Mati Greenspan, Senior Market Analyst at FX broker eToro, has provided his daily commentary on traditional and crypto markets for May 16, 2019. The text below is an excerpt and does not contain the full analysis.

Today’s Highlights

- Hit em in the Bonds

- Bitcoin Cycle Visualized

- Alts Catching Up

Please note: All data, figures & graphs are valid as of May 16th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Stocks continue to defy the politicians and are continuing to recover from the recent trade-war-driven dip. The feeling from many analysts seems to be that the new tariffs and counter-tariffs are already priced in and unless we see a serious deterioration from here, there’s only upside potential.

Such deterioration, of course, does remain a distinct possibility. Even today we saw headlines like…

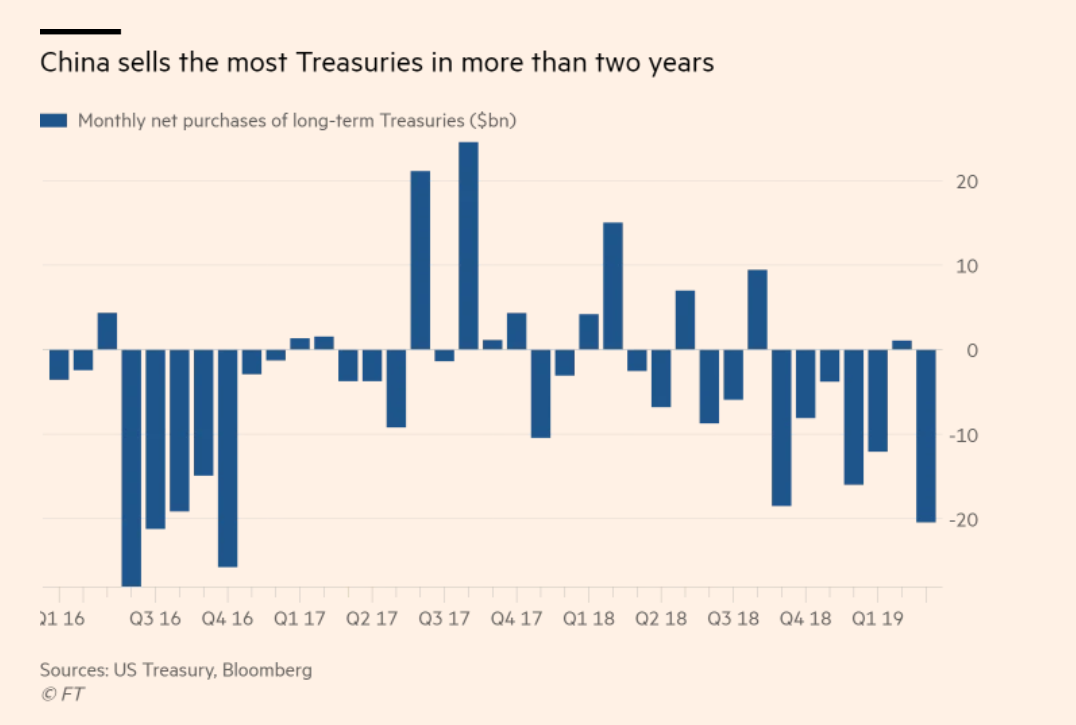

China isn’t taking this lying down either. We can see that over the last quarter China has offloaded US debt at its fastest pace in more than two years.

As China is the largest holder of US debt, this is a bit concerning and represents a notable escalation in the trade war. The fear and we haven’t seen it yet, is if China decides to devalue to the Yuan. Such a scenario doesn’t seem likely, as it would bring the currency’s stability into question and could cause Chinese citizens to try getting their money out of the country. However, if backed into a corner, they may have no other option but to take the hit in order to offset the tariffs.

Here we can see that the USD has been gaining against the CNH lately. The number to watch is the great wall of psychological resistance at seven Yuan to the Dollar.

Bitcoin’s Market Cycles

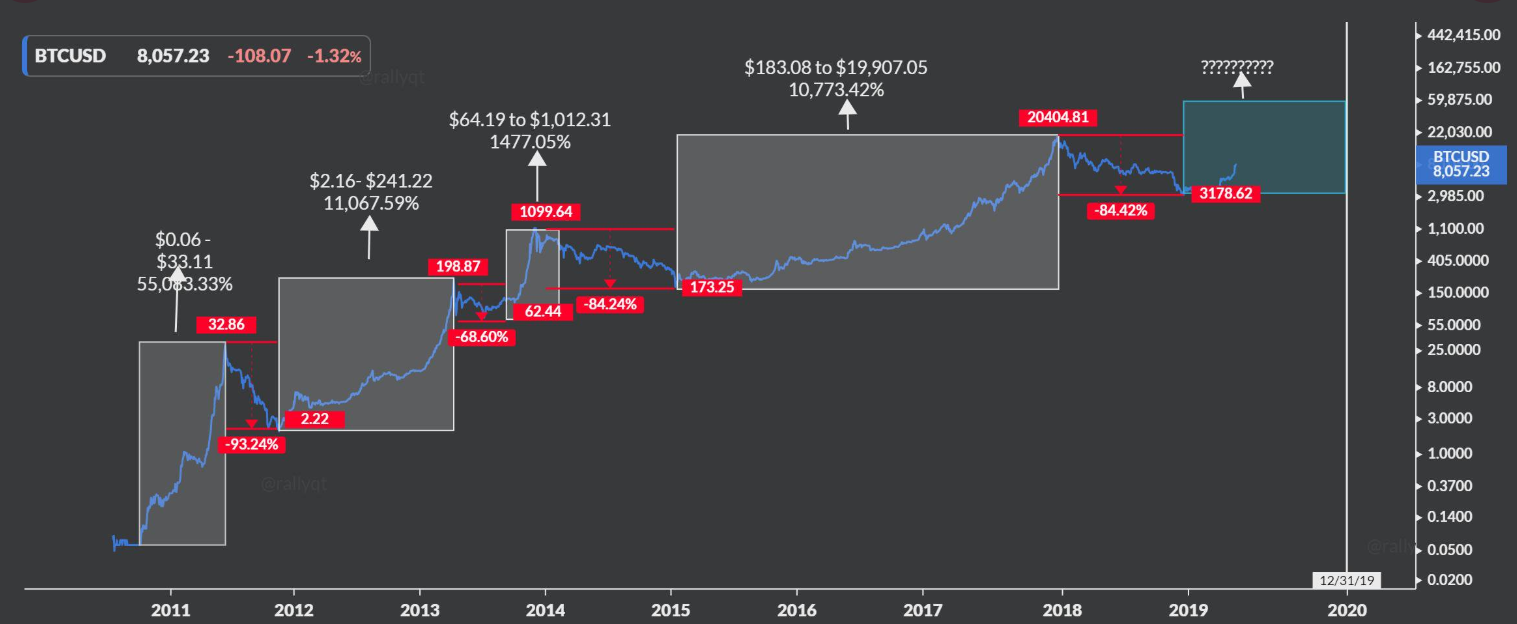

Those of you who’ve been reading for a while know that we’ve been talking about bitcoin’s bull and bear cycles a lot, in anticipation of history repeating itself. Of course, past performance is not an indication of future results but I thought that this graph showing bitcoin’s previous bull runs and massive pullbacks was worth sharing.

Notice that it is on a logarithmic scale, which is very popular among cryptoanalysts. It shows the highs and lows of each cycle and the percentage gains and losses on each one. Chart credit goes to @rallyqt.

How about a pullback?

Crypto markets are struggling to hold on to some of the lofty levels seen this week. Bitcoin itself just doesn’t seem to be able to keep above $8,000 and as I write it seems like a pullback is finally coming in.

Even John McAfee, the man whose ‘reputation’ is on the line for a massive moon, has recently stated that we could see a swift pullback.

In all fairness, we can’t really judge the strength of the bull run or even know if we’re in a bull market until we see a few pullbacks and continuations. Until then, all we’re seeing are temporary movements and not an overall trend.

Still, if it is the case that we’re going to the moon from a here a pullback has the potential to act as the slingshot that will take us there. Nobody wants to FOMO in at the top, so a nicely sized pullback could provide people who missed the last swing to join in at a better price.

The size of the pullback will also be significant. For example, if the worst is over right now, then that is an incredibly bullish sign. If it takes us back to test $6,000 and then continues to break above the recent highs, I would say that would be the start of a healthy bull market. If, on the other hand, a large pullback comes and takes us back below $5,000 then this entire party may have been for naught.

We’ll see how it goes.

Let’s have a flipping amazing day.

Mati Greenspan can be found on LinkedIn, Twitter, or etoro.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.