ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for April 12, 2019.

EURUSD

The Euro closed lower on Thursday, closing at 1.1261(-14 pips) against the greenback. The American dollar advanced across the FX board, as better-than-expected data leaned the scale in its favor ahead of the last trading session of the day. However, major pairs hold within familiar levels, with the EUR/USD pair peaking at 1.1287, to settle lower at around 1.1260.

Demand for the shared currency was dented by the ECB’s survey of professional forecasters showed that the real GDP growth expectation for this year, dropped to 1.2% from 1.5%, while 2020 forecast was also revised lower. German final March inflation was confirmed at 1.4% YoY when

harmonized to EU one. Across the Atlantic, things were a bit better as US March PPI was up by 0.6% MoM and by 2.2% YoY, while the core readings came in at 0.3% and 2.4% respectively.

Also, and for the week ended April 5, the number of those filing for unemployment decreased to 196K, better than the 211K expected, and the lowest reading in almost five decades. Friday will bring German Wholesale Price Index figures for March, February Industrial Production, and the

US preliminary April Michigan Consumer Sentiment Index, forecasted at 98.0 vs. the previous 98.4.

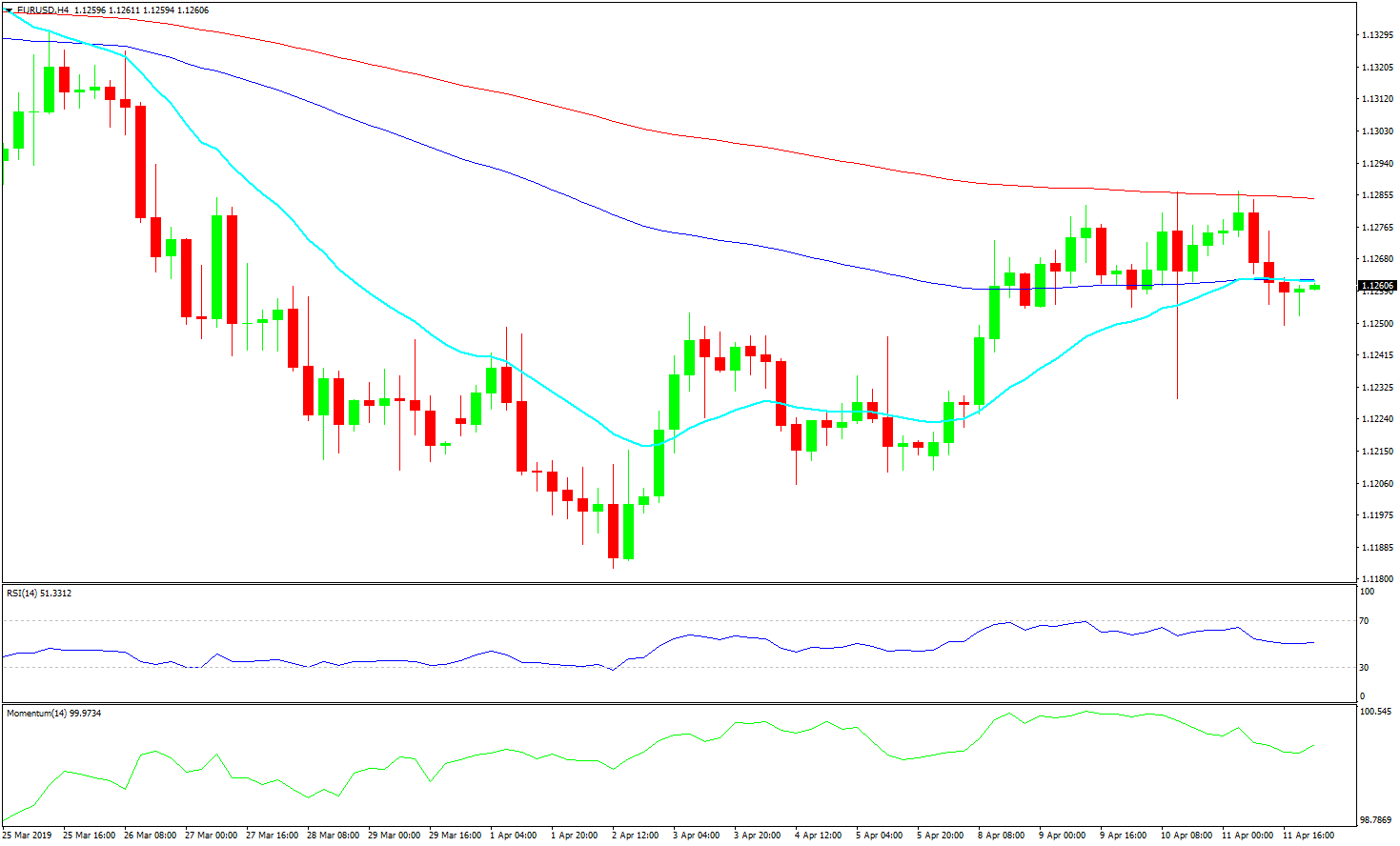

EURUSD 4 Hour Chart

Based on the chart above, the outlook for the pair appears to be bearish as the pair is now below all of its moving averages, while technical indicators entered negative ground, the Momentum extending its downward slope and the RSI currently at 48. The pair could re-test the yearly low at 1.1175 if 1.1245 gives up.

GBPUSD

The Pound depreciated on Thursday, closing at 1.3058(-38 pips) against the greenback. After a lengthy debate, EU representatives agreed to offer the UK a flexible Brexit deadline extension until October 31. The UK can leave earlier if they managed to approve a deal but would need to participate in EU elections. PM May addressed Commons later in the day and said that reaching a cross-party agreement won’t be easy, but that both parties need to compromise to do it.

Pressure mounts on PM May to resign, after failing to lead the kingdom out of the European Union. May, however, wants to deliver Brexit before stepping down and letting someone else negotiate the future relationship between the EU and the UK. The UK calendar had nothing to offer this Thursday and will remain empty also on Friday.

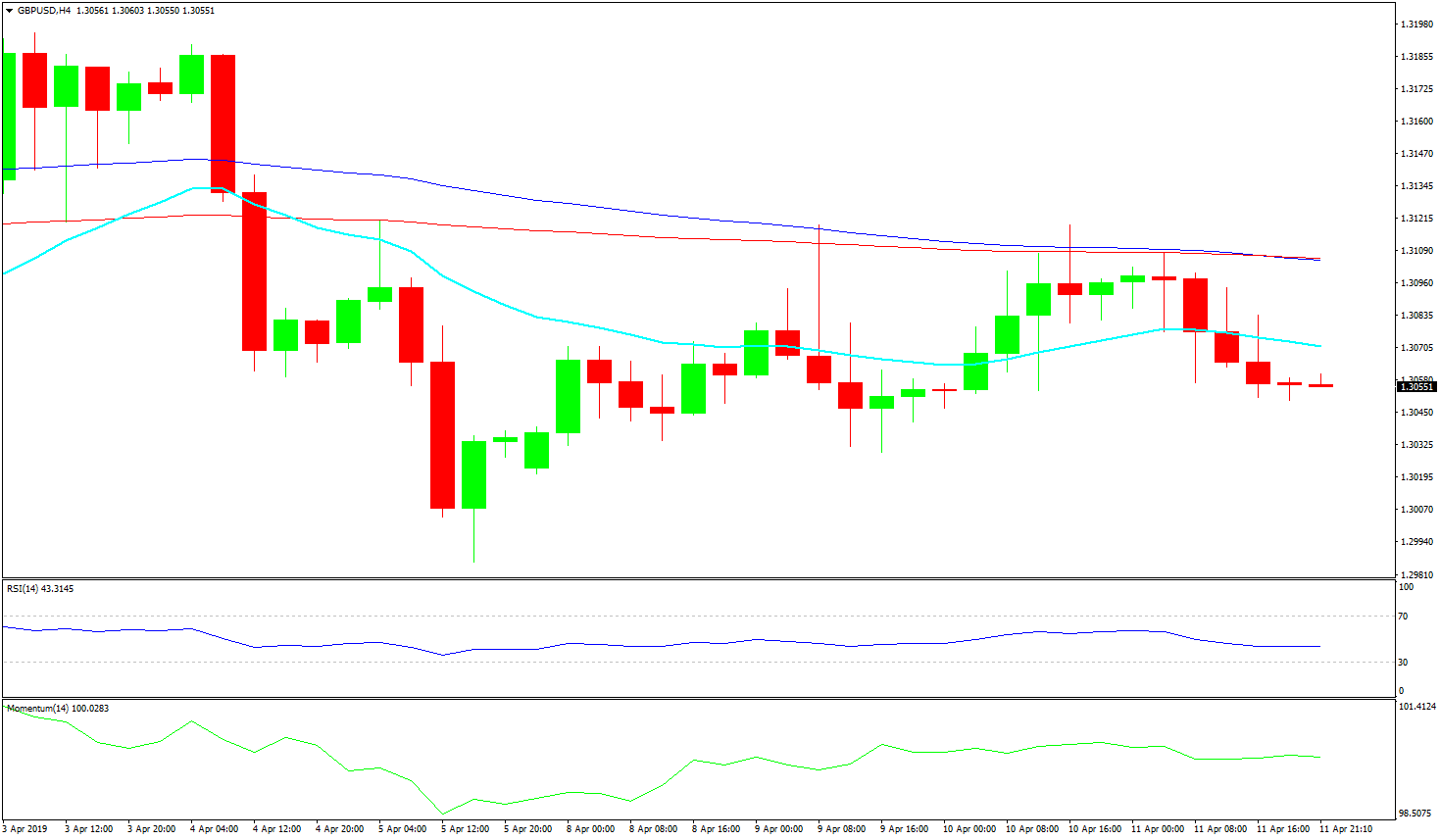

GBPUSD 4 Hour Chart

In the 4 hours chart, the pair hovers around 1.3060 at the beginning of the Asian session, with a neutral-to-bearish short-term stance. The pair experienced selling pressure right around the 200 EMA (Red Line). The Momentum indicator in the mentioned chart crosses its midline into negative ground, while the RSI heads nowhere around 49. The pair could lose further ground around 1.3050, yet seems unlikely it will reach the base of March’s range at 1.2965, the level to break to enter a bearish market. Gains beyond 1.3100 will likely keep attracting selling interest.

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.