The following article was written by Reem Aboul Hosn, Research and Market Analyst Officer at CFI Markets Ltd.

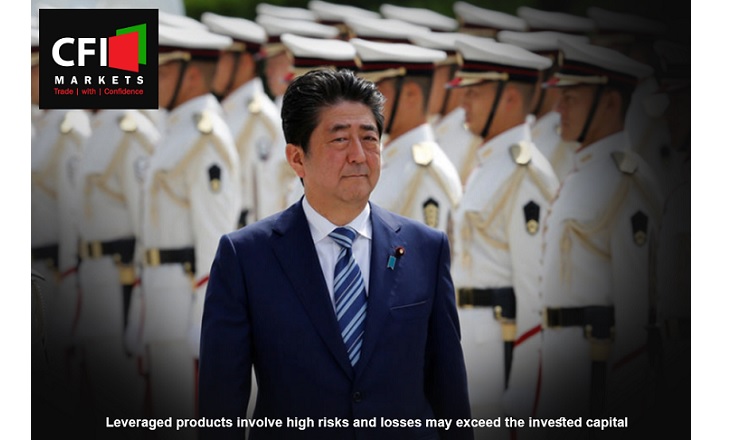

Japanese Prime Minister Shinzo Abe’s recollected two-thirds majority in the lower house of the parliament in Sunday’s election, as reported by Reuters, paving the way for more ultra-easy monetary policy.

The victory, has sent Tokyo Stock Exchange to its all-time high, while Yen plunged against the US dollar, which in turn stretched to its highest levels in more than three months against the Japanese currency, as investors translated Abe’s won to be an extension to the easing policy of the world’s third-largest economy.

Meanwhile Abe’s re-election reminded Japanese people, of the year 2012 when the central bank policy of quantitative easing pushed the Yen lower against the Dollar. Nearly five years after the government and central bank doubled down on their stimulus efforts, government debt is mounting, and despite the Bank of Japan’s best efforts, inflation is still as low as 0.7%, as reported by Reuters.

Faced with low inflation, and slight economic growth, central banks like BOJ the Fed Reserve and European Central Bank, have adopted unconventional monetary easing steps since the global financial crisis in 2008 in an attempt to boost growth. However, the resulting plunge in interest rates has hurt profits of financial institutions by narrowing their margins and destabilized the banking system.

In short, prolonged low profitability at financial institutions could signal a new financial crisis. With inflation still weak and wage growth still sluggish. How long will the government continue its stimulus plan? It is most likely forecasted that BOJ Governor Haruhiko Kuroda, will maintain the ultra-monetary easing program until consumer price index Inflation hits annualized rate of 2%.