This article was exclusively prepared for LeapRate by Yuhan Mo, Account Manager at Advanced Markets and Fortex, Inc.

LeapRate Exclusive… With high frequency trading estimated to account for more than 50% of the trading volume in the U.S. and more than 25% in Europe, the number of available price updates (ticks) per second has become an important criteria for FX Brokers, HFTs and Fund Managers when choosing a liquidity provider.

Yuhan Mo

High volume tick data delivers more market information (price discovery) to the quantitative trading models used by large hedge funds and high frequency traders, potentially increasing the profitability of trading strategies. It also helps to restore market efficiency and, in a way, improves liquidity in FX markets. In fact, these days it’s almost a necessity for some brokers as they look to create the perception of better liquidity whilst hoping to avoid being arbitraged by retail traders because of latent pricing.

More Informative for Quantitative Trading Models

In order to achieve ultra-low latency and to capture market moves, institutional fund managers are investing heavily in hardware and network colocation to the liquidity providers’ aggregator in major financial data centers. At the same time, they are subscribing to expensive, higher tick density data feeds. The reason for such investment is that their quantitative models work better with the granular market information associated with higher tick density, thus providing them with an advantage over the slower traders.

An academic research, Equilibrium High Frequency Trading, conducted by Biais, Foucault and Moinas in 2011 indicated that high frequency traders can generally process information on trading products faster, leading to increased gains from their trades. This result is also supported by an empirical study by Hendershott and Rioan (2010), Brogaard (2010), and Hendershott and Riodan (2011), which found that HFT’s orders are more informative than others. Also, with higher tick density, trades have a greater chance of being filled at their requested price, particularly on stop-loss and take-profit orders and especially during volatile market movements.

High frequency tick data facilitates to restore market efficiency

A research paper by Akram, Rime and Sarno, examined the efficiency of FX markets by evaluating frequency, size and duration of round-trip and one-way arbitrage opportunities utilizing the best bid/ask spot exchange rates from Reuters for three major products: USD/EUR, USD/GBP and USD/JPY and also the prices on exchange rate swaps. Key results showed that prices are set such that, trading aimed at exploiting no-arbitrage conditions (based on the Law of One Price) is, on average, not profit-making.

However, this paper finds evidence of numerous short-lived arbitrage opportunities, which had not been identified in all previous empirical researches.

This research believes that arbitrage opportunities are only detected because of the higher tick frequency tick data they deployed in this study. This result supported Grossman-Stiglitz’s view of efficiently functioning financial markets where very short-term arbitrage opportunities arise, traders are invited to exploit them, and arbitrage-free pricing is restored as a result. If arbitrage opportunities were never observed, market participants may not have an incentive to watch the market, and therefore market liquidity would soon decrease.

However, with all being said, one needs to consider that the effect of transactional cost and trade execution with counterparties may greatly change the game in real world trading.

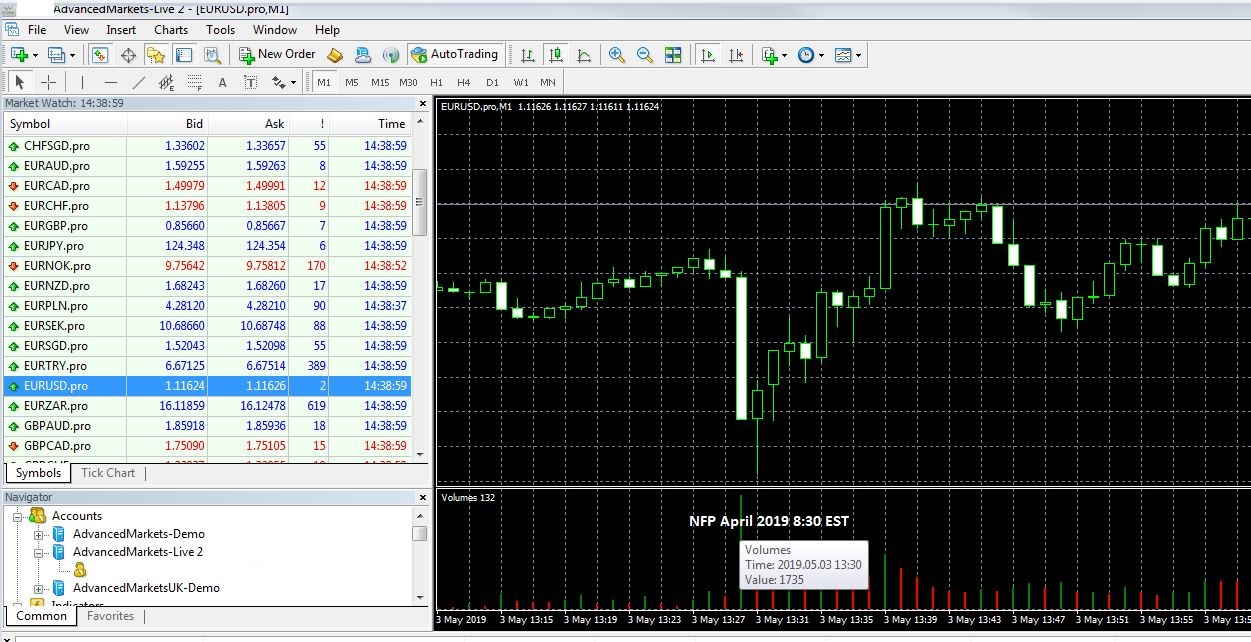

*EURUSD received 1735 ticks at 8:30 AM, May 3rd 2019 when US released NFP data for April 2019 on Advanced Markets Platform.

Lower Operational Risk and Better Brand Perception

Brokerages with low MT4 tick volume per second (slower price updates) run the operational risk that retail traders, with access to high tick density data feeds, will catch a market move much faster than the latent broker, say during economic data releases or news, and will take advantage of the arbitrage opportunity to the detriment of the broker itself. When choosing a liquidity provider, instead of only considering spread as an indicator of liquidity quality, a broker should also consider the volume of tick updates per second as an important set of criteria.

A greater number of tick updates creates the perception of “excellent” spreads. A higher number of MT4 price tick updates presents a greater chance that the trader’s eye will notice that split-second 0 spread. Compared to a 1-2 points spread on EUR/USD, a 0 spread is a perceptually strong indicator of good liquidity. Most retail traders are “spread-oriented” when choosing a broker to trade with and we have heard a lot discussion of “eye watching” the spread on a trading terminal.

Without scientific and systematic data analysis of spread over a significant amount of time, traders tend to make judgement on the “good or bad spread” based on what they are seeing on the platform itself. It follows therefore that, if you are able to find a liquidity provider who can generate more tick updates per second, and who has the robust hosting technology needed to consume and show the tick updates on MT4 or any other proprietary trading platform, then you have a higher chance of winning the pure spread battle.

Get free access to the video tutorial “How to check number of ticks on MT4” here.