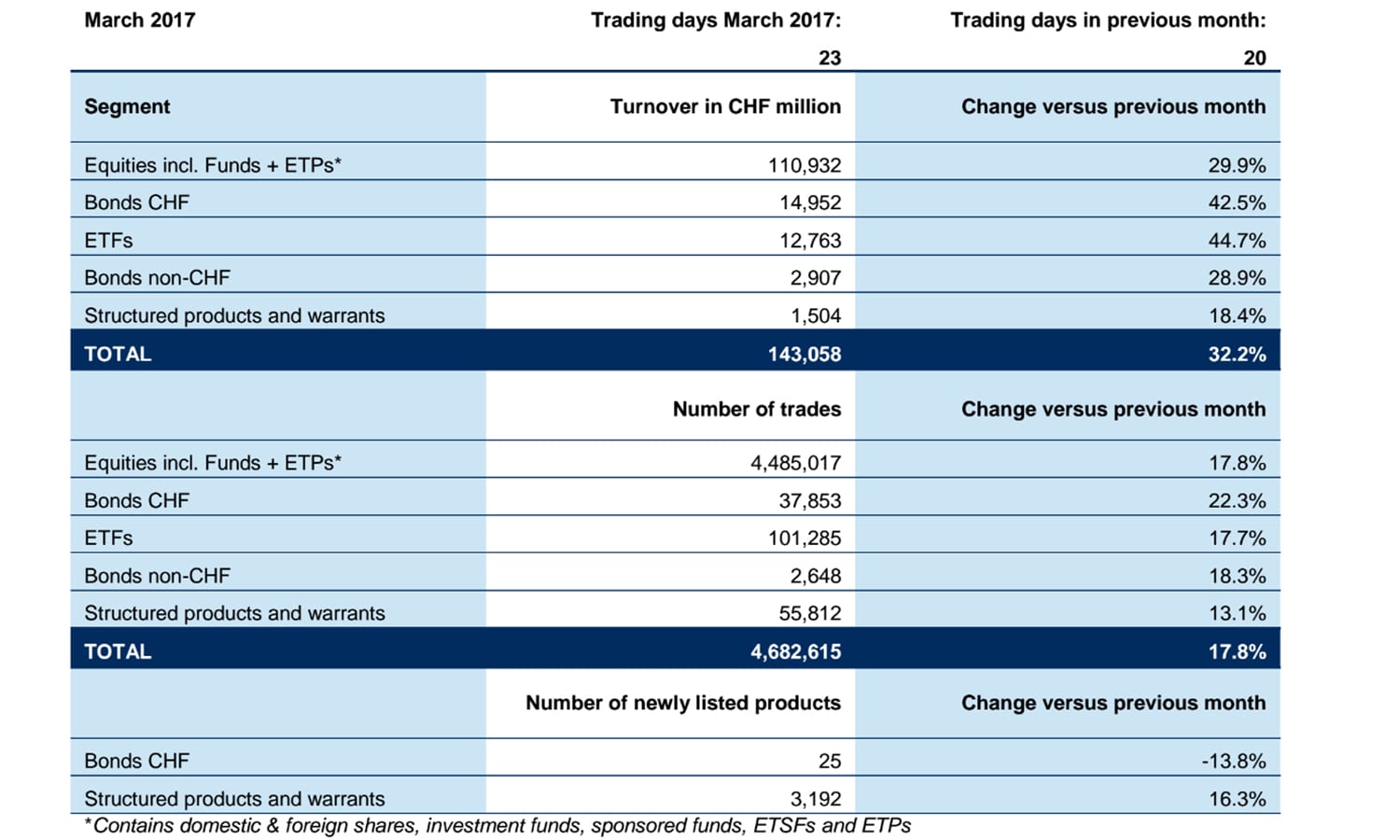

- Trading turnover of CHF 143.1 billion (+32.2% month-on-month)

- Number of trades 4,682,615 (+17.8% month-on-month)

- Average trading turnover per day of CHF 5.8 billion (Year-to-date)

Trading turnover reached a total of CHF 143.1 billion in March, which marked an impressive increase of 32.2% on the previous month. The average daily trading turnover was therefore CHF 6.2 billion. There was also a marked rise in the number of trades, which were up by 17.8% to 4,682,615. The highest number of trades during the month was recorded on Friday, 17 March, when market participants traded securities with a total value of CHF 11.9 billion. This day marked what is referred to as a triple witch, the third Friday of the third month in the quarter, which is when futures and options expire. The most-traded security in March was Roche GS.

Trading turnover was also up on a year-on-year basis. Over the first three months of 2017, turnover on the trading platforms of SIX Swiss Exchange totaled CHF 371.7 billion, equating to growth of 6.0% versus the same period last year. Last year’s trading was spread over a greater number of transactions, which is why the corresponding figure for this year of 12,861,385 is 7.8% down on last year’s total.

The month-on-month growth in March was reflected across all segments. The number of transactions was up by 17.8% in the equities including funds + ETPs segment, in which 4,485,017 trades were conducted, with trading turnover up by 29.9% to CHF 110.9 billion. In ETFs, trading turnover advanced 44.7% to CHF 12.8 billion, while the number of trades climbed by 17.7% to 101,285. In structured products and warrants, turnover was up 18.4% to CHF 1.5 billion. Furthermore, the volume of trades rose by 13.1% to 55,812. CHF bond trades were up by 22.3% to 37,853, with turnover surging by 42.5% to CHF 15.0 billion.

25 new CHF bond issues (-13.8%) and 3,192 new structured products and warrants (+16.3%) were admitted to trading in March. In all, this means that 67 new CHF bonds (+3.1%) and 8,904 new structured products and warrants (-10.5%) have been listed since the start of the year. In addition, SIX Swiss Exchange welcomed a new company in March. Shares in healthcare company Rapid Nutrition PLC were listed in accordance with the International Reporting Standard on 29 March.

The performance of the most important equity indices was as follows in March 2017: the blue chip SMI® index closed at 8,658.9 points at the end of March (+1.3% month-on-month; +5.3% versus end-2016). The SLI Swiss Leader Index® ended the month at 1,376.7 points (+1.7%/+6.1%), with the broader-based SPI® coming in at 9,637.8 points (+2.9%; +7.5%). The SBI® AAA-BBB Total Return index was down versus February (-0.8%/+0.2% compared with end-2016) at 136.5 points.