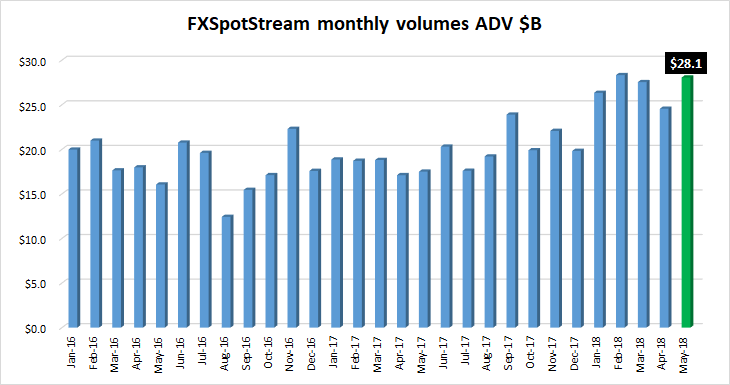

After reporting record trading volumes throughout Q1, multibank FX aggregation service FXSpotStream has announced that May volumes totaled $645.4 billion, a record for the company.

Average daily volumes of $28.1 billion were slightly off FXSpotStream’s record in that regard, $28.8 billion set in February 2018 (but as February had 3 fewer trading days, total volumes in February were not as large as in May).

Some of the results to note at FXSpotStream included:

- Overall volume MoM (May ’18 vs April ’18) increased 25.2%.

- Overall volume YoY (May ’18 vs May ’17) increased 60.8%.

- ADV in May MoM (May vs April ’18) increased 14.3% – the 2nd highest ADV on record at USD28.061 billion.

- ADV YoY (May ’18 vs May ’17) increased 60.8% – continuing an ADV increase of over 40% YoY every month so far in 2018.

- ADV for first 5 months of the year is up 48.8% when compared to the same time last year.

| Month |

Total Volume* | Avg Daily Volume (ADV) | ADV Change MoM |

ADV Change YoY | Trading Days |

| May-18 | $645,411 | $28,061 | +14.3% | +60.8% | 23 |

| Apr-18 | $515,696 | $24,557 | -10.9% | +43.5% | 21 |

| Mar-18 | $606,011 | $27,546 | -4.5% | +46.7% | 22 |

| Feb-18 | $576,631 | $28,832 | +9.5% | +54.1% | 20 |

| Jan-18 | $579,463 | $26,339 | +32.8% | +39.7% | 22 |

FXSpotStream is a bank owned consortium operating as a market utility, providing the infrastructure that facilitates a multibank API and GUI to route trades from clients to Liquidity Providers. FXSpotStream provides liquidity from 13 leading global banks – BofA Merrill Lynch, Bank of Tokyo-Mitsubishi UFJ, BNP Paribas, Citi, Commerzbank AG, Credit Suisse, Goldman Sachs, HSBC, J.P. Morgan, Morgan Stanley, Standard Chartered, State Street and UBS.