The following article was written by Reem Aboul Hosn, Research and Market Analyst Officer at Credit Financier Invest (CFI) Ltd.

Over the last few days, Newton’s law of action-reaction explains the nature relationship between Gold and US equity markets, as the panic on Wall Street and globally sent equities falling and gold surging higher on safe-haven buying. The question is will this action-reaction relationship lasts?

In October, Gold hit three-month highs, continuing its climb into a third week and reasserting itself as the hedge of choice for investors against a combination of geopolitical tensions, tumbling equity markets and global macro uncertainties. Global stocks were under pressure, weighing down by current macroeconomic conditions including:

1. Rising interest rates and bond yields.

2. Rising interest rates and softer than expected US inflation rates.

3. The impact of rising US debt and budget deficit.

4. Rising geopolitical tension between US, China and Middle East.

5. The Italian budget deficit.

6. Continuous delays to EU-Brexit negotiations.

1. Rising interest rates and bond yields. Government debt yields soften to 3.14% after the Labor Department said consumer prices rose less than expected in September, calming inflation fears that sent the 10-year Treasury yield to 3.26%, its highest in seven years, a major factor in the decline of US Equities.

2. Rising interest rates and softer than expected US inflation rates. Following the Fed’s third rate hike for 2018 in September and adoption of increasingly positive language, U.S. bond yields spiked on fears of a global economic slowdown, turning the dollar to Gold’s advantage. However, tight monetary policy makes it expensive for businesses to borrow money to fund operations and expansions, causing equity sell-off and damaging risk sentiment.

3. The impact of rising US debt and budget deficit. Debt is rising to historic highs, whether it’s emerging market debt, or U.S. government debt. Meanwhile, higher rates are making it more expensive to service all this debt. As interest payments will increase, its forecast that the federal deficit will increase in 2019. Rising debt could be one of the most compelling reasons to maintain some exposure to gold.

4. Rising geopolitical tension between US, China and Middle East. Rising geopolitical tension between the West and Middle East added to gold’s safe-haven edge. Also, the trade dispute between the world’s largest economies, US and China, is escalating as Washington and Beijing are imposing tariffs against each other’s exports, raising fears of a prolonged trade conflict.

5. The Italian budget deficit. Moving over to Europe, the Italian government adjusted its budget deficit to 2.4% in 2019, while that’s within the EU rules for budget deficits not to exceed 3% of GDP; it is still a higher amount than the government previously promised, of 1.8%. The EU could accept or reject the budget, asking the coalition to amend its plans.

6. Continuous delays to EU-Brexit negotiations. Over to UK, the delayed EU-Brexit negotiations will unfold in the coming weeks and will have a material impact not just for UK, but the EU and the global economy.

Last week, the IMF said that risks to the global financial system could increase if pressures in emerging markets escalate or global trade relations worsen.

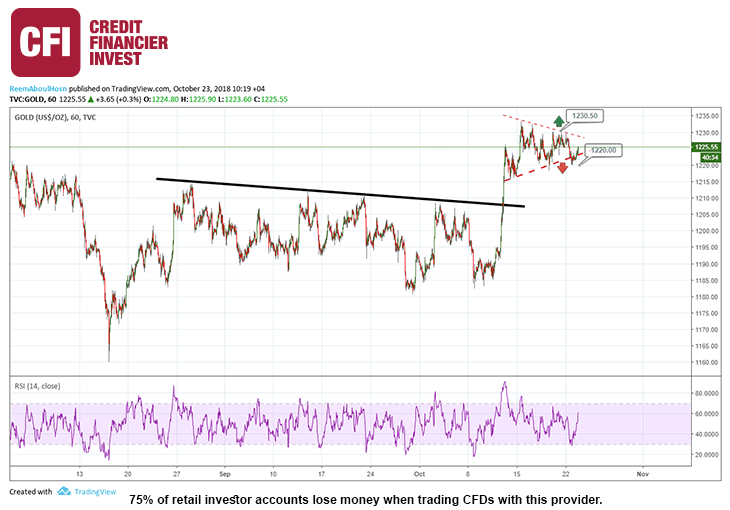

Investors are considering “Gold” as a safe store of value during political and economic uncertainty; however Gold remains about 10% below its April peak. If Gold prices touch USD 1,236 an ounce it is well off continuing its upward trend to USD 1,245. Alternatively trading below USD 1,220 an ounce will pressure again on the Gold prices to resume its downward trend.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.