The following article was written by Reem Aboul Hosn, Research and Market Analyst Officer at CFI Markets Ltd.

On January 1, 2018 Saudi Arabia, the United Arab Emirates and the remaining GCC countries introduced Value Added Tax at a standard rate of 5% on most goods and services, to boost alternative revenue after oil prices collapsed three years ago.

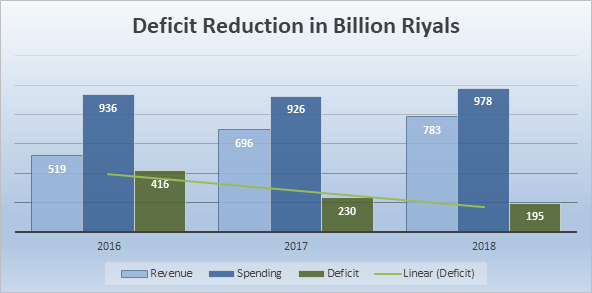

Meanwhile, Saudi Arabia has unveiled 2018’s budget as the government forecasts a boost in revenue from the introducing VAT and reducing subsidies. The highlight of the budget was the amplified expenditure of the kingdom reaching USD 261 billion (SAR 978 billion) in 2018. Nevertheless, Saudi Arabia will face budget deficit until at least 2021.

The International Monetary Fund has recommended oil-exporting Gulf countries to introduce taxes on business profits as one way to raise revenue from non-oil operations in an attempt to reduce Gulf States’ need for oil revenues.

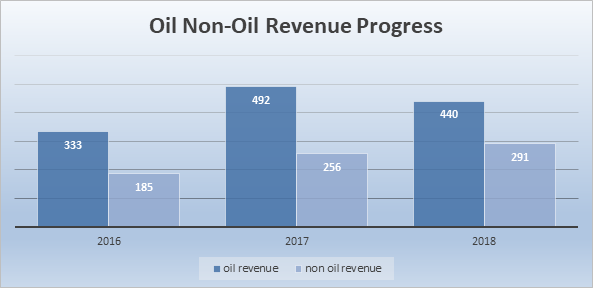

In 2018, oil revenue is expected to elevate to SAR 492 billion compared to SAR 440 billion, out of aggregate revenue of SAR 783 billion, which leaves non-oil revenues at SAR 291 billion from SAR 256 billion in 2017. The government expects the budget deficit to narrow to 7.3 % of GDP from almost 9% in 2017.

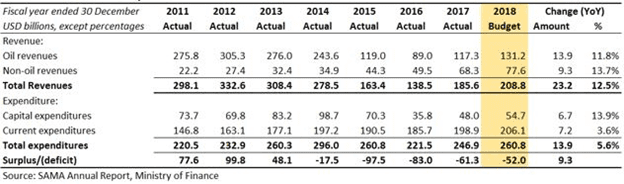

Government Revenues and Expenditures:

Saudi Budget – Revenue Expenditure and Deficit (Graph 1):

Saudi Revenue will still be dominated by oil sales even after taxes in 2018 (Graph 2):

Until 2014, oil income made up more than 90% of public revenue. Since then, the kingdom has focused on diversification, and this year non-oil revenue expectation to reach 50%.

The government are seeking to speed up development of non-oil revenue through structural reform of the economy, in two main categories; first through taxes on goods and services which are expected to generate SAR 35 billion in 2018 according to the Ministry, in addition to the return from investments Funds of SAMA Saudi Arabian Monetary Authority.

The overall Economy:

In 2017 the country entered into recession of overall negative growth outlook at 0.5%; oil GDP shrank to 4.3%, non-oil GDP rose 1.5%. In 2018, the real GDP growth is expected to score 2.7%, driven by non-oil activities. Also non-oil economy is expected to expand at a rate of 3.7%, as reported by the Ministry of Finance.

Funding and debt Inflation:

Inflation in the kingdom is expected to surge in 2018 to more than 5% from a negative rate at the end of 2017, driven by the implementation of VAT and quite a few new tariffs, according to data compiled by Jadwa Investment Bank in Riyadh.

Even with a 5% jump in prices, the tax rate is still significantly less than the average VAT rate of 20 % in some European countries. In mid-1970s during the oil boom and construction initiations in Saudi Arabia the country suspended income taxes on foreigners to attract more expatriates to live and work in the country.

Saudi Stock Market Overview:

Saudi Arabia’s stock market Tadawul All Share Index (TASI) rose 0.20% to hit one-month high after government’s release of its 2018 budget.