The following article is courtesy of financial service provider AETOS Capital Group. Part I of the article can be found here.

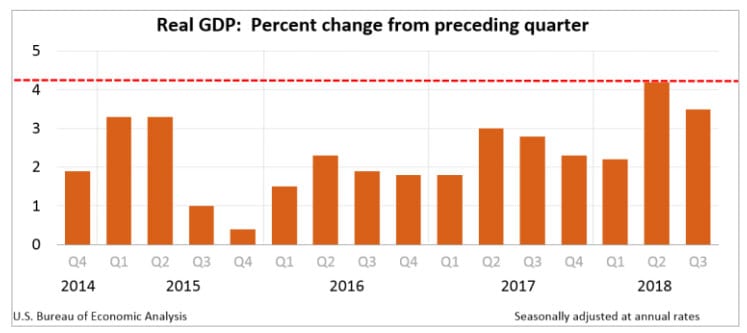

Additionally, the second quarter of 2018 may be the peak of America’s current round of economic growth.

Risky Assets Face Three Big Threats

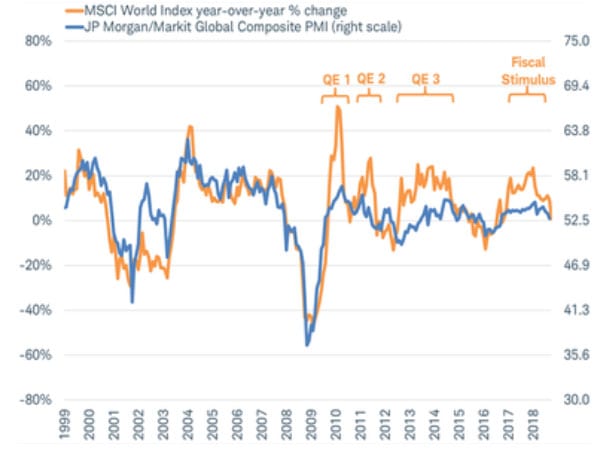

Over the past 20 years, the global market index of MSCI, which represents the trend of global stock markets, has remained in a high correlation with the PMI index, which represents the economic situation of major countries around the world. It is rare for financial market performance to depart from economic fundamentals. Thus, the four departures shown in the chart led to a decade-long bull run in U.S. stocks and a global financial asset boom.

Moreover, each departure had come as a result of the “easing highs” caused by stimulus, either quantitative easing or fiscal stimulus.

In November 2018, the two curves again overlapped. This time, there seems neither another 3 trillion dollars of liquidity like that which was released by the Federal Reserve in its three rounds of QE from 2008 to 2014 nor any stimulus like the $1.5 trillion in tax reform and $1.3 trillion in spending by the U.S. government in 2017. Risky assets have been exposed to the threats of high political risks, low growth expectations and tightening liquidity.

Foreign Currency Market in 2019

Given the conditions described above, we can analyze the factors that will influence the strengths and weaknesses of major currencies in the foreign-exchange market in 2019:

- U.S. dollar: The U.S. dollar faces many negative factors in the medium term. Given the flattening or inversion of the Treasury Yield Curve, or Federal Reserve officials’ comments on neutral rates, the U.S. is approaching the end of the interest-rate rise cycle. And the U.S. economy is expected to gradually lose momentum next year, as the impetus from the first round of tax cuts comes to an end. Furthermore, the trade deficit and fiscal deficit remain prominent, and consequently they pose a threat to the dollar.

- Euro: The euro could benefit from a shift in the monetary policy. According to the ECB, its 2.6 trillion euro QE program has pushed the euro down approximately 12% against the dollar.

Monetary tightening is expected to give the euro a boost with the ECB’s withdrawal from quantitative easing after the meeting in December 2018. - Pound sterling: The Brexit process remains a top priority, and it has been in the making for two years. It is impossible to make an accurate estimate of how it will end, but it is most unlikely that Britain will exit without an agreement. After a long tug-of-war, the impact of Brexit on the British economy will gradually diminish, and the U.K.’s strong labor market shows no sign of weakening.

To some extent, excessive short-selling of U.K. assets has lowered the bar for good news, giving the pound a chance to rebound. - Yen: For the yen, there are two key aspects. First, the hedging effect is doubtful. The threat of tariffs would reduce Japan’s exports to the United States, hurting the former country’s economy and the yen, given that additional tariffs are also imposed on Japan’s exports by the U.S.

Additionally, the market prefers the dollar to the yen as a safe-haven currency, as evidenced by the performance of the foreign currency market last year when the tariff war was brewing.

However, the U.S. stock market is at high risk in 2019. Give that U.S. stocks have long been negatively correlated with the yen, the yen will be pursued as a safe-haven currency in case of a U.S. stock-market crash. Second is the easy money policy. The Bank of Japan is expected to maintain its ultra-loose monetary policy, which is particularly noticeable in light of the tightened monetary policy among the FED, ECB, BOE and CAD, and surely it will affect the medium-term trend of the yen.