The exchange sector continued to demonstrate positive returns for investors with continued positive performances on the FTSE Mondo Visione Exchanges Index in Q3 of 2017.

Bulgarian Exchange topped the leader board with an increase in share value of 67.3 per cent in Q3 2017 against a 6.6 per cent increase in Q2 2017.

B3 SA experienced a 27.0 per cent increase in share value in Q3 2017, followed by CBOE Holdings with a 17.8 per cent increase for the same period.

The share price performance of India’s BSE was the bottom of the Index table with a 10.0 per cent decrease in share value during Q3 2017. Greece’s Hellenic Exchanges SA experienced a 7.0 per cent decrease in share value in Q3 2017, followed by the Multi Commodity Exchange of India with a 5.5 per cent decrease during the same period.

The Index, which aims to reflect market sentiment and is a key indicator of the exchanges’ performance, saw a 3.6 per cent increase in September 2017.

Overall, the FTSE Mondo Visione Exchange Index experienced a 6.8 per cent increase in Q3 2017. This compared to an 8.0 per cent increase in Q2 2017.

Commenting on the Index which closed up at 45,232.14 on 29 September 2017, Herbie Skeete, Managing Director, Mondo Visione and Co-founder of the Index said:

Eastern European exchanges were the pick of the crop in September and in the third quarter with strong returns for the Moscow Exchange in September and the Bulgarian Stock Exchange in the third quarter. Significantly, the U.S. Capital Group increased its shareholding in Moscow Exchange to 5%, despite a new round of anti-Russia sanctions. Capital Group obtained control of the stake through five subsidiary companies engaged in trust management.

The FTSE Mondo Visione Exchanges Index best performer by capital returns in US dollars was Moscow Exchange with a 10.6 per cent increase in share price from 31 August to 29 September 2017. The next best performer was CME Group with a 7.9 per cent increase over the same period.

The FTSE Mondo Visione Exchanges Index worst performer by capital returns in US dollars was South Africa’s JSE with a 11.5 per cent decrease in share price from 31 August to 29 September 2017. This was followed by Kenya’s Nairobi Securities Exchanges with a 9.8 per cent decrease over the same period.

The FTSE Mondo Visione Exchanges Index is compiled by FTSE Group from data based on the share price performance of listed exchanges and trading platforms.

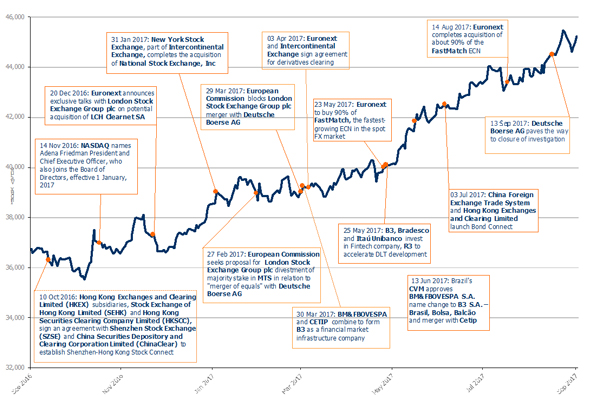

1 Year Performance Chart Of The FTSE Mondo Visione Exchanges Index (USD Capital Return)

Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD)

| July 2014 | 3.1% |

| August 2014 | 2.3% |

| September 2014 | -3.6% |

| October 2014 | 2.8% |

| November 2014 | 2.5% |

| December 2014 | -0.5% |

| January 2015 | -1.0% |

| February 2015 | 8.5% |

| March 2015 | 0.0% |

| April 2015 | 10.7% |

| May 2015 | 0.1% |

| June 2015 | -3.2% |

| July 2015 | -2.7% |

| August 2015 | -5.3% |

| September 2015 | -2.1% |

| October 2015 | 7.6% |

| November 2015 | 0.4% |

| December 2015 | -2.2% |

| January 2016 | -4,7% |

| February 2016 | -0.7% |

| March 2016 | 6.7% |

| April 2016 | 0.4% |

| May 2016 | 1.8% |

| June 2016 | -2.2% |

| July 2016 | 5.3% |

| August 2016 | 2.3% |

| September 2016 | -1.6% |

| October 2016 | -1.6% |

| November 2016 | 2.1% |

| December 2016 | 0.1% |

| January 2017 | 6.0% |

| February 2017 | -0.8% |

| March 2017 | 1.4% |

| April 2017 | 0.8% |

| May 2017 | 1.6% |

| June 2017 | 5.6% |

| July 2017 | 2.7% |

| August 2017 | 0.3% |

| September 2017 | 3.6% |