The following article was written by Reem Aboul Hosn, Research and Market Analyst Officer at Credit Financier Invest (CFI) Ltd.

After three years of asset purchases, negative Interest Rates and cheap loans, the European Central Bank could ease inflation in the euro area back on track. 2019 is the time to gradually slow down those easing measures.

The ECB has an obligation to keep inflation rates just below 2%. As a first step, policy makers have decided to decrease monthly asset purchases by the end of this year, while leaving Interest Rates at record lows at least through the first half of 2019.

The timeline below reveals the European Central Bank’s key indicators

In 2014, ECB becomes first major central bank to cut Interest Rates below zero to boost credit and ECB announces government-bond purchases after inflation rate fell below zero for first time since the financial crisis.

In 2015, Quantitative Easing commences, and in January 2017, ECB decides to reduce monthly pace of asset purchases program by half, to 30 billion euros until September 2018. Policy makers stressed the importance of bond reinvestments.

In August 2018, the easing policy started to phase out with 15 billion euros in each of October, November and December. Interest Rates will be kept at record lows at least through the first six month of 2019. In December 2018, ECB is expected to phases out net asset purchases after buying at reduced pace in final three months of 2018.

In December of 2019, Investors have first deposit-rate hike fully priced in for December 2019.

Since the June meeting, economic growth, inflation and the job market have developed in line with expectations. However, wage growth and inflation have remained soft. While President Mario Draghi could talk about geopolitical uncertainties in Turkey and Italy, as well as escalation of global trade tensions, the happenings so far are not material enough to affect ECB’s policy decision on Thursday, September 13th.

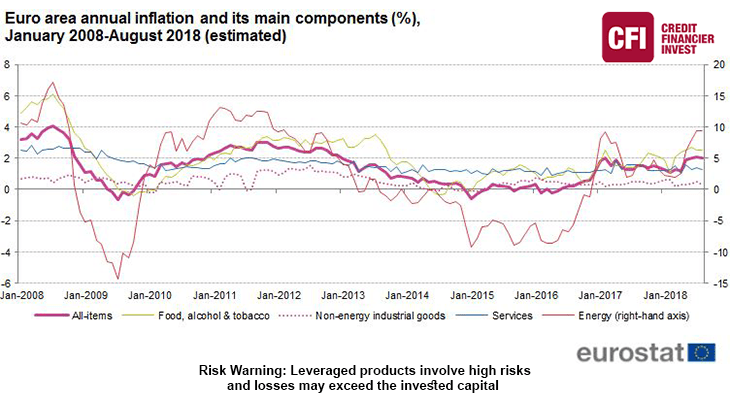

Eurozone Inflation Rate slows to 2% in August

The annual inflation rate in the Euro Area slowed down to 2% in August 2018 from the previous month’s five-and-a-half-year high of 2.1%. To control inflation rates moving forward, prices should rise at a softer pace for services, energy and non-energy industrial goods.

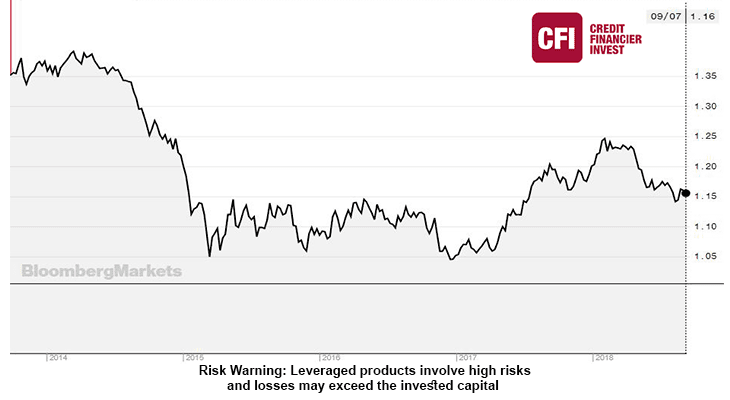

EUR/USD – 5Y Chart Technical Analysis:

The pair is expected to find support at 1.1557 and resistance at 1.1635

Conclusion

The ECB is not expected to make any big announcements of its already announced QE tapering. The message coming from Draghi and the new forecasts will likely be cautious or outright dovish, pushing the EUR/USD lower. An upbeat message has a lower probability. Inflation recently slowed down and growth is not going anywhere fast. The Turkish rate decision and US inflation can cause some distractions.