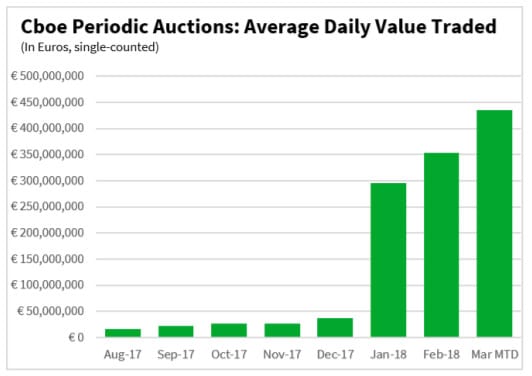

Cboe Global Markets, Inc. (Nasdaq: CBOE) has reported that Cboe Europe’s Periodic Auctions book set a new one-day record of €582.8 million traded on Monday, 12 March 2018.

The previous one-day record was €488 million set on 6 February 2018.

Mark Hemsley, Bats

Mark Hemsley, President of Europe for Cboe, said:

With the double-volume caps now in effect, the Cboe Periodic Auctions book is well-poised for continued growth as market participants seek to trade in venues that provide minimal market impact. Additionally, the Periodic Auctions book is a good solution for firms looking to meet their best execution requirements under MiFID II as all orders submitted to the book execute at or within the European Best Bid or Offer.

The Cboe Periodic Auctions book, which launched in October 2015, is a separate lit book that independently operates frequent randomised intra-day auctions throughout the day. Because of the nature of the periodic auction and attributes of the order book, information leakage is minimised and larger orders are prioritised in the auction process. Orders only execute at or within the European Best Bid and Offer (EBBO) to help ensure orderly markets and provide certainty around execution price range.

Month-to-date in March, the Cboe Periodic Auctions book has recorded average daily notional value traded (ADNV) of €435.4 million. In February, the Cboe Periodic Auctions book recorded ADNV of €353 million, a 19% increase on January ADNV of €296 million. Total notional value traded on the Periodic Auctions book in February topped €7.1 billion, up from €6.5 billion in January.